2024-16907. Medicare Program; Prospective Payment System and Consolidated Billing for Skilled Nursing Facilities; Updates to the Quality Reporting Program and Value-Based Purchasing Program for Federal Fiscal Year 2025

-

AGENCY:

Centers for Medicare & Medicaid Services (CMS), Department of Health and Human Services (HHS).

ACTION:

Final rule.

SUMMARY:

This final rule finalizes changes and updates to the policies and payment rates used under the Skilled Nursing Facility (SNF) Prospective Payment System (PPS) for fiscal year (FY) 2025. First, we are rebasing and revising the SNF market basket to reflect a 2022 base year. Next, we update the wage index used under the SNF PPS to reflect data collected during the most recent decennial census. Additionally, we finalize several technical revisions to the code mappings used to classify patients under the Patient Driven Payment Model (PDPM) to improve payment and coding accuracy. This final rule also updates the requirements for the SNF Quality Reporting Program and the SNF Value-Based Purchasing Program. Finally, we also are revising CMS' enforcement authority for imposing civil money penalties (CMPs) and including revisions to strengthen nursing home enforcement regulations.

DATES:

These regulations are effective on October 1, 2024.

FOR FURTHER INFORMATION CONTACT:

PDPM@cms.hhs.gov for issues related to the SNF PPS.

Heidi Magladry, (410) 786-6034, for information related to the skilled nursing facility quality reporting program.

Christopher Palmer, (410) 786-8025, for information related to the skilled nursing facility value-based purchasing program.

Celeste Saunders, (410) 786-5603, for information related to Nursing Home Enforcement.

SUPPLEMENTARY INFORMATION:

Availability of Certain Tables Exclusively Through the Internet on the CMS Website

As discussed in the FY 2014 SNF PPS final rule (78 FR 47936), tables setting forth the Wage Index for Urban Areas Based on Core-Based Statistical Area (CBSA) Labor Market Areas and the Wage Index Based on CBSA Labor Market Areas for Rural Areas are no longer published in the Federal Register . Instead, these tables are available exclusively through the internet on the CMS website. The wage index tables for this final rule can be accessed on the SNF PPS Wage Index home page, at https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/SNFPPS/WageIndex.html.

Readers who experience any problems accessing any of these online SNF PPS wage index tables should contact Kia Burwell at (410) 786-7816.

To assist readers in referencing sections contained in this document, we are providing the following Table of Contents.

Table of Contents

I. Executive Summary

A. Purpose

B. Summary of Major Provisions

C. Summary of Cost and Benefits

II. Background on SNF PPS

A. Statutory Basis and Scope

B. Initial Transition for the SNF PPS

C. Required Annual Rate Updates

III. Analysis and Responses to Public Comments on the FY 2025 SNF PPS Proposed Rule

A. General Comments on the FY 2025 SNF PPS Proposed Rule

IV. SNF PPS Rate Setting Methodology and FY 2025 Update

A. Federal Base Rates

B. SNF Market Basket Update

C. Case-Mix Adjustment

D. Wage Index Adjustment

E. SNF Value-Based Purchasing Program

F. Adjusted Rate Computation Example

V. Additional Aspects of the SNF PPS

A. SNF Level of Care—Administrative Presumption

B. Consolidated Billing

C. Payment for SNF-Level Swing-Bed Services

VI. Other SNF PPS Issues

A. Rebasing and Revising the SNF Market Basket

B. Changes to SNF PPS Wage Index

C. Technical Updates to PDPM ICD-10 Mappings

D. Request for Information: Update to PDPM Non-Therapy Ancillary Component

VII. Skilled Nursing Facility Quality Reporting Program (SNF QRP)

A. Background and Statutory Authority

B. General Considerations Used for the Selection of Measures for the SNF QRP

C. Collection of Four Additional Items as Standardized Patient Assessment Data Elements and Modification of One Item Collected as a Standardized Patient Assessment Data Element Beginning With the FY 2027 SNF QRP

D. SNF QRP Quality Measure Concepts Under Consideration for Future Years—Request for Information (RFI)

E. Form, Manner, and Timing of Data Submission Under the SNF QRP

F. Policies Regarding Public Display of Measure Data for the SNF QRP

VIII. Skilled Nursing Facility Value-Based Purchasing (SNF VBP) Program

A. Statutory Background

B. Regulation Text Technical Updates

C. SNF VBP Program Measures

D. SNF VBP Performance Standards

E. SNF VBP Performance Scoring Methodology

F. Updates to the SNF VBP Review and Correction Process

G. Updates to the SNF VBP Extraordinary Circumstances Exception Policy

IX. Nursing Home Enforcement

A. Background

B. Analysis of the Provisions of the Proposed Regulations

X. Collection of Information Requirements

XI. Economic Analyses

A. Regulatory Impact Analysis

B. Regulatory Flexibility Act Analysis

C. Unfunded Mandates Reform Act Analysis

D. Federalism Analysis

E. Regulatory Review Costs

I. Executive Summary

A. Purpose

This final rule will update the SNF prospective payment rates for fiscal year (FY) 2025, as required under section 1888(e)(4)(E) of the Social Security Act (the Act). It also responds to section 1888(e)(4)(H) of the Act, which requires the Secretary to provide for publication of certain specified information relating to the payment update (see section II.C. of this final rule) in the Federal Register before the August 1 that precedes the start of each FY. Additionally, in this final rule, we are finalizing the rebasing and revising of the SNF market basket to reflect a 2022 base year. Next, we are finalizing the update to the wage index used under the SNF PPS to reflect data collected during the most recent decennial census. We also finalize several technical revisions to the code mappings used to classify patients under the PDPM to improve payment and coding accuracy. This final rule updates the requirements for the SNF QRP, including the collection of four new items as standardized patient assessment data elements, and the modification of one item collected and submitted using the Minimum Data Set (MDS) beginning with the FY 2027 SNF QRP. We also finalize a policy that SNFs, which participate in the SNF QRP, participate in a validation process beginning with the FY 2027 SNF QRP. We also provide a summary of the comments received on the request for information on quality measure concepts under consideration for future SNF QRP program years. This final rule also includes requirements for the Skilled Nursing Facility Value-Based Purchasing (SNF VBP) Program, including adopting a measure selection, retention, and removal policy, a technical measure updates policy, a measure minimum for FY 2028 and subsequent years, updates to the review and correction policy to accommodate new measure data sources, updates to the Extraordinary Circumstances Exception policy, and updates to the SNF VBP regulation text. We also proposed revisions to existing long-term care (LTC) enforcement regulations that would enable CMS and the States to impose CMPs to better reflect amounts that are more consistent with the type of noncompliance that occurred.

B. Summary of Major Provisions

In accordance with sections 1888(e)(4)(E)(ii)(IV) and (e)(5) of the Act, this final rule updates the annual rates that we published in the SNF PPS final rule for FY 2024 (88 FR 53200, August 7, 2023). In addition, this final rule includes a forecast error adjustment for FY 2025. We are also finalizing the rebasing and revising of the SNF market basket to reflect a 2022 base year. Next, we are finalizing the update of the wage index used under the SNF PPS to reflect data collected during the most recent decennial census. We are also finalizing several technical revisions to the code mappings used to classify patients under the PDPM to improve payment and coding accuracy.

We are finalizing several updates for the SNF VBP Program. We are adopting a measure selection, retention, and removal policy that aligns with policies we have adopted in other CMS quality programs. We are adopting a technical measure updates policy that allows us to incorporate technical measure updates into SNF VBP measure specifications and to update the numerical values of the performance standards for a program year if a measure's specifications were technically updated between the time that we published the performance standards for a measure and the time that we calculate SNF performance on that measure at the conclusion of the applicable performance period. We are adopting the same measure minimum we previously finalized for the FY 2027 program year for the FY 2028 program year and subsequent program years. We are adopting modifications to Phase One of our review and correction policy such that the policy applies to all SNF VBP measures regardless of the measure's data source. We are updating the SNF VBP extraordinary circumstances exception (ECE) policy to allow SNFs to request an ECE if the SNF can demonstrate that, as a result of the extraordinary circumstance, it cannot report SNF VBP data on one or more measures by the specified deadline. We are also updating the instructions for requesting an extraordinary circumstance exception (ECE). Lastly, we are adopting several updates to the SNF VBP regulation text to align with previously finalized definitions and policies.

Beginning with the FY 2027 SNF QRP, we are finalizing requirements that SNFs participating in the SNF QRP collect and submit through the MDS four new items as standardized patient assessment data elements under the social determinants of health (SDOH) category: one item for Living Situation, two items for Food, and one item for Utilities. Additionally, we are finalizing our proposal to modify the current Transportation item. We are finalizing with modification a validation process for the SNF QRP, similar to the process that we adopted for the SNF VBP beginning with the FY 2027 SNF QRP. We are also finalizing with modification amendments to the regulation text at § 413.360 to implement the validation process we are finalizing. Finally, this final rule also summarizes comments we received in response to a request for information (RFI) on quality measure concepts under consideration for future SNF QRP years.

We are finalizing revisions to CMS' existing enforcement authority to expand the number and types of CMPs that can be imposed on LTC facilities, allowing for more per-instance (PI) CMPs to be imposed in conjunction with per-day (PD) CMPs. This update also expands our authority to impose multiple PI CMPs when the same type of noncompliance is identified on more than one day. Lastly, the final revisions will enable CMS or the States to impose a CMP for the number of days of previously cited noncompliance since the last three standard surveys for which a CMP has not yet been imposed to ensure that identified noncompliance may be subject to a penalty.

