-

Start Preamble

Start Printed Page 72760

AGENCY:

Centers for Medicare & Medicaid Services (CMS), HHS.

ACTION:

Proposed rule.

SUMMARY:

This proposed rule addresses changes to the Medicare Shared Savings Program (Shared Savings Program), including provisions relating to the payment of Accountable Care Organizations (ACOs) participating in the Shared Savings Program. Under the Shared Savings Program, providers of services and suppliers that participate in an ACO continue to receive traditional Medicare fee-for-service (FFS) payments under Parts A and B, but the ACO may be eligible to receive a shared savings payment if it meets specified quality and savings requirements.

DATES:

To be assured consideration, comments must be received at one of the addresses provided below, no later than 5 p.m. on February 6, 2015.

ADDRESSES:

In commenting, please refer to file code CMS-1461-P. Because of staff and resource limitations, we cannot accept comments by facsimile (FAX) transmission.

You may submit comments in one of four ways (please choose only one of the ways listed):

1. Electronically. You may submit electronic comments on this regulation to http://www.regulations.gov. Follow the “Submit a comment” instructions.

2. By regular mail. You may mail written comments to the following address ONLY: Centers for Medicare & Medicaid Services, Department of Health and Human Services, Attention: CMS-1461-P, P.O. Box 8013, Baltimore, MD 21244-8013.

Please allow sufficient time for mailed comments to be received before the close of the comment period.

3. By express or overnight mail. You may send written comments to the following address ONLY: Centers for Medicare & Medicaid Services, Department of Health and Human Services, Attention: CMS-1461-P, Mail Stop C4-26-05, 7500 Security Boulevard, Baltimore, MD 21244-1850.

4. By hand or courier. Alternatively, you may deliver (by hand or courier) your written comments ONLY to the following addresses prior to the close of the comment period:

a. For delivery in Washington, DC—Centers for Medicare & Medicaid Services, Department of Health and Human Services, Room 445-G, Hubert H. Humphrey Building, 200 Independence Avenue SW., Washington, DC 20201

(Because access to the interior of the Hubert H. Humphrey Building is not readily available to persons without Federal government identification, commenters are encouraged to leave their comments in the CMS drop slots located in the main lobby of the building. A stamp-in clock is available for persons wishing to retain a proof of filing by stamping in and retaining an extra copy of the comments being filed.)

b. For delivery in Baltimore, MD—Centers for Medicare & Medicaid Services, Department of Health and Human Services, 7500 Security Boulevard, Baltimore, MD 21244-1850.

If you intend to deliver your comments to the Baltimore address, call telephone number (410) 786-7195 in advance to schedule your arrival with one of our staff members.

Comments erroneously mailed to the addresses indicated as appropriate for hand or courier delivery may be delayed and received after the comment period.

For information on viewing public comments, see the beginning of the SUPPLEMENTARY INFORMATION section.

Start Further InfoFOR FURTHER INFORMATION CONTACT:

Dr. Terri Postma or Rick Ensor, 410-786-8084, Email address: aco@cms.hhs.gov.

End Further Info End Preamble Start Supplemental InformationSUPPLEMENTARY INFORMATION:

Inspection of Public Comments: All comments received before the close of the comment period are available for viewing by the public, including any personally identifiable or confidential business information that is included in a comment. We post all comments received before the close of the comment period on the following Web site as soon as possible after they have been received: http://www.regulations.gov. Follow the search instructions on that Web site to view public comments.

Comments received timely will also be available for public inspection as they are received, generally beginning approximately 3 weeks after publication of a document, at the headquarters of the Centers for Medicare & Medicaid Services, 7500 Security Boulevard, Baltimore, Maryland 21244, Monday through Friday of each week from 8:30 a.m. to 4 p.m. To schedule an appointment to view public comments, phone 1-800-743-3951.

Table of Contents

To assist readers in referencing sections contained in this preamble, we are providing a table of contents.

I. Executive Summary and Background

A. Executive Summary

1. Purpose

2. Summary of the Major Provisions

3. Summary of Costs and Benefits

B. Background

II. Provisions of This Proposed Rule

A. Definitions

1. Proposed Definitions

2. Proposed Revisions to Existing Definitions

a. Definition of ACO Participant

b. Definition of ACO Professional

c. Definition of ACO Provider/Supplier

d. Definition of Assignment

e. Definition of Hospital

f. Definition of Primary Care Services

g. Definitions of Continuously Assigned Beneficiary and Newly Assigned Beneficiary

h. Definition of Agreement Period

B. ACO Eligibility Requirements

1. Agreement Requirements

a. Overview

b. Proposed Revisions

2. Sufficient Number of Primary Care Providers and Beneficiaries

a. Overview

b. Proposed Revisions

3. Identification and Required Reporting of ACO Participants and ACO Providers/Suppliers

a. Overview

b. Proposed Revisions

(1) Certified List of ACO Participants and ACO Providers/Suppliers

(2) Managing Changes to ACO Participants

(3) Managing Changes to ACO Providers/Suppliers

(4) Update of Medicare Enrollment Information

4. Significant Changes to an ACO

a. Overview

b. Proposed Revisions

5. Consideration of Claims Billed by Merged/Acquired Medicare-Enrolled Entities

a. Overview

b. Proposal

6. Legal Structure and Governance

a. Legal Entity and Governing Body

(1) Overview

(2) Proposed Revisions

b. Fiduciary Duties of Governing Body Members

(1) Overview

(2) Proposed Revisions

c. Composition of the Governing Body

(1) Overview

(2) Proposed Revisions

7. Leadership and Management Structure

a. Overview

b. Proposed Revisions

8. Required Process To Coordinate Care

a. Overview

b. Accelerating Health Information Technology Start Printed Page 72761

c. Proposed Revisions

9. Transition of Pioneer ACOs Into the Shared Savings Program

a. Overview

b. Proposed Revisions

C. Establishing and Maintaining the Participation Agreement With the Secretary

1. Background

2. Application Deadlines

a. Overview

b. Proposed Revisions

3. Renewal of Participation Agreements

a. Overview

b. Proposed Revisions

4. Changes to Program Requirements During the 3-Year Agreement

a. Overview

b. Proposed Revisions

D. Provision of Aggregate and Beneficiary Identifiable Data

1. Background

2. Aggregate Data Reports and Limited Identifiable Data

a. Overview

b. Proposed Revisions

3. Claims Data Sharing and Beneficiary Opt-Out

a. Overview

b. Proposed Revisions

E. Assignment of Medicare FFS Beneficiaries

1. Background

2. Basic Criteria for a Beneficiary To Be Assigned to an ACO

3. Definition of Primary Care Services

a. Overview

b. Proposed Revisions

4. Consideration of Physician Specialties and Non-Physician Practitioners in the Assignment Process

a. Overview

b. Proposed Revisions

5. Assignment of Beneficiaries to ACOs That Include FQHCs, RHCs, CAHs, or ETA Hospitals

a. Assignment of Beneficiaries to ACOs That Include FQHCs and RHCs

(1) Overview

(2) Proposed Revisions

b. Assignment of Beneficiaries to ACOs That Include CAHs

c. Assignment of Beneficiaries to ACOs That Include ETA Hospitals

6. Effective Date for Finalization of Proposals Affecting Beneficiary Assignment

F. Shared Savings and Losses

1. Background

2. Modifications to the Existing Payment Tracks

a. Overview

b. Proposals Related to Transition From the One-Sided to Two-Sided Model

c. Proposals for Modifications to the Track 2 Financial Model

3. Creating Options for ACOs That Participate in Risk-Based Arrangements

a. Overview

b. Proposals for Assignment of Beneficiaries Under Track 3

(1) Background

(2) Proposal for Prospective Assignment Under Track 3

c. Proposed Exclusion Criteria for Prospectively Assigned Beneficiaries

d. Proposed Timing of Prospective Assignment

e. Proposals for Addressing Interactions Between Prospective and Retrospective Assignment Models

f. Proposals for Determining Benchmark and Performance Year Expenditures Under Track 3

g. Proposals for Risk Adjusting the Updated Benchmark for Track 3 ACOs

h. Proposals for Final Sharing/Loss Rate and Performance Payment/Loss Recoupment Limit Under Track 3

i. Proposals for Minimum Savings Rate and Minimum Loss Rate in Track 3

4. Seeking Comment on Ways To Encourage ACOs Participation in Performance-Based Risk Arrangements

a. Payment Requirements and Program Requirements That May Need To Be Waived in Order To Carry Out the Shared Savings Program