C. Summary of Cost and Benefits

II. Background on SNF PPS

A. Statutory Basis and Scope

As amended by section 4432 of the Balanced Budget Act of 1997 (BBA 1997) (Pub. L. 105-33, enacted August 5, 1997), section 1888(e) of the Act provides for the implementation of a PPS for SNFs. This methodology uses prospective, case-mix adjusted per diem payment rates applicable to all covered SNF services defined in section 1888(e)(2)(A) of the Act. The SNF PPS is effective for cost reporting periods beginning on or after July 1, 1998, and covers virtually all costs of furnishing covered SNF services (routine, ancillary, and capital-related costs) other than costs associated with approved educational activities and bad debts. Under section 1888(e)(2)(A)(i) of the Act, covered SNF services include post-hospital extended care services for which benefits are provided under Part A, as well as those items and services (other than a small number of excluded services, such as physicians' services) for which payment may otherwise be made under Part B and which are furnished to Medicare beneficiaries who are residents in a SNF during a covered Part A stay. A comprehensive discussion of these provisions appears in the May 12, 1998, interim final rule (63 FR 26252). In addition, a detailed discussion of the legislative history of the SNF PPS is available online at https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/SNFPPS/Downloads/Legislative_History_2018-10-01.pdf.

Section 215(a) of the Protecting Access to Medicare Act of 2014 (PAMA) (Pub. L. 113-93, enacted April 1, 2014) added section 1888(g) to the Act, requiring the Secretary to specify an all-cause all-condition hospital readmission measure and an all-condition risk-adjusted potentially preventable hospital readmission measure for the SNF setting. Additionally, section 215(b) of PAMA added section 1888(h) to the Act requiring the Secretary to implement a VBP program for SNFs. In 2014, section 2(c)(4) of the Improving Medicare Post-Acute Care Transformation (IMPACT) Act of 2014 (Pub. L. 113-185, enacted October 6, 2014) amended section 1888(e)(6) of the Act, which requires the Secretary to implement a QRP for SNFs under which SNFs report data on measures and resident assessment data. Finally, section 111 of the Consolidated Appropriations Act, 2021 (CAA, 2021) (Pub. L. 116-260, enacted December 27, 2020) amended section 1888(h) of the Act, authorizing the Secretary to apply up to nine additional measures to the VBP program for SNFs.

B. Initial Transition for the SNF PPS

Under sections 1888(e)(1)(A) and (e)(11) of the Act, the SNF PPS included an initial, three-phase transition that blended a facility-specific rate (reflecting the individual facility's historical cost experience) with the Federal case-mix adjusted rate. The transition extended through the facility's first 3 cost reporting periods under the PPS, up to and including the one that began in FY 2001. Thus, the SNF PPS is no longer operating under the transition, as all facilities have been paid at the full Federal rate effective with cost reporting periods beginning in FY 2002. As we now base payments for SNFs entirely on the adjusted Federal per diem rates, we no longer include adjustment factors under the transition related to facility-specific rates for the upcoming FY.

C. Required Annual Rate Updates

Section 1888(e)(4)(E) of the Act requires the SNF PPS payment rates to be updated annually. The most recent annual update occurred in a final rule that set forth updates to the SNF PPS payment rates for FY 2024 (88 FR 53200, August 7, 2023), as amended by the subsequent correction document (88 FR 68486, October 4, 2023).

Section 1888(e)(4)(H) of the Act specifies that we provide for publication annually in the Federal Register the following:

- The unadjusted Federal per diem rates to be applied to days of covered SNF services furnished during the upcoming FY.

- The case-mix classification system to be applied for these services during the upcoming FY.

- The factors to be applied in making the area wage adjustment for these services.

Along with other revisions discussed later in this preamble, this final rule will set out the required annual updates to the per diem payment rates for SNFs for FY 2025.

III. Analysis and Responses to Public Comments on the FY 2025 SNF PPS Proposed Rule

A. General Comments on the FY 2025 SNF PPS Proposed Rule

We received public comments on these proposals. The following is a summary of the comments we received and our responses.

Comment: Some commenters expressed concerns regarding several items outside the scope of this rule or outside the scope of CMS's current authorities. These comments included issues related to the recently finalized nursing home staffing rule (outside of issues related to that rule and calculation of the SNF market basket, which are addressed later in this rule), and a request that CMS remove the 3-day qualifying hospital stay (QHS) prerequisite for Part A SNF coverage.

Response: With regard to those comments related to the recently finalized nursing home staffing rule, any such issues are out of scope for this rule and should be directed to HealthandSafetyInquiries@cms.hhs.gov. With regard to the request that we remove the QHS requirement for Part A SNF coverage, we maintain that we do not have the statutory authority to pursue this change at this time. Moreover, we have previously conducted analyses of the associated cost of removing the 3-day stay requirement and found that it would significantly increase Medicare outlays.

Comment: Several commenters raised concerns with therapy treatment under PDPM, specifically related to reductions in the amount of therapy furnished to SNF patients since PDPM was implemented. Some of these commenters stated that CMS should revise the existing limit on concurrent and group therapy to provide a financial penalty in cases where the facility exceeds this limit. These commenters also recommended that CMS direct its review contractors to examine the practices of facilities that changed their therapy service provision after PDPM was implemented. Additionally, commenters want CMS to release the results of any monitoring efforts around therapy provision. Some commenters stated that the therapy items in O0400 should be maintained to track therapy provision. Finally, some commenters stated that CMS should reinstate the assessment schedule that had existed prior to implementing PDPM.

Response: We appreciate commenters raising these concerns around therapy provision under PDPM, as compared the Resource Utilization Groups, Version IV (RUG-IV). We agree with commenters that the amount of therapy that is furnished to patients under PDPM is less than that delivered under RUG-IV. As we stated in the FY 2020 SNF PPS final rule, we believe that close, real-time monitoring is essential to identifying any adverse trends under PDPM. While we have identified the same reduction in therapy services and therapy staff, we believe that these findings must be considered within the context of patient outcomes. To the extent that facilities are able to maintain or improve patient outcomes, we believe that this supersedes changes in service provision, whether this be in the amount of therapy furnished or the mode in which it is furnished. We continue to monitor all aspects of PDPM and advise our review contractors on any adverse trends. With regard to implementing a specific penalty for exceeding the group and concurrent therapy threshold, based on our current data, we have not identified any widespread misuse of this limit. Should we identify such misuse, either at a provider-level or at a broader level, we will pursue an appropriate course of action.

With regard to eliminating certain therapy tracking items in O0400, while the O0400 items are able to track therapy minutes, these items only track therapy provision for the seven days up to and including the assessment reference date. We agree with the commenters that items should exist to track therapy provision over the course of a full Medicare stay, which is the purpose of the O0425 items on the assessment.

Finally, with regard to the recommendation that we reinstate something akin to the assessment schedule that was in effect under RUG- IV, given that PDPM does not reimburse on the basis of therapy minutes, we do not believe that such an increase in administrative burden on providers would have an impact on therapy provision. That being said, we strongly encourage interested parties to continue to provide suggestions on how to ensure that SNF patients receive the care they need based on their unique characteristics and goals.

Comment: One commenter requested that we consider including recreational therapy time provided to SNF residents by recreational therapists into the case- mix adjusted therapy component of PDPM, rather than having it be considered part of the nursing component. This commenter further suggested that CMS begin collecting data, as part of a demonstration project, on the utilization of recreational therapy, as a distinct and separate service, and its impact on patient care cost and quality.

Response: We appreciate the commenter raising this issue, but we do not believe there is sufficient evidence at this time regarding the efficacy of recreational therapy interventions. More notably, we do not believe there are data that would substantiate a determination of the effect on payment of such interventions, as such services were not considered separately when the PDPM was being developed, unlike physical, occupational and speech-language pathology services. That being said, we would note that Medicare Part A originally paid for institutional care in various provider settings, including SNF, on a reasonable cost basis, but now makes payment using PPS methodologies, such as the SNF PPS. To the extent that one of these SNFs furnished recreational therapy to its inpatients under the previous, reasonable cost methodology, the cost of the services would have been included in the base payments when SNF PPS payment rates were derived. Under the PPS methodology, Part A makes a comprehensive payment for the bundled package of items and services that the facility furnishes during the course of a Medicare-covered stay. This package encompasses nearly all services that the beneficiary receives during the course of the stay—including any medically necessary recreational therapy—and payment for such services is included within the facility's comprehensive SNF PPS payment for the covered Part A stay itself. With regard to developing a demonstration project focused on this particular service, we do not believe that creating such a project would substantially improve the accuracy of the SNF PPS payment rates. Moreover, in light of comments discussed previously in this section on the impact of PDPM implementation on therapy provision more generally, we believe that carving out recreational therapy as a separate discipline will not have a significant impact on access to recreational therapy services for SNF patients.

IV. SNF PPS Rate Setting Methodology and FY 2025 Payment Update

A. Federal Base Rates

Under section 1888(e)(4) of the Act, the SNF PPS uses per diem Federal payment rates based on mean SNF costs in a base year (FY 1995) updated for inflation to the first effective period of the PPS. We developed the Federal payment rates using allowable costs from hospital-based and freestanding SNF cost reports for reporting periods beginning in FY 1995. The data used in developing the Federal rates also incorporated a Part B add-on, which is an estimate of the amounts that, prior to the SNF PPS, would be payable under Part B for covered SNF services furnished to individuals during the course of a covered Part A stay in a SNF.