(1) SNF 3-Day Rule

(2) Billing and Payment for Telehealth Services

(3) Homebound Requirement Under the Home Health Benefit

(4) Waivers for Referrals to Postacute Care Settings

(5) Waiver of Other Payment Rules

b. Other Options for Improving the Transition to Two-Sided Performance-Based Risk Arrangements

(1) Beneficiary Attestation

(2) Seeking Comment on a Step-Wise Progression for ACOs To Take on Performance-Based Risk

5. Modifications to Repayment Mechanism Requirements

a. Overview

b. Proposals for Amount and Duration of the Repayment Mechanism

c. Proposals Regarding Permissible Repayment Mechanisms

6. Seeking Comment on Methodology for Establishing, Updating, and Resetting the Benchmark

a. Background on Establishing, Updating, and Resetting the Benchmark

(1) Background on Use of National Growth Rate as a Benchmark Trending Factor

(2) Background on Use of National FFS Growth Factors in Updating the Benchmark During the Agreement Period

(3) Background on Managing Changes to ACOs During the Agreement Period

(4) Background on Resetting the Benchmark

(5) Background on Stakeholders' Concerns About Benchmarking Methodology

b. Factors To Use in Resetting ACO Benchmarks and Alternative Benchmarking Methodologies

(1) Equally Weighting the Three Benchmark Years

(2) Accounting for Shared Savings Payments in Benchmarks

(3) Use of Regional Factors (as opposed to national factors) in Establishing and Updating Benchmarks

(4) Alternative Benchmark Resetting Methodology: Hold the ACO's Historical Costs Constant Relative to Its Region

(5) Alternative Benchmark Methodology: Transition ACOs to Benchmarks Based Only on Regional FFS Costs Over the Course of Multiple Agreement Periods

(6) Seeking Comment on the Benchmarking Alternatives Considered and the Applicability of These Approaches

7. Seeking Comment on Technical Adjustments to the Benchmark and Performance Year Expenditures

G. Additional Program Requirements and Beneficiary Protections

1. Background

2. Public Reporting and Transparency

a. Overview

b. Proposed Revisions

3. Terminating Program Participation

a. Overview

b. Proposed Revisions

(1) Grounds for Termination

(2) Close-Out Procedures and Payment Consequences of Early Termination

(3) Reconsideration Review Process

(A) Overview

(B) Proposed Changes

(4) Monitoring ACO Compliance With Quality Performance Standards

III. Collection of Information Requirements

IV. Response to Comments

V. Regulatory Impact Analysis

A. Statement of Need

B. Overall Impact

C. Anticipated Effects

1. Effects on the Medicare Program

a. Assumptions and Uncertainties

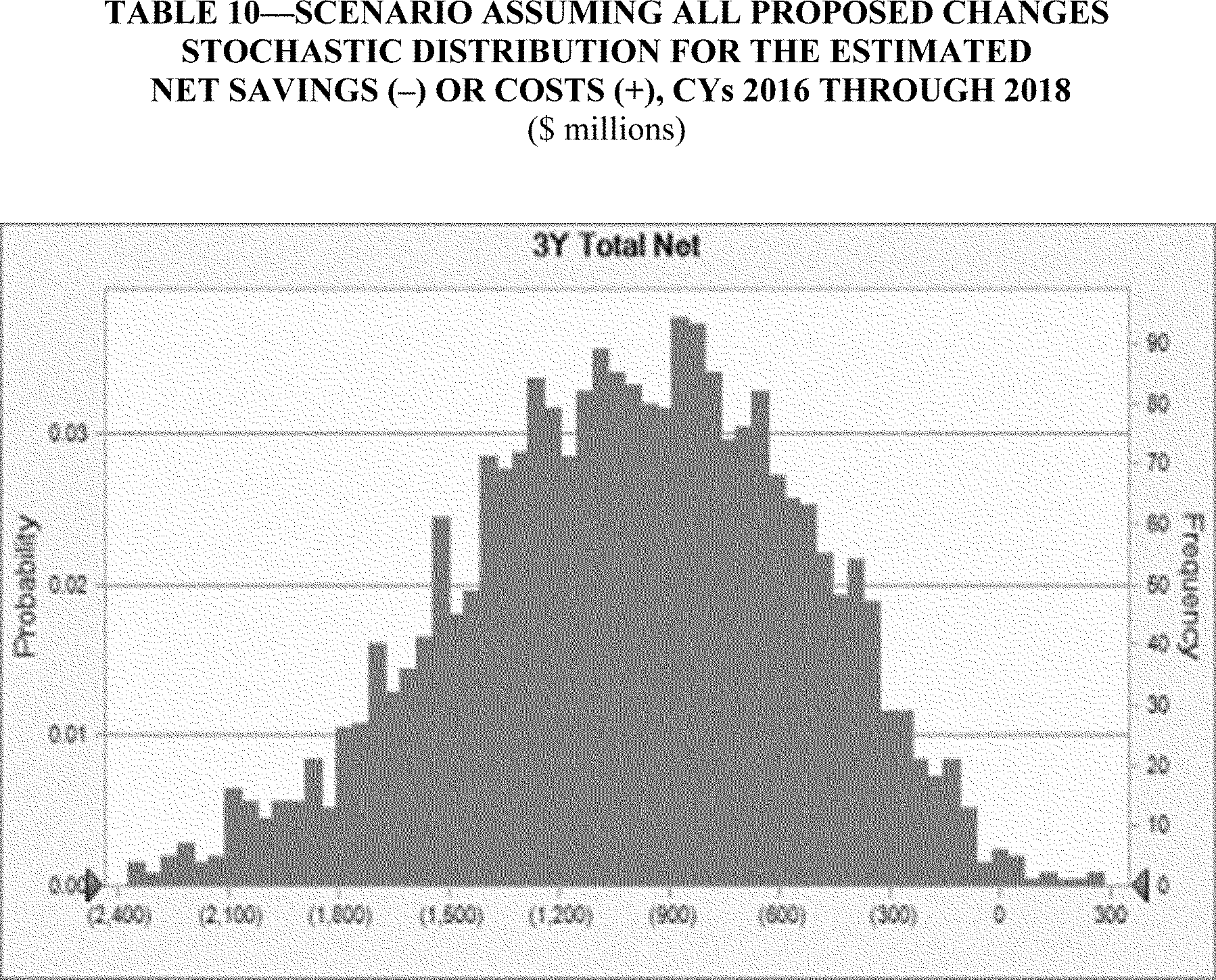

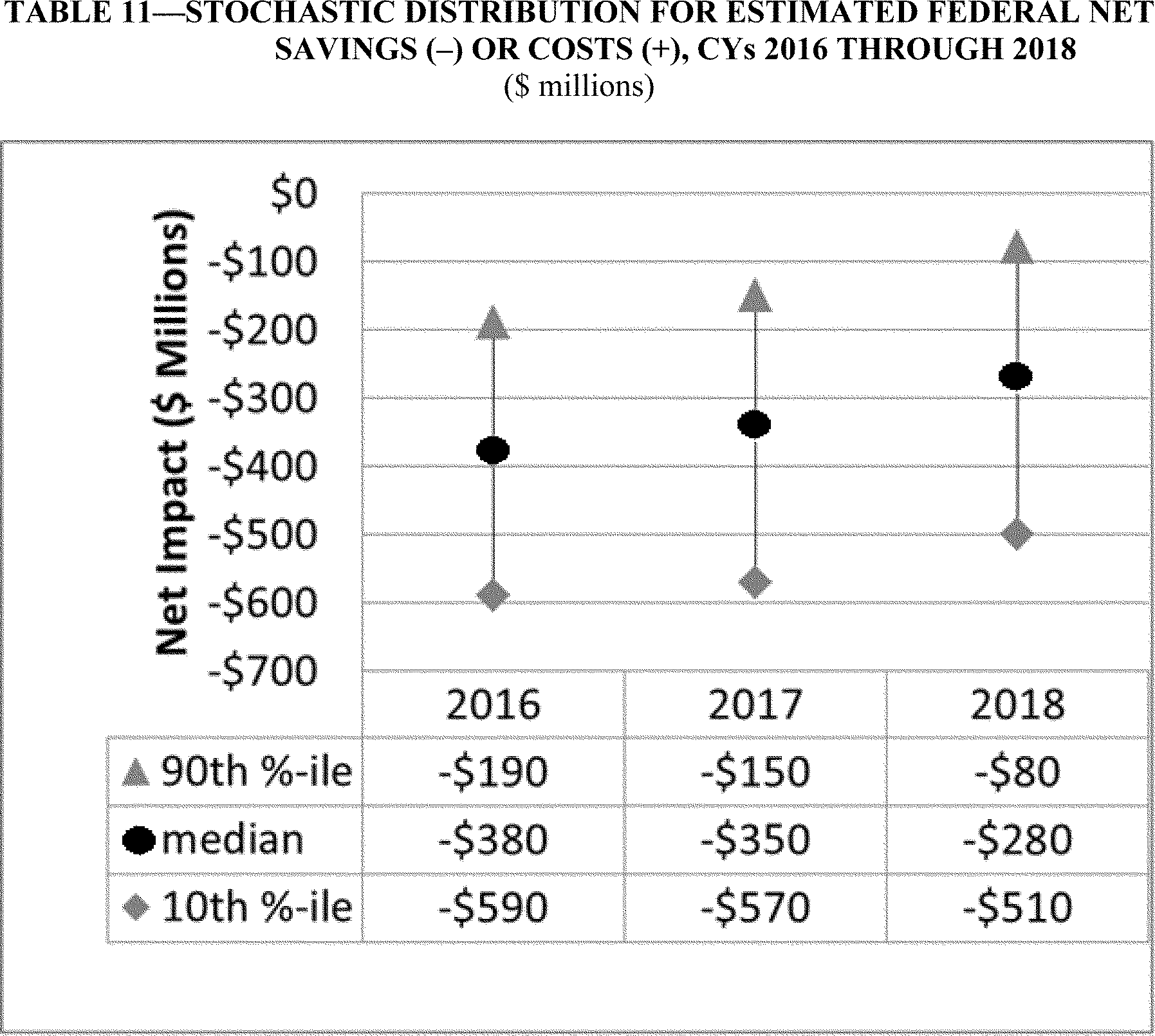

b. Detailed Stochastic Modeling Results

c. Further Considerations

2. Effects on Beneficiaries

3. Effect on Providers and Suppliers

4. Effect on Small Entities

5. Effect on Small Rural Hospitals

6. Unfunded Mandates

D. Alternatives Considered

E. Accounting Statement and Table

F. Conclusion

Regulations Text

Acronyms

ACO Accountable Care Organization

BIPA Medicare, Medicaid, and SCHIP Benefits Improvement and Protection Act of 2000 (Pub. L. 106-554)

CAHs Critical Access Hospitals

CCM Chronic Care Management

CEHRT Certified Electronic Health Record Technology

CG-CAHPS Clinician and Group Consumer Assessment of Health Providers and Systems

CHIP Children's Health Insurance Program

CMP Civil Monetary Penalties

CMS Centers for Medicare & Medicaid Services

CNM Certified Nurse Midwife

CMS-HCC CMS Hierarchal Condition Category

CPT [Physicians] Current Procedural Terminology (CPT codes, descriptions and other data only are copyright 2013 American Medical Association. All rights reserved.)

CWF Common Working File

DHHS Department of Health and Human Services

DOJ Department of Justice

DRA Deficit Reduction Act of 2005 (Pub. L. 109-171)

DSH Disproportionate Share Hospital

DUA Data Use Agreement Start Printed Page 72762

EHR Electronic Health Record

ESRD End Stage Renal Disease

ETA hospital Electing Teaching Amendment Hospital

FFS Fee-for-service

FQHCs Federally Qualified Health Centers

FTC Federal Trade Commission

GPCI Geographic Practice Cost Index

GPRO Group Practice Reporting Option

HCC Hierarchal Condition Category

HCPCS Healthcare Common Procedure Coding System

HICN Health Insurance Claim Number

HIPAA Health Insurance Portability and Accountability Act of 1996 (Pub. L. 104-191)

HVBP Hospital Value-based Purchasing

IPA Independent Practice Association

IPPS Inpatient Prospective Payment System

IRS Internal Revenue Service

MA Medicare Advantage

MedPAC Medicare Payment Advisory Commission

MLR Minimum Loss Rate

MSP Medicare Secondary Payer

MSR Minimum Savings Rate

MU Meaningful Use

NCQA National Committee for Quality Assurance

NP Nurse Practitioner

NPI National Provider Identifier

NQF National Quality Forum

OIG Office of Inspector General

PA Physician Assistant

PACE Program of All Inclusive Care for the Elderly

PECOS Provider Enrollment, Chain, and Ownership System

PFS Physician Fee Schedule

PGP Physician Group Practice

PHI Protected Health Information

PPS Prospective Payment System

PQRS Physician Quality Reporting System

PRA Paperwork Reduction Act

PSA Primary Service Areas

RHCs Rural Health Clinics

RIA Regulatory Impact Analysis

SNFs Skilled Nursing Facilities

SSA Social Security Act

SSN Social Security Number

TIN Taxpayer Identification Number

VM Value Modifier

CPT (Current Procedural Terminology) Copyright Notice

Throughout this proposed rule, we use CPT codes and descriptions to refer to a variety of services. We note that CPT codes and descriptions are copyright 2013 American Medical Association. All Rights Reserved. CPT is a registered trademark of the American Medical Association (AMA). Applicable Federal Acquisition Regulations (FARs) and Defense Federal Acquisition Regulations (DFARs) apply.

I. Executive Summary and Background

A. Executive Summary

1. Purpose

Section 1899 of the Social Security Act (the Act) established the Medicare Shared Savings Program, which promotes accountability for a patient population, fosters coordination of items and services under parts A and B, and encourages investment in infrastructure and redesigned care processes for high quality and efficient health care service delivery. This proposed rule would make changes to the regulations that were promulgated in November 2011 to implement the Shared Savings Program in order to make refinements based on our experience with the program and to respond to concerns raised by stakeholders. Unless otherwise noted, these changes would be effective 60 days after publication of the final rule. Application or implementation dates may vary, depending on the nature of the policy; however, we anticipate all of the final policies and methodological changes would be applied for the 2016 performance year for all participating organizations unless otherwise noted.

2. Summary of the Major Provisions

This proposed rule is designed to codify existing guidance, reduce administrative burden and improve program function and transparency in the following areas: (1) Data-sharing requirements; (2) requirements for ACO participant agreements, the ACO application process, and our review of applications; (3) identification and reporting of ACO participants and ACO providers/suppliers, including managing changes to the list of ACO participants and ACO providers/suppliers; (4) eligibility requirements related to the ACO's number of beneficiaries, required processes, the ACO's legal structure and governing body, and its leadership and management structure; (5) modification to assignment methodology; (6) repayment mechanisms for ACOs in two-sided performance-based risk tracks; (7) alternatives to encourage participation in risk-based models; (8) ACO public reporting and transparency; (9) the ACO termination process; and (10) the reconsideration review process. To achieve these goals, we make the following proposed modifications to our current program rules:

- Clarify existing and establish new definitions of terms including an ACO participant, ACO provider/supplier, and ACO participation agreement.

- Add a process for ACOs to renew the participation agreement for an additional agreement period.

- Add, clarify, and revise the beneficiary assignment algorithm, including the following—

++ Update the CPT codes that would be considered to be primary care services as well as changing the treatment of certain physician specialties in the assignment process;

++ Include the claims for primary care services furnished by NP, PAs, and CNSs in Step 1 of the assignment algorithm; and

++ Clarify how primary care services furnished in federally qualified health centers (FQHCs), rural health clinics (RHCs), and electing teaching amendment (ETA) hospitals will be considered in the assignment process.

- Expand the kinds of beneficiary-identifiable data that would be provided to ACOs in various reports under the Shared Savings Program as well as simplify the claims data sharing opt-out process to improve the timeliness of access to claims data.

- Add or change policies to encourage greater ACO participation in risk-based models by—

++ Offering the opportunity for ACOs to continue participating under a one-sided participation agreement after their first 3-year agreement;

++ Reducing risk under Track 2; and

++ Adopting an alternative risk-based model referred to as Track 3 which includes proposals for a higher sharing rate and prospective assignment of beneficiaries.