In developing the rates for the initial period, we updated costs to the first effective year of the PPS (the 15-month period beginning July 1, 1998) using the SNF market basket, and then standardized for geographic variations in wages and for the costs of facility differences in case-mix. In compiling the database used to compute the Federal payment rates, we excluded those providers that received new provider exemptions from the routine cost limits, as well as costs related to payments for exceptions to the routine cost limits. Using the formula that the BBA 1997 prescribed, we set the Federal rates at a level equal to the weighted mean of freestanding costs plus 50 percent of the difference between the freestanding mean and weighted mean of all SNF costs (hospital-based and freestanding) combined. We computed and applied separately the payment rates for facilities located in urban and rural areas and adjusted the portion of the Federal rate attributable to wage-related costs by a wage index to reflect geographic variations in wages.

B. SNF Market Basket Update

1. SNF Market Basket

Section 1888(e)(5)(A) of the Act requires us to establish a SNF market basket that reflects changes over time in the prices of an appropriate mix of goods and services included in covered SNF services. Accordingly, we have developed a SNF market basket that encompasses the most commonly used cost categories for SNF routine services, ancillary services, and capital-related expenses. In the SNF PPS final rule for FY 2022 (86 FR 42444 through 42463), we rebased and revised the SNF market basket, which included updating the base year from 2014 to 2018. In the SNF PPS proposed rule for FY 2025 (89 FR 23427 through 23451), we proposed to rebase and revise the SNF market basket and update the base year from 2018 to 2022. We are finalizing the 2022-based SNF market basket as proposed, as discussed in section VI.A. of this final rule. The SNF market basket is used to compute the market basket percentage increase that is used to update the SNF Federal rates on an annual basis, as required by section 1888(e)(4)(E)(ii)(IV) of the Act. This market basket percentage increase is adjusted by a forecast error adjustment, if applicable, and then further adjusted by the application of a productivity adjustment as required by section 1888(e)(5)(B)(ii) of the Act and described in section IV.B.4. of this final rule.

As outlined in the proposed rule, we proposed a FY 2025 SNF market basket percentage increase of 2.8 percent based on IHS Global Inc.'s (IGI's) fourth-quarter 2023 forecast of the proposed 2022-based SNF market basket (before application of the forecast error adjustment and productivity adjustment). We also proposed that if more recent data subsequently became available (for example, a more recent estimate of the market basket and/or the productivity adjustment), we would use such data, if appropriate, to determine the FY 2025 SNF market basket percentage increase, labor-related share relative importance, forecast error adjustment, or productivity adjustment in this SNF PPS final rule.

Since the proposed rule, we have updated the FY 2025 market basket percentage increase based on IGI's second quarter 2024 forecast with historical data through the first quarter of 2024. The FY 2025 growth rate of the 2022-based SNF market basket is estimated to be 3.0 percent.

2. Market Basket Update for FY 2025

Section 1888(e)(5)(B) of the Act defines the SNF market basket percentage increase as the percentage change in the SNF market basket from the midpoint of the previous FY to the midpoint of the current FY. For the Federal rates outlined in the proposed rule, we used the percentage change in the SNF market basket to compute the update factor for FY 2025. This factor was based on the FY 2025 percentage increase in the proposed 2022-based SNF market basket reflecting routine, ancillary, and capital-related expenses. Sections 1888(e)(4)(E)(ii)(IV) and (e)(5)(B)(i) of the Act require that the update factor used to establish the FY 2025 unadjusted Federal rates be at a level equal to the SNF market basket percentage increase. Accordingly, we determined the total growth from the average market basket level for the period of October 1, 2023, through September 30, 2024, to the average market basket level for the period of October 1, 2024, through September 30, 2025. As outlined in the proposed rule, we proposed a FY 2025 SNF market basket percentage increase of 2.8 percent. For this final rule, based on IGI's second quarter 2024 forecast with historical data through the first quarter of 2024, the FY 2025 growth rate of the 2022-based SNF market basket is estimated to be 3.0 percent.

As further explained in section IV.B.3. of this final rule, as applicable, we adjust the percentage increase by the forecast error adjustment from the most recently available FY for which there is final data and apply this adjustment whenever the difference between the forecasted and actual percentage increase in the market basket exceeds a 0.5 percentage point threshold in absolute terms. Additionally, section 1888(e)(5)(B)(ii) of the Act requires us to reduce the market basket percentage increase by the productivity adjustment (the 10-year moving average of changes in annual economy-wide private nonfarm business total factor productivity (TFP) for the period ending September 30, 2025) which is estimated to be 0.5 percentage point, as described in section IV.B.4. of this final rule.

We also note that section 1888(e)(6)(A)(i) of the Act provides that, beginning with FY 2018, SNFs that fail to submit data, as applicable, in accordance with sections 1888(e)(6)(B)(i)(II) and (III) of the Act for a fiscal year will receive a 2.0 percentage point reduction to their market basket update for the fiscal year involved, after application of section 1888(e)(5)(B)(ii) of the Act (the productivity adjustment) and section 1888(e)(5)(B)(iii) of the Act (the market basket increase). In addition, section 1888(e)(6)(A)(ii) of the Act states that application of the 2.0 percentage point reduction (after application of section 1888(e)(5)(B)(ii) and (iii) of the Act) may result in the market basket percentage change being less than zero for a fiscal year and may result in payment rates for a fiscal year being less than such payment rates for the preceding fiscal year. Section 1888(e)(6)(A)(iii) of the Act further specifies that the 2.0 percentage point reduction is applied in a noncumulative manner, so that any reduction made under section 1888(e)(6)(A)(i) of the Act applies only to the fiscal year involved, and that the reduction cannot be taken into account in computing the payment amount for a subsequent fiscal year.

The following is a of the public comments received on the proposed FY 2025 SNF market basket percentage increase to the SNF PPS rates, along with our responses.

Comment: Many commenters stated that they appreciate and support the proposed net 4.1 percent payment update and forecast error adjustment; however, some commenters expressed concerns about missed forecasts and whether the market basket is appropriately capturing inflation.

Commenters cited a report from the AHA, which found that hospital employee compensation has grown by 45 percent since 2014, and workforce shortages that may persist into the future could continue to drive labor-related inflation higher. As a result, providers have turned to more expensive contract labor to sustain operations. Several commenters noted themselves or their members experiencing high rates of inflation in equipment and supplies, and questioned whether the inflation is being properly captured in the market basket.

A few commenters noted that there have now been four consecutive years of under-forecasts, and that growth in the Consumer Price Index All Urban totaled 16.8 percent between 2021 and 2023 while SNF market basket growth totaled only 15.5 percent over the same time period. Several commenters also expressed that the proposed 4.1 percent payment update will fall short of covering the costs of the finalized minimum staffing rule. Two commenters urged CMS to consider a prospective adjustment for labor inflation. Two commenters urged CMS to use more recent data to determine the FY SNF market basket update in the final rule.

Response: We recognize commenters' concerns in relation to forecast error during a high inflationary period. SNF PPS market basket updates are set prospectively, which means that the market basket update relies on a mix of both historical data for part of the period for which the update is calculated and forecasted data for the remainder. For instance, the FY 2025 market basket update in this final rule reflects historical data through the first quarter of 2024 and forecasted data through the third quarter of 2025. IHS Global Inc. (IGI) is a nationally recognized economic and financial forecasting firm with which CMS contracts to forecast the components of the market baskets. We believe that basing the prospective update on these forecasts is an appropriate method, while also acknowledging that these are expectations of trends and may differ from actual experience.

We also understand commenters' concerns regarding the minimum staffing rule not being taken into account. The 2022-based SNF market basket is a fixed-weight, Laspeyres-type price index that measures the change in price, over time, of the same mix of goods and services purchased in the base period. Any changes in the quantity or mix of goods and services (that is, intensity) purchased over time relative to a base period are not measured. The cost weights in this final rule are based on the most recent set of complete and comprehensive cost data for the universe of SNF providers available at the time of rulemaking, and the price proxies for each cost category include expectations of the inflationary pressures for each category of expenses in the market basket. Any changes in intensity relative to the 2022-based SNF market basket will be reflected in future Medicare cost reports and thus captured in the next rebasing. We will continue to monitor Medicare cost report data for freestanding SNFs as it becomes available to assess whether the 2022-based SNF market basket cost weights continue to be appropriate in the coming years.

We recognize the challenges facing SNFs in operating during a high inflationary environment. Due to SNF payments under PPS being set prospectively, we rely on a projection of the SNF market basket that reflects both recent historical trends, as well as forecast expectations over the next 18 months. The forecast error for a market basket update is calculated as the actual market basket increase for a given year, less the forecasted market basket increase. Due to the uncertainty regarding future price trends, forecast errors can be both positive or negative. We are confident that the forecast error adjustments built into the SNF market basket update factor will account for these discrepancies over time.

The proposed FY 2025 SNF market basket percentage increase of 2.8 percent reflected the most-recent forecast available at that time of rulemaking. As stated in the SNF PPS proposed rule for FY 2025 (89 FR 23451), we also proposed that if more recent data subsequently became available (for example, a more recent estimate of the market basket and/or the productivity adjustment), we would use such data, if appropriate, to determine the FY 2025 SNF market basket percentage increase, labor-related share relative importance, forecast error adjustment, or productivity adjustment in the SNF PPS final rule. For this final rule, we have incorporated the most recent historical data and forecasts provided by IGI to capture the expected price and wage pressures facing SNFs in FY 2025. For this final rule, based on IGI's second-quarter 2024 forecast with historical data through first-quarter 2024, the FY 2025 growth rate of the 2022-based SNF market basket is 3.0 percent. By incorporating the most recent estimates available of the market basket percentage increase, we believe these data reflect the best available projection of input price inflation faced by SNFs in FY 2025.

After consideration of the comments received on the FY 2025 SNF market basket proposals, we are finalizing a FY 2025 SNF market basket percentage increase of 3.0 percent (prior to the application of the forecast error adjustment and productivity adjustment, which are discussed later in this section).

3. Forecast Error Adjustment

As discussed in the June 10, 2003 supplemental proposed rule (68 FR 34768) and finalized in the August 4, 2003 final rule (68 FR 46057 through 46059), § 413.337(d)(2) provides for an adjustment to account for market basket forecast error. The initial adjustment for market basket forecast error applied to the update of the FY 2003 rate for FY 2004 and took into account the cumulative forecast error for the period from FY 2000 through FY 2002, resulting in an increase of 3.26 percent to the FY 2004 update. Subsequent adjustments in succeeding FYs take into account the forecast error from the most recently available FY for which there is final data and apply the difference between the forecasted and actual change in the market basket when the difference exceeds a specified threshold. We originally used a 0.25 percentage point threshold for this purpose; however, for the reasons specified in the FY 2008 SNF PPS final rule (72 FR 43425), we adopted a 0.5 percentage point threshold effective for FY 2008 and subsequent FYs. As we stated in the final rule for FY 2004 that first issued the market basket forecast error adjustment (68 FR 46058), the adjustment will reflect both upward and downward adjustments, as appropriate.

For FY 2023 (the most recently available FY for which there is final data), the forecasted or estimated increase in the SNF market basket was 3.9 percent, and the actual increase for FY 2023 was 5.6 percent, resulting in the actual increase being 1.7 percentage points higher than the estimated increase. Accordingly, as the difference between the estimated and actual amount of change in the market basket exceeds the 0.5 percentage point threshold, under the policy previously described (comparing the forecasted and actual market basket percentage increase), the FY 2025 market basket percentage increase of 3.0 percent is adjusted upward to account for the forecast error adjustment of 1.7 percentage points, resulting in a SNF market basket percentage increase of 4.7 percent, which is then reduced by the productivity adjustment of 0.5 percentage point, discussed in section IV.B.4. of this final rule. This results in a SNF market basket update for FY 2025 of 4.2 percent.

Table 2 shows the forecasted and actual market basket increases for FY 2023.

A discussion of the public comments received on the forecast error adjustment, along with our responses, can be found below.

Comment: Several commenters noted that while they appreciate the forecast error adjustment, forecast error adjustments are made two years after the year in question and SNFs must contend with the underpayment for two years before it is reconciled. One commenter suggested updating the method to use more timely data that would capture increased costs in recent years.

Response: While we understand that earlier forecast error adjustments might be preferable, a two-year lag is necessary because historical data for the current fiscal year are not available until after the following year's update is determined.

Comment: One commenter stated that not including Federal relief funds, the aggregate fee-for-service (FFS) Medicare margin for freestanding SNFs in 2022 was over 18 percent, the 23rd consecutive year this this margin has exceeded 10 percent. They note that high margins indicate that a reduction is needed to more closely align aggregate payments to aggregate costs.

The commenter also noted that although CMS is required by statute to update the payment rates each year by the estimated change in the market basket, CMS is not required to make automatic forecast error corrections. They maintain that they do not support forecast error adjustments for three reasons. First, in some years, such as the one addressed by the proposed rule for FY 2025, the forecast error correction results in making a larger payment increase in addition to the statutory update, even as the aggregate FFS Medicare margin is high. Second, the adjustments result in more variable updates than had no adjustment been made. Since FY 2004, when CMS implemented the adjustment, forecast error corrections have ranged from a 3.26 percent increase (in FY 2004) to a −0.8 percent reduction (in FY 2022). Eliminating the adjustment for forecast errors would result in more stable updates. Third, the adjustment results in inconsistent approaches to updates across settings: except for the updates to the capital payments to acute care hospitals, CMS does not apply forecast error adjustments to any other market basket updates.

Response: We appreciate the commenter's input and suggestions. We note that apart from the last several years of various unprecedented market shocks and resulting volatility, forecast errors have generally been relatively small and clustered near zero. We agree that forecast error adjustments have potential to introduce more variable and unstable updates. As a result, for FY 2008 and subsequent years we increased the threshold at which adjustments are triggered from 0.25 percentage point to 0.5 percentage point. Our intent in raising the threshold was to distinguish typical statistical variances from more major unanticipated impacts, such as unforeseen disruptions of the economy or unexpected inflationary patterns.

As was stated when the SNF forecast error adjustment was introduced in the FY 2004 SNF PPS final rule (68 FR 46035), our goal continues to be to “pay the appropriate amount, to the correct provider, for the proper service, at the right time.” Accordingly, we are optimistic that market volatility will soon subside to a point where forecast errors will not be frequently triggered. Nonetheless, we will continue to monitor the effects of forecast error adjustments, and their appropriateness in responding to unforeseen inflationary patterns. Any changes, if deemed necessary, would be proposed through notice and comment rulemaking.

After consideration of the comments received, we are finalizing the application of the proposed forecast error adjustment without modification. As stated above, based on IGI's second-quarter 2024 forecast with historical data through the first quarter of 2024, the FY 2025 growth rate of the 2022-based SNF market basket is estimated to be 3.0 percent. Accordingly, as the difference between the estimated and actual amount of change in the market basket exceeds the 0.5 percentage point threshold, under the policy previously described (comparing the forecasted and actual market basket percentage increase), the FY 2025 market basket percentage increase of 3.0 percent is adjusted upward to account for the forecast error adjustment of 1.7 percentage points, resulting in a SNF market basket percentage increase of 4.7 percent, which is then reduced by the productivity adjustment as discussed later in this section.

4. Productivity Adjustment

Section 1888(e)(5)(B)(ii) of the Act, as added by section 3401(b) of the Patient Protection and Affordable Care Act (Affordable Care Act) (Pub. L. 111-148, enacted March 23, 2010) requires that, in FY 2012 and in subsequent FYs, the market basket percentage under the SNF payment system (as described in section 1888(e)(5)(B)(i) of the Act) is to be reduced annually by the productivity adjustment described in section 1886(b)(3)(B)(xi)(II) of the Act. Section 1886(b)(3)(B)(xi)(II) of the Act, in turn, defines the productivity adjustment to be equal to the 10-year moving average of changes in annual economy-wide, private nonfarm business multifactor productivity (MFP) (as projected by the Secretary for the 10-year period ending with the applicable FY, year, cost-reporting period, or other annual period).

The U.S. Department of Labor's Bureau of Labor Statistics (BLS) publishes the official measure of productivity for the U.S. We note that previously the productivity measure referenced at section 1886(b)(3)(B)(xi)(II) of the Act was published by BLS as private nonfarm business multifactor productivity. Beginning with the November 18, 2021, release of productivity data, BLS replaced the term MFP with TFP. BLS noted that this is a change in terminology only and will not affect the data or methodology. As a result of the BLS name change, the productivity measure referenced in section 1886(b)(3)(B)(xi)(II) of the Act is now published by BLS as private nonfarm business total factor productivity. We refer readers to the BLS website at www.bls.gov for the BLS historical published TFP data. A complete description of the TFP projection methodology is available on our website at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/MedicareProgramRatesStats/MarketBasketResearch. In addition, in the FY 2022 SNF final rule (86 FR 42429) we noted that, effective with FY 2022 and forward, we changed the name of this adjustment to refer to it as the “productivity adjustment,” rather than the “MFP adjustment.”

Per section 1888(e)(5)(A) of the Act, the Secretary shall establish a SNF market basket that reflects changes over time in the prices of an appropriate mix of goods and services included in covered SNF services. Section 1888(e)(5)(B)(ii) of the Act, added by section 3401(b) of the Affordable Care Act, requires that for FY 2012 and each subsequent FY, after determining the market basket percentage described in section 1888(e)(5)(B)(i) of the Act, the Secretary shall reduce such percentage by the productivity adjustment described in section 1886(b)(3)(B)(xi)(II) of the Act. Section 1888(e)(5)(B)(ii) of the Act further states that the reduction of the market basket percentage by the productivity adjustment may result in the market basket percentage being less than zero for a FY and may result in payment rates under section 1888(e) of the Act being less than such payment rates for the preceding fiscal year. Thus, if the application of the productivity adjustment to the market basket percentage calculated under section 1888(e)(5)(B)(i) of the Act results in a productivity-adjusted market basket percentage that is less than zero, then the annual update to the unadjusted Federal per diem rates under section 1888(e)(4)(E)(ii) of the Act would be negative, and such rates would decrease relative to the prior FY.

Based on the data available for this FY 2025 SNF PPS final rule, the productivity adjustment (the 10-year moving average of changes in annual economy-wide private nonfarm business TFP for the period ending September 30, 2025) is projected to be 0.5 percentage point.

Comment: A few commenters noted that they are disappointed in the productivity adjustment, and that CMS should closely monitor the effect of such productivity adjustments and explore ways to use its authority to offset or waive them.

Response: Section 1888(e)(5)(B)(ii) of the Act requires the application of the productivity adjustment described in section 1886(b)(3)(xi)(II) of the Act to the SNF PPS market basket increase factor. As required by statute, the FY 2025 productivity adjustment is derived based on the 10-year moving average growth in economy-wide productivity for the period ending in FY 2025. We recognize the concerns of the commenters regarding the appropriateness of the productivity adjustment; however, we are required under section 1888(e)(5)(B)(ii) of the Act to apply the specific productivity adjustment described here in this section.