In addition, we seek comment on a number of options that we have been considering in order to encourage ACOs to take on two-sided performance-based risk under the Shared Savings Program. We also seek comment on issues related to resetting the benchmark in a subsequent performance year and the use of statutory waiver authority to improve participation in two-sided risk models.

3. Summary of Costs and Benefits

We assume that our proposals to ease the transition to risk, reduce risk under Track 2, and adopt an alternative risk-based model (Track 3) would result in increased participation in the Shared Savings Program. As shown in our impact analysis, we expect the proposed changes to result in a significant increase in total shared savings, while shared losses would decrease. Moreover, as participation in the Shared Savings Program continues to expand, we anticipate there would be a broader focus on care coordination and quality improvement among providers and suppliers within the Medicare program that would lead to both increased efficiency in the provision of care and improved quality of the care provided to beneficiaries.

The proposed changes detailed in this rule would result in median estimated federal savings of $280 million greater than the $730 million median net Start Printed Page 72763savings estimated at baseline for calendar years (CYs) 2016 through 2018. We estimate that the provisions of this proposed rule would result in a reduction in the median shared loss dollars by $140 million and an increase in the median shared savings payments by $320 million dollars relative to the baseline for CYs 2016 through 2018. The estimated aggregate average start up investment and 3 year operating costs if all proposals are finalized is approximately $441 million.

B. Background

On March 23, 2010, the Patient Protection and Affordable Care Act (Pub. L. 111-148) was enacted, followed by enactment of the Health Care and Education Reconciliation Act of 2010 (Pub. L. 111-152) on March 30, 2010, which amended certain provisions of Public Law 111-148. Collectively known as the Affordable Care Act, these public laws include a number of provisions designed to improve the quality of Medicare services, support innovation and the establishment of new payment models, better align Medicare payments with provider costs, strengthen Medicare program integrity, and put Medicare on a firmer financial footing.

Section 3022 of the Affordable Care Act amended Title XVIII of the Act (42 U.S.C. 1395 et seq.) by adding new section 1899 to the Act to establish a Shared Savings Program. This program is a key component of the Medicare delivery system reform initiatives included in the Affordable Care Act and is a new approach to the delivery of health care. The purpose of the Shared Savings Program is to promote accountability for a population of Medicare beneficiaries, improve the coordination of FFS items and services, encourage investment in infrastructure and redesigned care processes for high quality and efficient service delivery, and promote higher value care. ACOs that successfully meet quality and savings requirements share a percentage of the achieved savings with Medicare. Under the Shared Savings Program, ACOs share in savings only if they meet both the quality performance standards and generate shareable savings. Consistent with the purpose of the Shared Savings Program, we focused on developing policies aimed at achieving the three-part aim consisting of: (1) Better care for individuals; (2) better health for populations; and (3) lower growth in expenditures.

In the November 2, 2011 Federal Register (76 FR 67802), we published the final rule entitled “Medicare Program; Medicare Shared Savings Program: Accountable Care Organizations” (November 2011 final rule). We viewed this final rule as a starting point for the program, and because of the scope and scale of the program and our limited experience with shared savings initiatives under FFS Medicare, we built a great deal of flexibility into the program rules. We anticipated that subsequent rulemaking for the Shared Savings Program would be informed by lessons learned from our experience with the program as well as from testing through the Pioneer ACO Model and other initiatives conducted by the Center for Medicare and Medicaid Innovation (Innovation Center) under section 1115A of the Act.

Over 330 organizations are now participating in the Shared Savings Program. We are gratified by stakeholder interest in this program. In the November 2011 final rule (76 FR 67805), we stated that we intended to assess the policies for the Shared Savings Program and models being tested by the Innovation Center to determine how well they were working and if there were any modifications that would enhance them. As evidenced by the high degree of interest in participation in the Shared Savings Program, we believe that the policies adopted in the November 2011 final rule are generally well-accepted. However, we have identified several policy areas we would like to revisit in light of the additional experience we have gained during the first 2 years of program implementation.

We note that in developing the Shared Savings Program, and in response to stakeholder suggestions, we worked very closely with agencies across the federal government to develop policies to encourage participation in the program and to ensure a coordinated inter- and intra-agency program implementation. The result of this effort was the release of several documents regarding the application of other relevant laws and regulations to ACOs. These documents are described in more detail in section II.C.5. of the November 2011 final rule (76 FR 67840) and include: (1) A joint CMS and DHHS OIG interim final rule with comment period establishing waivers of the application of the physician self-referral law, the Federal anti-kickback statute, and certain civil monetary penalties (CMP) law provisions for specified arrangements involving ACOs participating in the Shared Savings Program (76 FR 67992); (2) an Internal Revenue Service (IRS) notice (Notice 2011-20) and fact sheet (FS-2011-11) issued in response to comments regarding the need for additional tax guidance for tax-exempt organizations, including tax-exempt hospitals, that may participate in the Shared Savings Program (see Notice 2011-20 at www.irs.gov//pub/irs-drop/n-11-20.pdf and FS-2011-11 at www.irs.gov/pub/irs-news/fs-2011-11.pdf); and (3) a final Statement of Antitrust Enforcement Policy Regarding Accountable Care Organizations Participating in the Shared Savings Program issued jointly by the FTC and DOJ (collectively, the Antitrust Agencies) and published in the October 28, 2011 Federal Register (76 FR 67026). We have continued working with these agencies as we have implemented this program and believe that these materials continue to offer valuable information regarding a number of issues of great importance both to our implementation of the Shared Savings Program and to the entities that participate in the program. We encourage ACOs and other stakeholders to review and comply with the referenced documents. Documents can be accessed through the links on our Web site at: http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/sharedsavingsprogram/Statutes_Regulations_Guidance.html.

II. Provisions of This Proposed Rule

The purpose of this proposed rule is to propose revisions to some key policies adopted in the November 2011 final rule (76 FR 67802), to incorporate in our regulations certain guidance that we have issued since the Shared Savings Program was established, and to propose regulatory additions to support program compliance and growth. Our intent is to encourage continued and enhanced stakeholder participation, to reduce administrative burden for ACOs while facilitating their efforts to improve care outcomes, and to maintain excellence in program operations while bolstering program integrity.

A. Definitions

In the November 2011 final rule (76 FR 67802), we adopted definitions of key terms for purposes of the Shared Savings Program at § 425.20. These terms are used throughout this proposed rule. We encourage readers to review these definitions. Based on our experiences thus far with the Shared Savings Program and inquiries we received regarding the defined terms, we propose some additions to the definitions and a few revisions to the existing definitions.

1. Proposed Definitions

We propose to add several new terms to the definitions in § 425.20. First, we propose to add a definition of “participation agreement.” Specifically, Start Printed Page 72764we propose to define the term to mean the written agreement required under § 425.208(a) between the ACO and CMS that, along with the regulations at part 425, governs the ACO's participation in the Shared Savings Program. We further propose to make conforming changes throughout part 425, replacing references to an ACO's agreement with CMS with the defined term “participation agreement.” In addition, we propose to make a conforming change in § 425.204(c)(1)(i) to remove the incorrect reference to “participation agreements” and replace it with “ACO participant agreements.”

Second, we propose to add the related definition of “ACO participant agreement.” Specifically, we propose to define “ACO participant agreement” to mean the written agreement between an ACO and an ACO participant required at § 425.116 in which the ACO participant agrees to participate in, and comply with, the requirements of the Shared Savings Program.

Third, as discussed in greater detail in section II.F. of this proposed rule, we propose to add a definition for “assignment window,” to mean the 12-month period used to assign beneficiaries to an ACO.

2. Proposed Revisions to Existing Definitions

a. Definition of ACO Participant

The current definition of “ACO participant” states that an “ACO participant means an individual or group of ACO provider(s)/supplier(s), that is identified by a Medicare-enrolled TIN, that alone or together with one or more other ACO participants comprise(s) an ACO, and that is included on the list of ACO participants that is required under § 425.204(c)(5).” Based on inquiries we have received since the publication of November 2011 final rule, we believe that there has been some confusion as to the distinction between an ACO participant and an ACO provider/supplier. The key point is that an ACO participant is an entity, not a practitioner, identified by a Medicare-enrolled TIN (that is, a TIN that is used to bill Medicare for services furnished to Medicare fee-for-service beneficiaries). An ACO participant may be composed of one or more ACO providers/suppliers whose services are billed under a Medicare billing number assigned to the TIN of the ACO participant. Additionally, we emphasize that the ACO is responsible for ensuring that all individuals and entities that have reassigned the right to receive Medicare payment to the TIN of the ACO participant have also agreed to be ACO providers/suppliers.

We propose to revise the definition of “ACO participant” to clarify that an ACO participant is an entity identified by a Medicare-enrolled TIN. Additionally, we are correcting a grammatical error by revising the definition to indicate that one or more ACO participants “compose,” rather than “comprise” an ACO. We note that a related grammatical error is corrected at § 425.204(c)(iv). These proposed changes to the definition of “ACO participant” are not intended to alter the way the Shared Savings Program currently operates.

b. Definition of ACO Professional

Under the current definition at § 425.20, an “ACO professional” means an ACO provider/supplier who is either of the following:

- A physician legally authorized to practice medicine and surgery by the State in which he performs such function or action.

- A practitioner who is one of the following:

++ A physician assistant (as defined at § 410.74(a)(2)).

++ A nurse practitioner (as defined at § 410.75(b)).

++ A clinical nurse specialist (as defined at § 410.76(b)).

We propose to revise the definition of ACO professional to remove the requirement that an ACO professional be an ACO provider/supplier. We also propose to revise the definition of ACO professional to indicate that an ACO professional is an individual who bills for items or services he or she furnishes to Medicare fee-for-service beneficiaries under a Medicare billing number assigned to the TIN of an ACO participant in accordance with Medicare regulations. We are proposing these modifications because there may be ACO professionals who furnished services billed through an ACO participant's TIN in the benchmarking years but are no longer affiliated with the ACO participant and therefore are not furnishing services billed through the TIN of the ACO participant during the performance years. These proposed changes to the definition of “ACO professional” are not intended to alter the way the Shared Savings Program currently operates.

c. Definition of ACO Provider/Supplier

Under the current definition at § 425.20, an “ACO provider/supplier” means an individual or entity that—(1) is a provider (as defined at § 400.202) or a supplier (as defined at § 400.202); (2) is enrolled in Medicare; (3) bills for items and services it furnishes to Medicare fee-for-service beneficiaries under a Medicare billing number assigned to the TIN of an ACO participant in accordance with applicable Medicare regulations; and (4) is included on the certified list of ACO providers/suppliers that is submitted by the ACO. We propose to modify the definition to clarify that an individual or entity is an ACO provider/supplier only when it bills for items and services furnished to Medicare FFS beneficiaries during the agreement period under a Medicare billing number assigned to the TIN of an ACO participant and is included on the list of ACO providers/suppliers that is required under the proposed regulation at § 425.118. We do not believe that an individual or entity that may previously have reassigned the right to receive Medicare payment to an ACO participant, but that is not participating in the activities of the ACO by furnishing care to Medicare FFS beneficiaries that is billed through the TIN of an ACO participant during the ACO's agreement period, should be considered to be an ACO provider/supplier. Thus, this modification is intended to clarify that a provider or supplier must bill for items or services furnished to Medicare FFS beneficiaries through the TIN of an ACO participant during the ACO's agreement period in order to be an ACO provider/supplier.

d. Definition of Assignment

Under the current definition at § 425.20, “assignment” means “the operational process by which CMS determines whether a beneficiary has chosen to receive a sufficient level of the requisite primary care services from a physician who is an ACO provider/supplier so that the ACO may be appropriately designated as exercising basic responsibility for that beneficiary's care.” As discussed previously in this section, we are proposing to modify the definition of “ACO professional” to remove the requirement that an ACO professional be an ACO provider/supplier. Similarly, we believe that for purposes of defining assignment, it is more appropriate to use the term “ACO professional,” as revised, than the term “ACO provider/supplier” because a physician or other practitioner can only be an ACO provider/supplier if he or she bills for items and services through the TIN of an ACO participant during the ACO's agreement period and is included on the list of ACO providers/suppliers required under our regulations. However, as we discussed previously, there may be an ACO professional who furnished services billed through an ACO participant's TIN Start Printed Page 72765in the benchmarking years but is no longer billing through the ACO participant's TIN during the performance years and therefore cannot be considered an ACO provider/supplier. For example, a practitioner that retired before the ACO entered into a participation agreement with CMS and is no longer billing through the TIN of an ACO participant, and therefore was not included on the ACO provider/supplier list is not an ACO provider/supplier. Nevertheless, the services furnished by this ACO professional and billed through the TIN of an ACO participant would be considered for purposes of determining beneficiary assignment to the ACO during the benchmarking period.

In the interests of clarity, we therefore propose to modify the definition of assignment to reflect that our assignment methodology takes into account claims for primary care services furnished by ACO professionals, not solely claims for primary care services furnished by physicians in the ACO. This revision will ensure consistency with program operations and alignment with the definition of “ACO professional” since it is the aggregation of the ACO professionals' claims that impacts assignment. Consistent with section 1899(c) of the Act, a beneficiary must have at least one primary care service furnished by a physician in the ACO in order to be eligible for assignment to the ACO, and this is reflected in the assignment methodology articulated under subpart E of the Shared Savings Program regulations. Once a beneficiary is determined to be eligible for assignment, the beneficiary is then assigned to the ACO if its ACO professionals have rendered the plurality of primary care services for the beneficiary as determined under the stepwise assignment methodology in § 425.402. Thus, we believe the proposed modification to the definition of “assignment” would more accurately reflect the use of claims for primary care services furnished by ACO professionals that are submitted through an ACO participant's TIN in determining beneficiary assignment in the ACO's benchmark and performance years.

Additionally, we propose to make conforming changes as necessary to the regulations governing the assignment methodology in subpart E of part 425, to revise the references to “ACO provider/supplier” to read “ACO professional.”

e. Definition of Hospital

We are proposing a technical revision to the definition of “hospital” for purposes of the Shared Savings Program. Section 1899(h)(2) of the Act provides that, for purposes of the Shared Savings Program, the term “hospital” means a subsection (d) hospital as defined in section 1886(d)(1)(B) of the Act. In the November 2011 final rule (76 FR 67812), we stated that this statutory definition of hospital thus limits: ”. . . the definition to include only acute care hospitals paid under the hospital inpatient prospective payment system (IPPS).” Consistent with this interpretation, we proposed and finalized the following definition of “hospital” for purposes of the Shared Savings Program at § 425.20: “Hospital means a hospital subject to the prospective payment system specified in § 412.1(a)(1) of this chapter.”

Under this regulatory definition, Maryland acute care hospitals would not be considered to be hospitals for purposes of the Shared Savings Program because hospitals in the state of Maryland are subject to a waiver from the Medicare payment methodologies under which they would otherwise be paid. However, we have taken the position in other contexts, for example, for purposes of electronic health record (EHR) incentive payments (75 FR 44448) and in the FY 2014 IPPS final rule (78 FR 50623), that Maryland acute care hospitals remain subsection (d) hospitals. This is because these hospitals are “located in one of the fifty states or the District of Columbia” (as provided in the definition of subsection (d) hospitals at section 1886(d)(1)(B) of the Act) and are not hospitals that are specifically excluded from that category, such as cancer hospitals and psychiatric hospitals.

Therefore, we propose to revise the definition of “hospital” for purposes of the Shared Savings Program to provide that a “hospital” means a hospital as defined in section 1886(d)(1)(B) of the Act. The proposed regulation text is consistent with both the statutory definition of “hospital” for purposes of the Shared Savings Program in section 1899(h)(2) of the Act and the position we have taken in other contexts in referring to subsection (d) hospitals. The effect of this change is to clarify that a Maryland acute care hospital is a “hospital” for purposes of the Shared Savings Program.

f. Definition of Primary Care Services

We propose to modify the definition of “primary care services.” We refer the reader to section II.E.3. of this proposed rule for a more detailed discussion of the proposed revision to this definition, which is relevant to the assignment of a Medicare beneficiary to an ACO.

g. Definitions of “Continuously Assigned Beneficiary” and “Newly Assigned Beneficiary”

As discussed in greater detail in section II.F.3.b. of this proposed rule, we propose revisions to the definitions of “continuously assigned beneficiary” and “newly assigned beneficiary.” These definitions relate to risk adjustment for the assigned population and require minor modification to accommodate the newly proposed Track 3.

h. Definition of Agreement Period

In connection with our discussion of the applicability of certain changes that are made to program requirements during the agreement period, we propose revisions to the definition of “agreement period.” Readers should refer to section II.C.4. of this proposed rule for a discussion of the proposed changes to the definition.