As stated previously, in the proposed rule the productivity adjustment was estimated to be 0.4 percentage point based on IGI's fourth-quarter 2024 forecast. For this final rule, based on IGI's second-quarter 2024 forecast, the productivity adjustment (the 10-year moving average of changes in annual economy-wide private nonfarm business TFP for the period ending September 30, 2025) is 0.5 percentage point.

Consistent with section 1888(e)(5)(B)(i) of the Act and § 413.337(d)(2), and as outlined previously in section IV.B.1. of this final rule, the market basket percentage increase for FY 2025 for the SNF PPS is based on IGI's second quarter 2024 forecast of the SNF market basket percentage increase, which is estimated to be 3.0 percent. This market basket percentage increase is then increased by 1.7 percentage points, due to application of the forecast error adjustment outlined earlier in section IV.B.3. of this final rule. Finally, as outlined earlier in this section, we are applying a 0.5 percentage point productivity adjustment to the FY 2025 SNF market basket percentage increase. Therefore, the resulting productivity-adjusted FY 2025 SNF market basket update is equal to 4.2 percent, which reflects a market basket percentage increase of 3.0 percent, plus the 1.7 percentage points forecast error adjustment, and reduced by the 0.5 percentage point productivity adjustment. Thus, we apply a net SNF market basket update factor of 4.2 percent in our determination of the FY 2025 SNF PPS unadjusted Federal per diem rates.

5. Unadjusted Federal Per Diem Rates for FY 2025

As discussed in the FY 2019 SNF PPS final rule (83 FR 39162), in FY 2020 we implemented a new case-mix classification system to classify SNF patients under the SNF PPS, the PDPM. As discussed in section V.B.1. of that final rule (83 FR 39189), under PDPM, the unadjusted Federal per diem rates are divided into six components, five of which are case-mix adjusted components (Physical Therapy (PT), Occupational Therapy (OT), Speech-Language Pathology (SLP), Nursing, and Non-Therapy Ancillaries (NTA)), and one of which is a non-case-mix component, as existed under the previous RUG-IV model. We proposed to use the SNF market basket, adjusted as outlined previously in sections III.B.1. through III.B.4. of the proposed rule, to adjust each per diem component of the Federal rates forward to reflect the change in the average prices for FY 2024 from the average prices for FY 2023. We also proposed to further adjust the rates by a wage index budget neutrality factor, outlined in section III.D. of the proposed rule.

Further, in the past, we used the revised Office of Management and Budget (OMB) delineations adopted in the FY 2015 SNF PPS final rule (79 FR 45632, 45634), with updates as reflected in OMB Bulletin Nos. 15-01 and 17-01, to identify a facility's urban or rural status for the purpose of determining which set of rate tables apply to the facility. As discussed in the FY 2021 SNF PPS proposed and final rules, we adopted the revised OMB delineations identified in OMB Bulletin No. 18-04 (available at https://www.whitehouse.gov/wp-content/uploads/2018/09/Bulletin-18-04.pdf) to identify a facility's urban or rural status effective beginning with FY 2021. However, as further outlined in section V.A of the proposed rule, the current CBSAs are based on OMB standards contained in Bulletin 20-01, which is based on data collected during the 2010 Decennial Census. In this final rule, we are updating the SNF PPS wage index using the CBSAs defined within Bulletin 23-01.

Tables 3 and 4 reflect the proposed unadjusted Federal rates for FY 2025, prior to adjustment for case-mix.

C. Case-Mix Adjustment

Under section 1888(e)(4)(G)(i) of the Act, the Federal rate also incorporates an adjustment to account for facility case-mix, using a classification system that accounts for the relative resource utilization of different patient types. The statute specifies that the adjustment is to reflect both a resident classification system that the Secretary establishes to account for the relative resource use of different patient types, as well as resident assessment data and other data that the Secretary considers appropriate. In the FY 2019 final rule (83 FR 39162, August 8, 2018), we finalized a new case-mix classification model, the PDPM, which took effect beginning October 1, 2019. The previous RUG-IV model classified most patients into a therapy payment group and primarily used the volume of therapy services provided to the patient as the basis for payment classification, thus creating an incentive for SNFs to furnish therapy regardless of the individual patient's unique characteristics, goals, or needs. PDPM eliminates this incentive and improves the overall accuracy and appropriateness of SNF payments by classifying patients into payment groups based on specific, data-driven patient characteristics, while simultaneously reducing the administrative burden on SNFs.

The PDPM uses clinical data from the MDS to assign case-mix classifiers to each patient that are then used to calculate a per diem payment under the SNF PPS, consistent with the provisions of section 1888(e)(4)(G)(i) of the Act. As outlined in section IV.A. of the proposed rule, the clinical orientation of the case-mix classification system supports the SNF PPS's use of an administrative presumption that considers a beneficiary's initial case-mix classification to assist in making certain SNF level of care determinations. Further, because the MDS is used as a basis for payment, as well as a clinical assessment, we have provided extensive training on proper coding and the timeframes for MDS completion in our Resident Assessment Instrument (RAI) Manual. As we have stated in prior rules, for an MDS to be considered valid for use in determining payment, the MDS assessment should be completed in compliance with the instructions in the RAI Manual in effect at the time the assessment is completed. For payment and quality monitoring purposes, the RAI Manual consists of both the Manual instructions and the interpretive guidance and policy clarifications posted on the appropriate MDS website at https://www.cms.gov/Medicare/Quality-Initiatives-Patient-Assessment-Instruments/NursingHomeQualityInits/MDS30RAIManual.html.

Under section 1888(e)(4)(H) of the Act, each update of the payment rates must include the case-mix classification methodology applicable for the upcoming FY. The FY 2025 payment rates set forth in this final rule reflect the use of the PDPM case-mix classification system from October 1, 2023, through September 30, 2024. The case-mix adjusted PDPM payment rates for FY 2025 are listed separately for urban and rural SNFs, in Tables 5 and 6 with corresponding case-mix values.

Given the differences between the previous RUG-IV model and PDPM in terms of patient classification and billing, it was important that the format of Tables 5 and 6 reflect these differences. More specifically, under both RUG-IV and PDPM, providers use a Health Insurance Prospective Payment System (HIPPS) code on a claim to bill for covered SNF services. Under RUG-IV, the HIPPS code included the three-character RUG-IV group into which the patient classified, as well as a two-character assessment indicator code that represented the assessment used to generate this code. Under PDPM, while providers still use a HIPPS code, the characters in that code represent different things. For example, the first character represents the PT and OT group into which the patient classifies. If the patient is classified into the PT and OT group “TA”, then the first character in the patient's HIPPS code would be an A. Similarly, if the patient is classified into the SLP group “SB”, then the second character in the patient's HIPPS code would be a B. The third character represents the Nursing group into which the patient classifies. The fourth character represents the NTA group into which the patient classifies. Finally, the fifth character represents the assessment used to generate the HIPPS code.

Tables 5 and 6 reflect the PDPM's structure. Accordingly, Column 1 of Tables 5 and 6 represents the character in the HIPPS code associated with a given PDPM component. Columns 2 and 3 provide the case-mix index and associated case-mix adjusted component rate, respectively, for the relevant PT group. Columns 4 and 5 provide the case-mix index and associated case-mix adjusted component rate, respectively, for the relevant OT group. Columns 6 and 7 provide the case-mix index and associated case-mix adjusted component rate, respectively, for the relevant SLP group. Column 8 provides the nursing case-mix group (CMG) that is connected with a given PDPM HIPPS character. For example, if the patient qualified for the nursing group CBC1, then the third character in the patient's HIPPS code would be a “P.” Columns 9 and 10 provide the case-mix index and associated case-mix adjusted component rate, respectively, for the relevant nursing group. Finally, columns 11 and 12 provide the case-mix index and associated case-mix adjusted component rate, respectively, for the relevant NTA group.

Tables 5 and 6 do not reflect adjustments which may be made to the SNF PPS rates as a result of the SNF VBP Program, outlined in section VII. of this final rule, or other adjustments, such as the variable per diem adjustment.

D. Wage Index Adjustment

Section 1888(e)(4)(G)(ii) of the Act requires that we adjust the Federal rates to account for differences in area wage levels, using a wage index that the Secretary determines appropriate. Since the inception of the SNF PPS, we have used hospital inpatient wage data in developing a wage index to be applied to SNFs. We will continue this practice for FY 2025, as we continue to believe that in the absence of SNF-specific wage data, using the hospital inpatient wage index data is appropriate and reasonable for the SNF PPS. As explained in the update notice for FY 2005 (69 FR 45786), the SNF PPS does not use the hospital area wage index's occupational mix adjustment, as this adjustment serves specifically to define the occupational categories more clearly in a hospital setting; moreover, the collection of the occupational wage data under the inpatient prospective payment system (IPPS) also excludes any wage data related to SNFs. Therefore, we believe that using the updated wage data exclusive of the occupational mix adjustment continues to be appropriate for SNF payments. As in previous years, we continue to use the pre-reclassified IPPS hospital wage data, without applying the occupational mix, rural floor, or outmigration adjustment, as the basis for the SNF PPS wage index. For FY 2025, the updated wage data are for hospital cost reporting periods beginning on or after October 1, 2020, and before October 1, 2021 (FY 2021 cost report data).