B. ACO Eligibility Requirements

1. Agreement Requirements

a. Overview

Section 1899(b)(2)(B) of the Act requires participating ACOs to “enter into an agreement with the Secretary to participate in the program for not less than a 3-year period.” If the ACO is approved for participation in the Shared Savings Program, an executive who has the ability to legally bind the ACO must sign and submit a participation agreement to CMS (§ 425.208(a)(1)). Under the participation agreement with CMS, the ACO agrees to comply with the regulations governing the Shared Savings Program (§ 425.208(a)(2)). In addition, the ACO must require its ACO participants, ACO providers/suppliers, and other individuals or entities performing functions or services related to the ACO's activities to agree to comply with the Shared Savings Program regulations and all other applicable laws and regulations (§ 425.208(b) and § 425.210(b)). The ACO must provide a copy of its participation agreement with CMS to all ACO participants, ACO providers/suppliers, and other individuals and entities involved in ACO governance (§ 425.210(a)). As part of its application, we currently require each ACO to submit a sample of the agreement it executes with each of its ACO participants (the “ACO participant agreement”). Also, as part of its application and when requesting the addition of new ACO participants, we require an ACO to submit evidence that it has a signed written agreement with each of its ACO participants. (See guidance on our Web site at http://Start Printed Page 72766www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/sharedsavingsprogram/Downloads/Memo_Additional_Guidance_on_ACO_Participants.pdf.) An ACO's application to participate in the Shared Savings Program and any subsequent request to add new ACO participants will not be approved if the ACO does not have an agreement in place with each of its ACO participants in which each ACO participant agrees to participate in the Shared Savings Program and to comply with the requirements of the Shared Savings Program.

In our review of applications to participate in the Shared Savings Program, we received many ACO participant agreements that were not properly executed, were not between the correct parties, lacked the required provisions, contained incorrect information, or failed to comply with § 425.304(c) relating to the prohibition on certain required referrals and cost shifting. When we identified such agreements, ACOs experienced processing delays, and in some cases, we were unable to approve the ACO applicant and/or its ACO participant to participate in the Shared Savings Program. Consequently, we issued guidance for ACO applicants in which we reiterated the required elements for ACO participant agreements and strongly recommended that ACOs employ good contracting practices to ensure that each of their ACO participant agreements met our requirements (see http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/sharedsavingsprogram/Downloads/Tips-ACO-Developing-Participant-Agreements.pdf).

The ACO participant agreements are necessary for purposes of program transparency and to ensure an ACO's compliance with program requirements. Moreover, many important program operations (including calculation of shared savings, assignment of beneficiaries, and financial benchmarking), use claims and other information that are submitted to CMS by the ACO participant. Our guidance clarified that ACO participant agreements and any agreements with ACO providers/suppliers must contain the following:

- An explicit requirement that the ACO participant or the ACO provider/supplier will comply with the requirements and conditions of the Shared Savings Program (part 425), including, but not limited to, those specified in the participation agreement with CMS.

- A description of the ACO participants' and ACO providers'/suppliers' rights and obligations in and representation by the ACO.

- A description of how the opportunity to get shared savings or other financial arrangements will encourage ACO participants and ACO providers/suppliers to follow the quality assurance and improvement program and evidence-based clinical guidelines.

- Remedial measures that will apply to ACO participants and ACO providers/suppliers who do not comply with the requirements of their agreements with the ACO.

Our guidance also requires that the ACO participant agreements be made directly between the ACO and the ACO participant. We believe it is important that the parties entering into the agreement have a direct legal relationship to ensure that the requirements of the agreement are fully and directly enforceable by the ACO, including the ability of the ACO to terminate an agreement with an ACO participant that is not complying with the requirements of the Shared Savings Program. Additionally, a direct legal relationship ensures that the ACO participant may, if necessary, terminate the agreement with the ACO according to the terms of the agreement without interrupting other contracts or agreements with third parties. Therefore, the ACO and the ACO participant must be the only parties to an ACO participant agreement; the agreements may not include a third party to the agreement. For example, the agreement may not be between the ACO and another entity, such as an independent practice association (IPA) or management company that in turn has an agreement with one or more ACO participants. Similarly, existing contracts between ACOs and ACO participants that include third parties should not be used.

We recognize that there are existing contractual agreements between entities (for example, contracts that permit organizations like IPAs to negotiate contracts with health care payers on behalf of individual practitioners). However, because it is important to ensure that there is a direct legal relationship between the ACO and the ACO participant evidenced by a written agreement, and because ACO participants continue to bill and receive payments as usual under the Medicare FFS rules (that is, there is no negotiation for payment under the program) we believe that typical IPA contracts are generally inappropriate and unnecessary for purposes of participation in the Shared Savings Program. An ACO and ACO participant may use a contract unrelated to the Shared Savings Program as an ACO participant agreement only when it is between the two parties and is amended to satisfy the requirements for ACO participant agreements under the Shared Savings Program.

It is the ACO's responsibility to make sure that each ACO participant agreement identifies the parties entering into the agreement using their correct legal names, specifies the term of the agreement, and is signed by both parties to the agreement. We validate the legal names of the parties based on information the ACO submitted in its application and the legal name of the entity associated with the ACO participant's TIN in the Provider Enrollment Chain & Ownership System (PECOS). We reject an ACO participant agreement if the party names do not match our records. It may be necessary for the ACO to execute a new or amended ACO participant agreement.

Although the ACO participant must ensure that each of its ACO providers/suppliers (as identified by a National Provider Identifier (NPI)) has agreed to participate in the ACO and will comply with program rules, the ACO has the ultimate responsibility for ensuring that all the ACO providers/suppliers that bill through the TIN of the ACO participant (that is, reassign their right to receive Medicare payment to the ACO participant) have also agreed to participate in the Shared Savings Program and comply with our program regulations. The ACO may ensure this by directly contracting with each ACO provider/supplier (NPI) or by contractually requiring the ACO participant to ensure that all ACO providers/suppliers that bill through its TIN have agreed to participate in, and comply with the requirements of, the Shared Saving Program. If the ACO chooses to contract directly with the ACO providers/suppliers, the agreements must meet the same requirements as the agreements with ACO participants. We emphasize that even if an ACO chooses to contract directly with the ACO providers/suppliers (NPIs), it must still have the required ACO participant agreement. In other words, the ACO must be able to produce valid written agreements for each ACO participant and each ACO provider/supplier. Furthermore, since we use TINs (and not merely some of the NPIs that make up the entity identified by a TIN) as the basis for identifying ACO participants, and we use all claims submitted under an ACO participant's TIN for financial calculations and beneficiary assignment, an ACO may not include an entity as an ACO participant unless all Medicare Start Printed Page 72767enrolled providers and suppliers billing under that entity's TIN have agreed to participate in the ACO as ACO providers/suppliers.

To illustrate the requirement that all ACO providers/suppliers must agree to participate in and comply with the terms of the Shared Savings Program before the ACO can include the ACO participant's TIN on its list of ACO participants, we offer the following scenarios that describe when an ACO participant's TIN may and may not be included on the applicant's ACO participant list:

Correct: A large group practice (Medicare-enrolled TIN) decides to participate in an ACO as an ACO participant. Its owner signs an agreement with the ACO on behalf of the practice to participate in the program and follow program regulations. Also, all practitioners that have reassigned their right to receive Medicare payments to the TIN of the large group practice have also agreed to participate and follow program regulations. Therefore, the ACO may include this group practice TIN on its list of ACO participants.

Incorrect: A large group practice (Medicare-enrolled TIN) decides to participate in an ACO as an ACO participant. Its owner signs an agreement to participate in the program and follow program regulations. However, not all practitioners that have reassigned their right to receive Medicare payment to the group practice TIN have agreed to participate in the ACO and follow Shared Savings Program regulations. Therefore, the ACO may not include this group practice TIN on its list of ACO participants.

Incorrect: Several practitioners in a large group practice (Medicare-enrolled TIN) decide to participate in an ACO. However, the group practice as a whole has not agreed to participate in the program. Therefore, the ACO may not include this group practice TIN on its list of ACO participants.