We note that section 315 of the Medicare, Medicaid, and SCHIP Benefits Improvement and Protection Act of 2000 (BIPA) (Pub. L. 106-554, enacted December 21, 2000) gave the Secretary the discretion to establish a geographic reclassification procedure specific to SNFs, but only after collecting the data necessary to establish a SNF PPS wage index that is based on wage data from nursing homes. To date, this has proven to be unfeasible due to the volatility of existing SNF wage data and the significant amount of resources that would be required to improve the quality of the data. More specifically, auditing all SNF cost reports, similar to the process used to audit inpatient hospital cost reports for purposes of the IPPS wage index, would place a burden on providers in terms of recordkeeping and completion of the cost report worksheet. Adopting such an approach would require a significant commitment of resources by CMS and the Medicare Administrative Contractors (MACs), potentially far in excess of those required under the IPPS, given that there are nearly five times as many SNFs as there are inpatient hospitals. While we do not believe this undertaking is feasible at this time, we will continue to explore implementation of a spot audit process to improve SNF cost reports to ensure they are adequately accurate for cost development purposes, in such a manner as to permit us to establish a SNF-specific wage index in the future.

In addition, we will continue to use the same methodology discussed in the SNF PPS final rule for FY 2008 (72 FR 43423) to address those geographic areas in which there are no hospitals, and thus, no hospital wage index data on which to base the calculation of the FY 2025 SNF PPS wage index. For rural geographic areas that do not have hospitals and, therefore, lack hospital wage data on which to base an area wage adjustment, we will continue using the average wage index from all contiguous Core-Based Statistical Areas (CBSAs) as a reasonable proxy. For FY 2025, the only rural area without wage index data available is North Dakota. We have determined that the borders of 18 rural counties are local and contiguous with 8 urban counties. Therefore, under this methodology, the wage indexes for the counties of Burleigh/Morton/Oliver (CBSA 13900: 0.9020), Cass (CBSA 22020: 0.8763), Grand Forks (CBSA 24220: 0.7865), and McHenry/Renville/Ward (CBSA 33500: 0.7686) are averaged, resulting in an imputed rural wage index of 0.8334 for rural North Dakota for FY 2025. In past years for rural Puerto Rico, we did not apply this methodology due to the distinct economic circumstances there; due to the close proximity of almost all of Puerto Rico's various urban and non-urban areas, this methodology will produce a wage index for rural Puerto Rico that is higher than that in half of its urban areas. However, because rural Puerto Rico now has hospital wage index data on which to base an area wage adjustment, we will not apply this policy for FY 2025. For urban areas without specific hospital wage index data, we will continue using the average wage indexes of all urban areas within the State to serve as a reasonable proxy for the wage index of that urban CBSA. For FY 2025, the only urban area without wage index data available is CBSA 25980, Hinesville-Fort Stewart, GA.

In the SNF PPS final rule for FY 2006 (70 FR 45026, August 4, 2005), we adopted the changes discussed in OMB Bulletin No. 03-04 (June 6, 2003), which announced revised definitions for MSAs and the creation of micropolitan statistical areas and combined statistical areas. In adopting the CBSA geographic designations, we provided for a 1-year transition in FY 2006 with a blended wage index for all providers. For FY 2006, the wage index for each provider consisted of a blend of 50 percent of the FY 2006 MSA-based wage index and 50 percent of the FY 2006 CBSA-based wage index (both using FY 2002 hospital data). We referred to the blended wage index as the FY 2006 SNF PPS transition wage index. As discussed in the SNF PPS final rule for FY 2006 (70 FR 45041), after the expiration of this 1-year transition on September 30, 2006, we used the full CBSA-based wage index values.

In the FY 2015 SNF PPS final rule (79 FR 45644 through 45646), we finalized changes to the SNF PPS wage index based on the newest OMB delineations, as described in OMB Bulletin No. 13-01, beginning in FY 2015, including a 1-year transition with a blended wage index for FY 2015. OMB Bulletin No. 13-01 established revised delineations for Metropolitan Statistical Areas, Micropolitan Statistical Areas, and Combined Statistical Areas in the United States and Puerto Rico based on the 2010 Census and provided guidance on the use of the delineations of these statistical areas using standards published in the June 28, 2010 Federal Register (75 FR 37246 through 37252). Subsequently, on July 15, 2015, OMB issued OMB Bulletin No. 15-01, which provided minor updates to and superseded OMB Bulletin No. 13-01 that was issued on February 28, 2013. The attachment to OMB Bulletin No. 15-01 provided detailed information on the update to statistical areas since February 28, 2013. The updates provided in OMB Bulletin No. 15-01 were based on the application of the 2010 Standards for Delineating Metropolitan and Micropolitan Statistical Areas to Census Bureau population estimates for July 1, 2012, and July 1, 2013, and were adopted under the SNF PPS in the FY 2017 SNF PPS final rule (81 FR 51983, August 5, 2016). In addition, on August 15, 2017, OMB issued Bulletin No. 17-01 which announced a new urban CBSA, Twin Falls, Idaho (CBSA 46300), which was adopted in the SNF PPS final rule for FY 2019 (83 FR 39173, August 8, 2018).

As discussed in the FY 2021 SNF PPS final rule (85 FR 47594), we adopted the revised OMB delineations identified in OMB Bulletin No. 18-04 (available at https://www.whitehouse.gov/wp-content/uploads/2018/09/Bulletin-18-04.pdf) beginning October 1, 2020, including a 1-year transition for FY 2021 under which we applied a 5 percent cap on any decrease in a hospital's wage index compared to its wage index for the prior fiscal year (FY 2020). The updated OMB delineations more accurately reflect the contemporary urban and rural nature of areas across the country, and the use of such delineations allows us to determine more accurately the appropriate wage index and rate tables to apply under the SNF PPS.

In the FY 2023 SNF PPS final rule (87 FR 47521 through 47525), we finalized a policy to apply a permanent 5 percent cap on any decreases to a provider's wage index from its wage index in the prior year, regardless of the circumstances causing the decline. We amended the SNF PPS regulations at 42 CFR 413.337(b)(4)(ii) to reflect this permanent cap on wage index decreases. Additionally, we finalized a policy that a new SNF would be paid the wage index for the area in which it is geographically located for its first full or partial FY with no cap applied because a new SNF would not have a wage index in the prior FY. A full discussion of the adoption of this policy is found in the FY 2023 SNF PPS final rule.

As we previously stated in the FY 2008 SNF PPS proposed and final rules (72 FR 25538 through 25539, and 72 FR 43423), this and all subsequent SNF PPS rules and notices are considered to incorporate any updates and revisions set forth in the most recent OMB bulletin that applies to the hospital wage data used to determine the current SNF PPS wage index. OMB issued further revised CBSA delineations in OMB Bulletin No. 20-01, on March 6, 2020 (available on the web at https://www.whitehouse.gov/wp-content/uploads/2020/03/Bulletin-20-01.pdf). However, we determined that the changes in OMB Bulletin No. 20-01 do not impact the CBSA-based labor market area delineations adopted in FY 2021. Therefore, we did not propose to adopt the revised OMB delineations identified in OMB Bulletin No. 20-01 for FY 2022 through FY 2024.

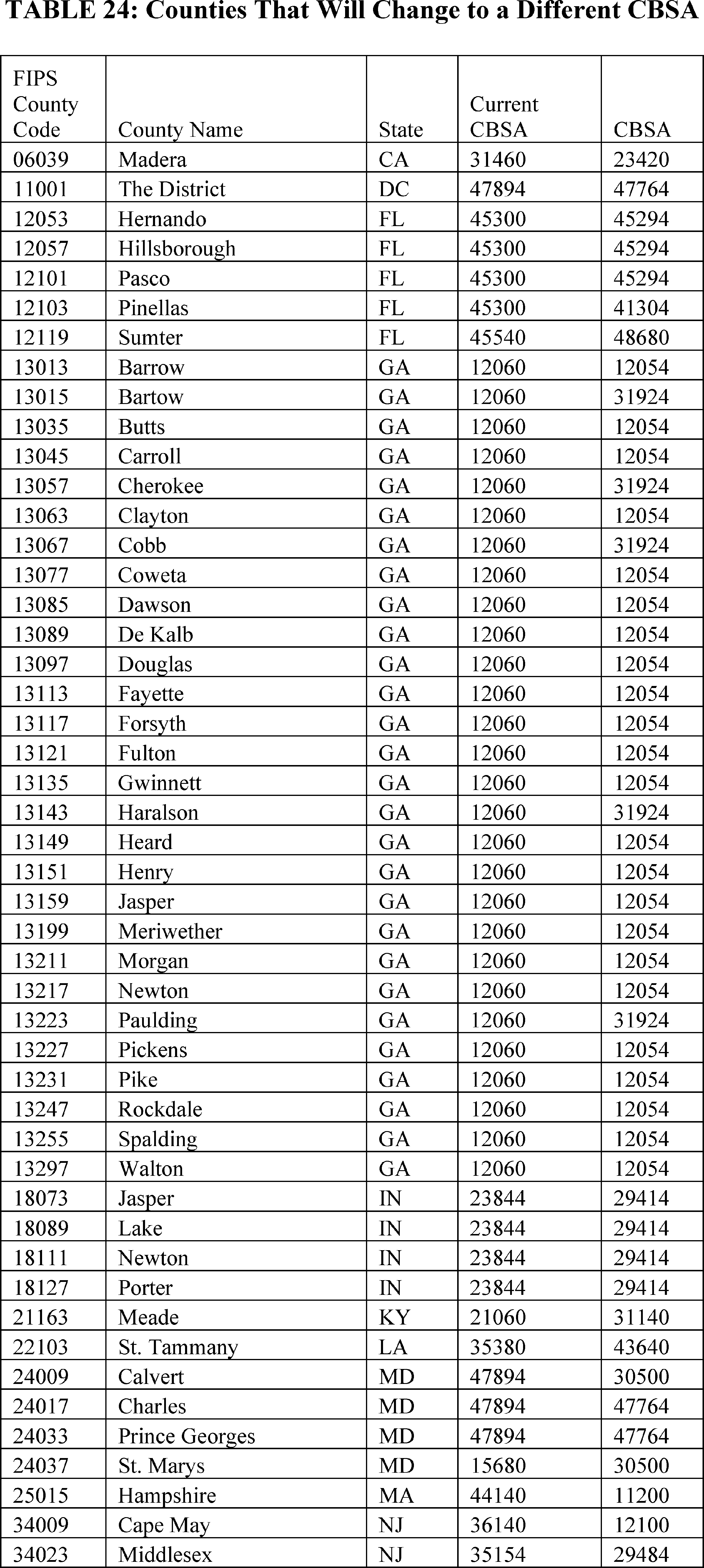

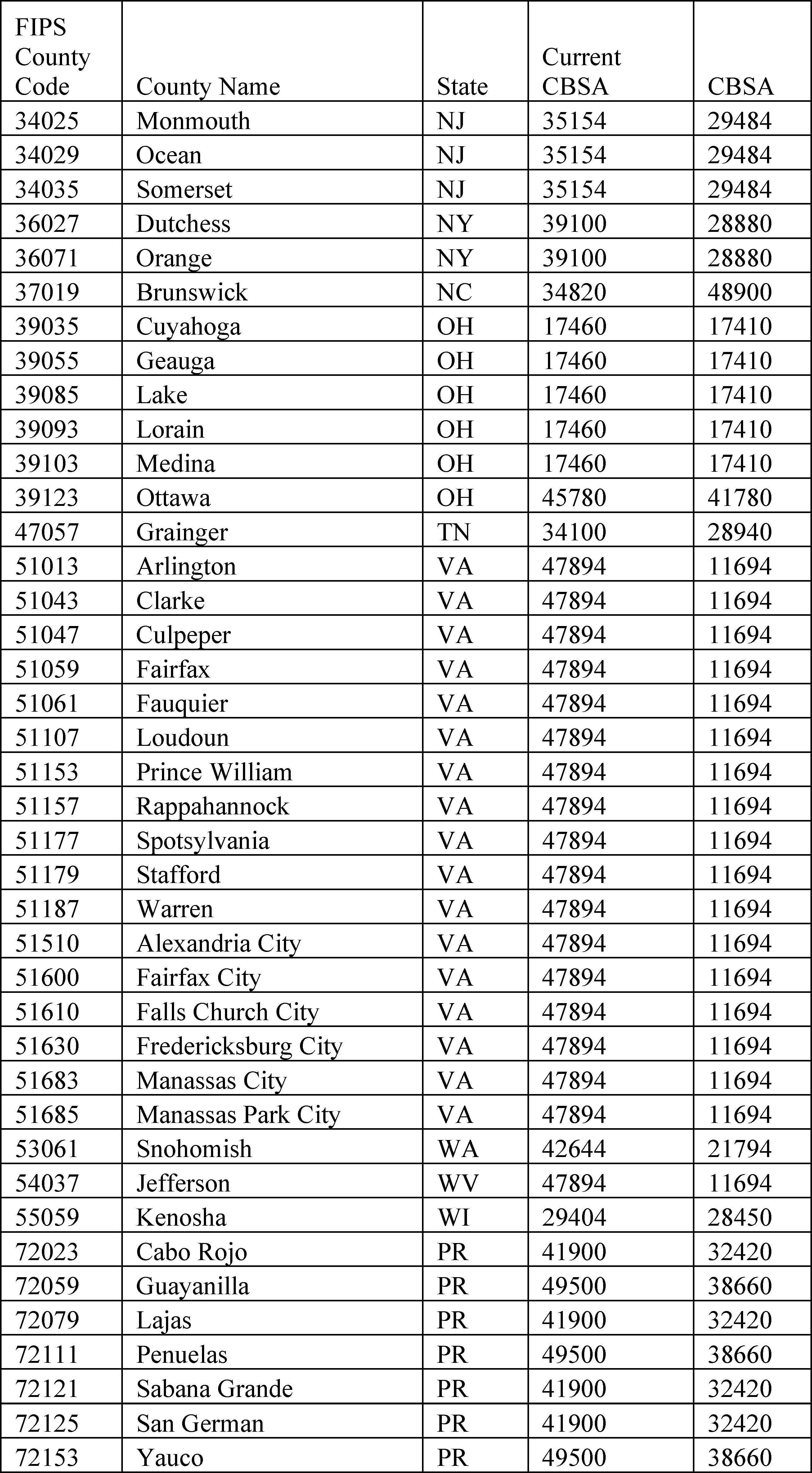

On July 21, 2023, OMB issued OMB Bulletin No. 23-01 which updates and supersedes OMB Bulletin No. 20-01 based on the decennial census. OMB Bulletin No. 23-01 revised delineations for CBSAs which are made up of counties and equivalent entities (for example, boroughs, a city and borough, and a municipality in Alaska, planning regions in Connecticut, parishes in Louisiana, municipios in Puerto Rico, and independent cities in Maryland, Missouri, Nevada, and Virginia). For FY 2025, we proposed to adopt the revised OMB delineations identified in OMB Bulletin No. 23-01 (available at https://www.whitehouse.gov/wp-content/uploads/2023/07/OMB-Bulletin-23-01.pdf). The wage index applicable to FY 2025 is set forth in Table A and B, available on the CMS website at https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/SNFPPS/WageIndex.html.

Once calculated, we will apply the wage index adjustment to the labor-related portion of the Federal rate. Each year, we calculate a labor-related share, based on the relative importance of labor-related cost categories (that is, those cost categories that are labor-intensive and vary with the local labor market) in the input price index. In the SNF PPS final rule for FY 2022 (86 FR 42437), we finalized a proposal to revise the labor-related share to reflect the relative importance of the 2018-based SNF market basket cost weights for the following cost categories: Wages and Salaries; Employee Benefits; Professional Fees: Labor-Related; Administrative and Facilities Support Services; Installation, Maintenance, and Repair Services; All Other: Labor-Related Services; and a proportion of Capital-Related expenses. The methodology for calculating the labor-related portion beginning in FY 2022 is discussed in detail in the FY 2022 SNF PPS final rule (86 FR 42461 through 42463). Effective beginning in FY 2025, as described in section VI.A. of this final rule, we are rebasing and revising the labor-related share to reflect the relative importance of the 2022-based SNF market basket cost weights for the following categories: Wages and Salaries; Employee Benefits; Professional Fees: Labor-Related; Administrative and Facilities Support Services; Installation, Maintenance, and Repair Services; All Other: Labor-Related Services; and a proportion of Capital-Related expenses. The methodology for calculating the labor-related share of the 2022-based SNF market basket is detailed in section VI.A.4. of this final rule.

We calculate the labor-related relative importance from the SNF market basket, and it approximates the labor-related portion of the total costs after taking into account historical and projected price changes between the base year and FY 2025. The price proxies that move the different cost categories in the market basket do not necessarily change at the same rate, and the relative importance captures these changes. Accordingly, the relative importance figure more closely reflects the cost share weights for FY 2025 than the base year weights from the SNF market basket. We calculate the labor-related relative importance for FY 2025 in four steps. First, we compute the FY 2025 price index level for the total market basket and each cost category of the market basket. Second, we calculate a ratio for each cost category by dividing the FY 2025 price index level for that cost category by the total market basket price index level. Third, we determine the FY 2025 relative importance for each cost category by multiplying this ratio by the base year (2022) weight. Finally, we add the FY 2025 relative importance for each of the labor-related cost categories (Wages and Salaries; Employee Benefits; Professional Fees: Labor-Related; Administrative and Facilities Support Services; Installation, Maintenance, and Repair Services; All Other: Labor-Related Services; and a portion of Capital-Related expenses) to produce the FY 2025 labor-related relative importance.

For the proposed rule, the labor-related share for FY 2025 was based on IGI's fourth quarter 2023 forecast of the proposed 2022-based SNF market basket with historical data through third-quarter 2023. For this final rule, as proposed, we estimate the labor-related share for FY 2025 based on IGI's more recent second quarter 2024 forecast, with historical data through the first quarter of 2024. Table 7 summarizes the labor-related share for FY 2025, based on IGI's second quarter 2024 forecast of the 2022-based SNF market basket, compared to the labor-related share that was used for the FY 2024 SNF PPS final rule.

To calculate the labor portion of the case-mix adjusted per diem rate, we will multiply the total case-mix adjusted per diem rate, which is the sum of all five case-mix adjusted components into which a patient classifies, and the non-case-mix component rate, by the FY 2025 labor-related share percentage provided in Table 7. The remaining portion of the rate will be the non-labor portion. Under the previous RUG-IV model, we included tables which provided the case-mix adjusted RUG-IV rates, by RUG-IV group, broken out by total rate, labor portion and non-labor portion, such as Table 9 of the FY 2019 SNF PPS final rule (83 FR 39175). However, as we discussed in the FY 2020 final rule (84 FR 38738), under PDPM, as the total rate is calculated as a combination of six different component rates, five of which are case-mix adjusted, and given the sheer volume of possible combinations of these five case-mix adjusted components, it is not feasible to provide tables similar to those that existed in the prior rulemaking.