We propose to codify much of our guidance regarding the content of the ACO participant and ACO provider/supplier agreements.

b. Proposed Revisions

First, we propose to add new § 425.116 to set forth the requirements for agreements between an ACO and an ACO participant or ACO provider/supplier. We believe the new provision would promote a better general understanding of the Shared Savings Program and transparency for ACO participants and ACO providers/suppliers. It is our intent to provide requirements that would facilitate and enhance the relationships between ACOs and ACO participants, and reduce uncertainties and misunderstandings leading to rejection of ACO participant agreements during application review. Specifically, we propose to require that ACO participant agreements satisfy the following criteria:

- The ACO and the ACO participant are the only parties to the agreement.

- The agreement must be signed on behalf of the ACO and the ACO participant by individuals who are authorized to bind the ACO and the ACO participant, respectively.

- The agreement must expressly require the ACO participant to agree, and to ensure that each ACO provider/supplier billing through the TIN of the ACO participant agrees, to participate in the Shared Savings Program and to comply with the requirements of the Shared Savings Program and all other applicable laws and regulations (including, but not limited to, those specified at § 425.208(b)).

- The agreement must set forth the ACO participant's rights and obligations in, and representation by, the ACO, including without limitation, the quality reporting requirements set forth in Subpart F, the beneficiary notification requirements set forth at § 425.312, and how participation in the Shared Savings Program affects the ability of the ACO participant and its ACO providers/suppliers to participate in other Medicare demonstration projects or programs that involve shared savings.

- The agreement must describe how the opportunity to receive shared savings or other financial arrangements will encourage the ACO participant to adhere to the quality assurance and improvement program and evidence-based medicine guidelines established by the ACO.

- The agreement must require the ACO participant to update enrollment information with its Medicare contractor using the PECOS, including the addition and deletion of ACO professionals billing through the TIN of the ACO participant, on a timely basis in accordance with Medicare program requirements. The Agreement must also require ACO participants to notify the ACO within 30 days after any addition or deletion of an ACO provider/supplier.

- The agreement must permit the ACO to take remedial action against the ACO participant, and must require the ACO participant to take remedial action against its ACO providers/suppliers, including imposition of a corrective action plan, denial of shared savings payments (that is, the ability of the ACO participant or ACO provider/supplier to receive a distribution of the ACO's shared savings) and termination of the ACO participant agreement, to address noncompliance with the requirements of the Shared Savings Program and other program integrity issues, including those identified by CMS.

- The term of the agreement must be for at least 1 performance year and must articulate potential consequences for early termination from the ACO.

- The agreement must require completion of a close-out process upon the termination or expiration of the ACO's participation agreement that requires the ACO participant to furnish data necessary to complete the annual assessment of the ACO's quality of care and addresses other relevant matters.

Although we propose that the term of an ACO participant agreement be for at least 1 performance year, we do not intend to prohibit early termination of the agreement. We recognize that there may be legitimate reasons to terminate an ACO participant agreement. However, because care coordination and quality improvement requires commitment from ACO participants, we believe this requirement would improve the likelihood of success in the Shared Savings Program. We are also considering whether and how ACO participant agreements should encourage participation to continue for subsequent performance years. We seek comment on this issue.

In the case of an ACO that chooses to contract directly with its ACO providers/suppliers, we propose virtually identical requirements for its agreements with ACO providers/suppliers. We note that agreements with ACO providers/suppliers would not be required to be for a term of 1 year, because we do not want to impede individual practitioners from activities such as retirement, reassignment of billing rights, or changing employers. In the case of ACO providers/suppliers that do not have a contract directly with the ACO, we are considering requiring each ACO to ensure that its ACO participants contract with or otherwise arrange for the services of its ACO providers/suppliers on the same or similar terms as those required for contracts made directly between the ACO and ACO providers/suppliers.

In addition, we propose to add at § 425.204(c)(6) a requirement that, as part of the application process and upon request thereafter, the ACO must submit documents demonstrating that its ACO participants, ACO providers/suppliers, and other individuals or entities performing functions or services related to ACO activities are required to comply Start Printed Page 72768with the requirements of the Shared Savings Program. In the case of ACO participants, the evidence to be submitted must, consistent with our past guidance, include executed agreements or sample form agreements together with the first and last (signature) page of each form agreement that has been fully executed by the parties to the agreement. However, we reserve the right, to request all pages of an executed ACO participant agreement to confirm that it conforms to the sample form agreement submitted by the ACO. We further propose at § 425.116(c) that executed ACO participant agreements must also be submitted when an ACO seeks approval to add new ACO participants. The agreements may be submitted in the same form and manner as set forth in § 425.204(c)(6). Finally, although we would not routinely request an ACO to submit copies of executed agreements with its ACO providers/suppliers or other individuals or entities performing functions or services related to ACO activities as part of the ACO's application or continued participation in each performance year, we reserve our right to request this information during the application or renewal process and at any other time for audit or monitoring purposes in accordance with § 425.314 and § 425.316.

We believe that the proposed requirements regarding agreements between ACOs and ACO participants, together with our earlier guidance regarding good contracting practices, would enhance transparency between the ACO, ACO participants, and ACO professionals, reduce turnover among ACO participants, prevent misunderstandings related to participation in the Shared Savings Program, and assist prospective ACOs in submitting complete applications and requests for adding ACO participants. We believe that codifying these requirements would assist the ACO, ACO participants, and ACO providers/suppliers in better understanding the program and their rights and responsibilities while participating in the program. We solicit comment on the proposed new requirements and on whether there are additional elements that should be considered for inclusion in the agreements the ACO has with its ACO participants and ACO providers/suppliers.

2. Sufficient Number of Primary Care Providers and Beneficiaries

a. Overview

Section 1899(b)(2)(D) of the Act requires participating ACOs to “include primary care ACO professionals that are sufficient for the number of Medicare fee-for-service beneficiaries assigned to the ACO . . .” and that at a minimum, “the ACO must have at least 5,000 such beneficiaries assigned to it. . . .” Under § 425.110(a)(2) of the regulations, an ACO is deemed to have initially satisfied the requirement to have at least 5,000 assigned beneficiaries if the number of Medicare beneficiaries historically assigned to the ACO participants in each of the 3 years before the start of the agreement period is 5,000 or more.

Under the beneficiary assignment methodology set forth in the regulations at part 425, subpart E, the assignment of beneficiaries to a particular ACO for a calendar year is dependent upon a number of factors, including where the beneficiary elected to receive primary care services and whether the beneficiary received primary care services from ACO professionals participating in one or more Shared Savings Program ACOs. We note that to ensure no duplication in shared savings payments for care provided to the same beneficiaries, assignment of a beneficiary may also be dependent on whether the beneficiary has been assigned to another initiative involving shared savings, such as the Pioneer ACO Model (§ 425.114(c)). While a final assignment determination can be made for the first 2 benchmark years (BY1 and BY2, respectively) for an ACO applying to participate in the Shared Savings Program, it is not possible to determine the final assignment for the third benchmark year (BY3) (that is, the calendar year immediately prior to the start of the agreement period) because application review and determination of whether the ACO has met the required 5,000 assignment must take place during BY3 before all claims are submitted for the calendar year. Further, there is a lag period after the end of a calendar year during which additional claims for the year are billed and processed. Therefore, the final historical benchmark for the 3-year period and the preliminary prospective assignment for PY1 must be determined after the ACO's agreement period has already started. We note that we currently estimate the number of historically assigned beneficiaries for the third benchmark year for Tracks 1 and 2 by using claims with dates of service for the last 3 months of benchmark year 2 (October through December) and the first 9 months of benchmark year 3 (January through September, with up to 3 months claims run out, as available). We use this approach to calculate the number of assigned beneficiaries for BY3 in order to be as consistent as possible with the timeframes (that is, 12 month period) and claims run out used for the BY1 and BY2 calculations.

Section 425.110(b) provides that an ACO that falls below 5,000 assigned beneficiaries at any time during the agreement period will be allowed to continue in the program, but CMS must issue a warning letter and place the ACO on a CAP. The purpose of this provision is to ensure that the ACO is aware that its number of assigned beneficiaries is below 5,000, is notified of the consequences of remaining under 5,000, and that the ACO is taking appropriate steps to correct the deficiency.