Therefore, to aid interested parties in understanding the effect of the wage index on the calculation of the SNF per diem rate, we have included a hypothetical rate calculation in Table 9.

Section 1888(e)(4)(G)(ii) of the Act also requires that we apply this wage index in a manner that does not result in aggregate payments under the SNF PPS that are greater or less than would otherwise be made if the wage adjustment had not been made. For FY 2025 (Federal rates effective October 1, 2023), we apply an adjustment to fulfill the budget neutrality requirement. We meet this requirement by multiplying each of the components of the unadjusted Federal rates by a budget neutrality factor, equal to the ratio of the weighted average wage adjustment factor for FY 2025 to the weighted average wage adjustment factor for FY 2025. For this calculation, we will use the same FY 2023 claims utilization data for both the numerator and denominator of this ratio. We define the wage adjustment factor used in this calculation as the labor portion of the rate component multiplied by the wage index plus the non-labor portion of the rate component. The budget neutrality factor for FY 2025 is 1.0005.

In the proposed rule, we noted that if more recent data became available (for example, revised wage data), we would use such data, if appropriate, to determine the wage index budget neutrality factor in the SNF PPS final rule.

E. SNF Value-Based Purchasing Program

Beginning with payment for services furnished on October 1, 2018, section 1888(h) of the Act requires the Secretary to reduce the adjusted Federal per diem rate determined under section 1888(e)(4)(G) of the Act otherwise applicable to a SNF for services furnished during a fiscal year by 2 percent, and to adjust the resulting rate for a SNF by the value-based incentive payment amount earned by the SNF based on the SNF's performance score for that fiscal year under the SNF VBP Program. To implement these requirements, we finalized in the FY 2019 SNF PPS final rule the addition of § 413.337(f) to our regulations (83 FR 39178).

Please see section VIII. of this final rule for further discussion of the updates we are finalizing for the SNF VBP Program.

F. Adjusted Rate Computation Example

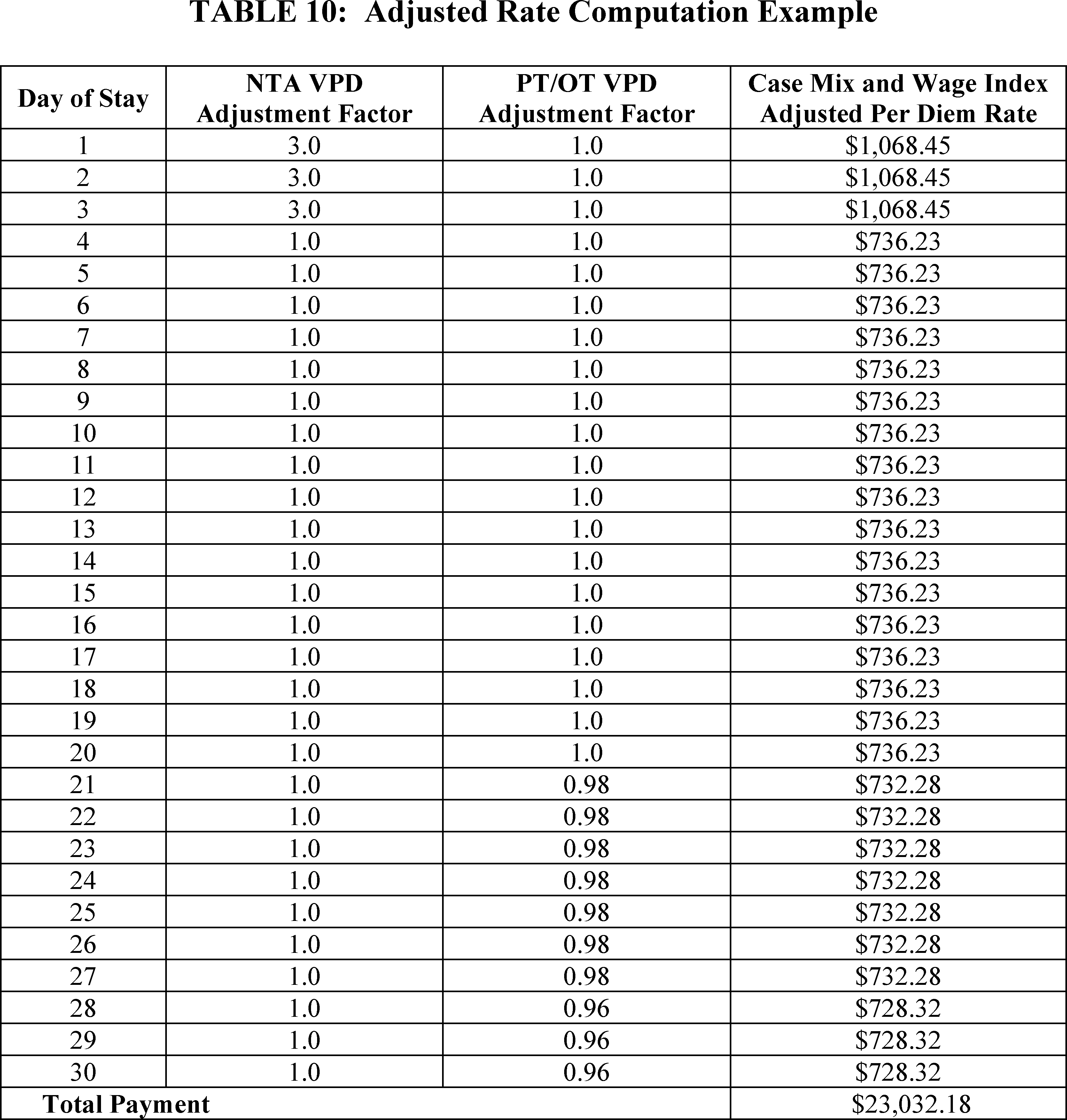

Tables 8 through 10 provide examples generally illustrating payment calculations during FY 2025 under PDPM for a hypothetical 30-day SNF stay, involving the hypothetical SNF XYZ, located in Frederick, MD (Urban CBSA 23224), for a hypothetical patient who is classified into such groups that the patient's HIPPS code is NHNC1. Table 8 shows the adjustments made to the Federal per diem rates (prior to application of any adjustments under the SNF VBP Program as discussed) to compute the provider's case-mix adjusted per diem rate for FY 2025, based on the patient's PDPM classification, as well as how the variable per diem (VPD) adjustment factor affects calculation of the per diem rate for a given day of the stay. Table 9 shows the adjustments made to the case-mix adjusted per diem rate from Table 8 to account for the provider's wage index. The wage index used in this example is based on the FY 2025 SNF PPS wage index that appears in Table A available on the CMS website at https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/SNFPPS/WageIndex.html. Finally, Table 10 provides the case-mix and wage index adjusted per-diem rate for this patient for each day of the 30-day stay, as well as the total payment for this stay. Table 10 also includes the VPD adjustment factors for each day of the patient's stay, to clarify why the patient's per diem rate changes for certain days of the stay. As illustrated in Table 10, SNF XYZ's total PPS payment for this particular patient's stay would equal $23,032.18.

V. Additional Aspects of the SNF PPS

A. SNF Level of Care—Administrative Presumption

The establishment of the SNF PPS did not change Medicare's fundamental requirements for SNF coverage. However, because the case-mix classification is based, in part, on the beneficiary's need for skilled nursing care and therapy, we have attempted, where possible, to coordinate claims review procedures with the existing resident assessment process and case-mix classification system outlined in section III.C. of the proposed rule. This approach includes an administrative presumption that utilizes a beneficiary's correct assignment, at the outset of the SNF stay, of one of the case-mix classifiers designated for this purpose to assist in making certain SNF level of care determinations.

In accordance with § 413.345, we include in each update of the Federal payment rates in the Federal Register a discussion of the resident classification system that provides the basis for case-mix adjustment. We also designate those specific classifiers under the case-mix classification system that represent the required SNF level of care, as provided in 42 CFR 409.30. This designation reflects an administrative presumption that those beneficiaries who are correctly assigned one of the designated case-mix classifiers on the initial Medicare assessment are automatically classified as meeting the SNF level of care definition up to and including the assessment reference date (ARD) for that assessment.

A beneficiary who does not qualify for the presumption is not automatically classified as either meeting or not meeting the level of care definition, but instead receives an individual determination on this point using the existing administrative criteria. This presumption recognizes the strong likelihood that those beneficiaries who are correctly assigned one of the designated case-mix classifiers during the immediate post-hospital period would require a covered level of care, which would be less likely for other beneficiaries.

In the July 30, 1999 final rule (64 FR 41670), we indicated that we would announce any changes to the guidelines for Medicare level of care determinations related to modifications in the case-mix classification structure. The FY 2018 final rule (82 FR 36544) further specified that we would henceforth disseminate the standard description of the administrative presumption's designated groups via the SNF PPS website at https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/SNFPPS/ index.html (where such designations appear in the paragraph entitled “Case Mix Adjustment”) and would publish such designations in rulemaking only to the extent that we actually intend to propose changes in them. Under that approach, the set of case-mix classifiers designated for this purpose under PDPM was finalized in the FY 2019 SNF PPS final rule (83 FR 39253) and is posted on the SNF PPS website ( https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/SNFPPS/index.html), in the paragraph entitled “Case Mix Adjustment.”