Section 425.110(b)(1) provides that, while under the CAP, the ACO will remain eligible to share in savings for the performance year in which it fell below the 5,000, and the MSR will be adjusted according to the number of assigned beneficiaries determined at the time of reconciliation. For example, according to Table 6 in the November 2011 final rule (42 FR 67928), a Track 1 ACO with an assigned population of 5,000 would have an MSR of 3.9. If the ACO's number of assigned beneficiaries falls below 5,000, we would work with the CMS Office of the Actuary to determine the MSR for the number of beneficiaries below 5,000, set at the same 90 percent confidence interval that is used to determine an ACO's MSR when the ACO has a smaller assigned beneficiary population. If the number of beneficiaries assigned to the ACO remains less than 5,000 by the end of the next performance year, the ACO is terminated and is not be permitted to share in savings for that performance year (§ 425.110(b)(2)).

b. Proposed Revisions

First, we propose to revise § 425.110(a)(2) to clarify the data used during the application review process to estimate the number of beneficiaries historically assigned in each of the 3 years of the benchmarking period. Specifically, we propose that the number of assigned beneficiaries would be calculated for each benchmark year using the assignment methodology set forth in Subpart E of part 425, and in the case of BY3, we would use the most recent data available with up to a 3-month claims run out to estimate the number of assigned beneficiaries. This proposed revision would reflect current operational processes under which we assign beneficiaries to ACOs using complete claims data for BY1 and BY2 but must rely on incomplete claims data for BY3. We would likely continue to Start Printed Page 72769estimate the number of historically assigned beneficiaries for the third benchmark year by using claims with dates of service for the last 3 months of BY2 and the first 9 months of BY3, with up to 3 months claims run out. However, that could vary from year to year depending on data availability during the application review process. As discussed previously, we believe that using this approach to calculate the number of assigned beneficiaries for BY3 is consistent with the timeframes and claims run out used for BY1 and BY2 calculations because we would be using a full 12 months of claims, rather than the only available claims for the calendar year, which would be less than 12 months.

The estimates of the number of assigned beneficiaries would be used during the ACO application review process to determine whether the ACO exceeds the 5,000 assigned beneficiary threshold for each year of the historical benchmark period. If based upon these estimates, we determine that an ACO had at least 5,000 assigned beneficiaries in each of the benchmark years, it would be deemed to have initially satisfied the eligibility requirement that the ACO have at least 5,000 assigned beneficiaries. The specific data to be used for computing these initial estimates during the ACO application review process would be designated through program instructions and guidance. Although unlikely, it is possible that when final benchmark year assignment numbers are generated after the ACO has been accepted into the program, the number of assigned beneficiaries could be below 5,000. In this event, the ACO will be allowed to continue in the program, but may be subject to the actions set forth in § 425.110(b).

Second, given our experience with the program and the timing of performance year determinations regarding beneficiary assignment provided during reconciliation, we wish to modify our rules to provide greater flexibility to address situations in which an ACO's assigned beneficiary population falls below 5,000 assigned beneficiaries. Specifically, we have concerns that in some cases it may be very difficult for an ACO to increase its number of assigned beneficiaries by the end of the next performance year, as currently required by § 425.110(b)(2). For example, assume an ACO with a start date of January 2013 were to get its third quarterly report for PY1 in November or December 2013, and the report indicated that the ACO's preliminary prospectively assigned beneficiary population had fallen below 5,000. Under our current regulations, we would send the ACO a warning letter and place the ACO on a CAP. If the ACO were to fail to increase its assigned beneficiary population to at least 5,000 by the end of the next performance year (PY2), it would be terminated. We note that increasing the number of assigned beneficiaries generally involves adding new ACO participants and/or ACO providers/suppliers. However, in the previous example, by the time the ACO had been notified that its assigned beneficiary population had fallen below 5,000 beneficiaries, it would have been too late for the ACO to add new ACO participants for PY2, leaving the ACO with more limited options for timely correction of the deficit. We believe that § 425.110(b) should be modified to provide ACOs with adequate time to successfully complete a CAP. Therefore, we propose to revise § 425.110(b)(2) to state that CMS will specify in its request for a CAP the performance year during which the ACO's assigned population must meet or exceed 5,000 beneficiaries. This modification would permit some flexibility for ACOs whose assigned populations fall below 5,000 late in a performance year to take appropriate actions to address the deficit.

Additionally, we do not believe it is necessary to request a CAP from every ACO whose assigned beneficiary population falls below 5,000. For example, we should have the discretion not to impose a CAP when the ACO has already submitted a request to add ACO participants effective at the beginning of the next performance year and CMS has a reasonable expectation that the addition of these new ACO participants would increase the assigned beneficiary population above the 5,000 minimum beneficiary threshold. Therefore, we propose to revise § 425.110(b) to indicate that we have the discretion whether to impose any remedial measures or to terminate an ACO for failure to satisfy the minimum assigned beneficiary threshold. Specifically, we propose to revise § 425.110(b) to state that the ACO “may” be subject to any of the actions described in § 425.216 (actions prior to termination, including a warning letter or request for CAP) and § 425.218 (termination). However, we note that although we are proposing to retain discretion as to whether to impose remedial measures or terminate an ACO whose assigned beneficiary population falls below 5,000, we recognize that the requirement that an ACO have at least 5,000 assigned beneficiaries is a condition of eligibility to participate in the Shared Savings Program under § 1899(b)(2)(D), and would exercise our discretion accordingly and consistently.

3. Identification and Required Reporting of ACO Participants and ACO Providers/Suppliers

a. Overview

For purposes of the Shared Savings Program, an ACO is an entity that is identified by a TIN and comprised of one or more Medicare-enrolled TINs associated with ACO participants (see § 425.20). The Medicare-enrolled TINs of ACO participants, in turn, are associated with Medicare enrolled individuals and entities that bill through the TIN of the ACO participant. (For example, in the case of a physician, the physician has reassigned to the TIN of the ACO participant his or her right to receive Medicare payments, and their services to Medicare beneficiaries are billed by the ACO participant under a billing number assigned to the TIN of the ACO participant).

As part of the application process and annually thereafter, the ACO must submit a certified list identifying all of its ACO participants and their Medicare-enrolled TINs (the “ACO participant list”) (§ 425.204(c)(5)(i)). Additionally, for each ACO participant, the ACO must submit a list identifying all ACO providers/suppliers (including their NPIs or other provider identifiers) that bill Medicare during the agreement period under a billing number assigned to the TIN of an ACO participant (the “ACO provider/supplier list”) (§ 425.204(c)(5)(i)(A)). Our regulations require the ACO to indicate on the ACO provider/supplier list whether an individual is a primary care physician as defined at § 425.20. All Medicare enrolled individuals and entities that bill through an ACO participant's TIN during the agreement period must be on the certified ACO provider/supplier list and agree to participate in the ACO. ACOs are required to maintain, update, and annually furnish the ACO participant and ACO provider/supplier lists to CMS at the beginning of each performance year and at such other times as may be specified by CMS (§ 425.304(d)).

We use TINs identified on the ACO participant list to identify claims billed to Medicare in order to support the assignment of Medicare fee-for-service beneficiaries to the ACO, the implementation of quality and other reporting requirements, and the determination of shared savings and losses (see section 1899(b)(2)(E) of the Act). We also use the ACO's initial (and annually updated) ACO participant list to: Identify parties subject to the Start Printed Page 72770screenings under § 425.304(b); determine whether the ACO satisfies the requirement to have a minimum of 5,000 assigned beneficiaries; establish the historical benchmark; perform financial calculations associated with quarterly and annual reports; determine preliminary prospective assignment for and during the performance year; determine a sample of beneficiaries for quality reporting; and coordinate participation in the Physician Quality Reporting System (PQRS) under the Shared Savings Program. Both the ACO participant and ACO provider/supplier lists are used to ensure compliance with program requirements. We refer readers to our guidance at http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/sharedsavingsprogram/Updating-ACO-Participant-List.html for more information.

In this section, we discuss current policy and procedures regarding the identification and required reporting of ACO participants and ACO providers/suppliers. In addition, we propose revisions to our regulations to improve program transparency by ensuring that all ACO participants and ACO providers/suppliers are accurately identified.

b. Proposed Revisions

In order to administer the Shared Savings Program, we need to identify accurately the ACO participants and ACO providers/suppliers associated with each ACO that participates in the program. An accurate understanding of the ACO participants is critical for assignment of beneficiaries to the ACO as well as assessing the quality of care provided by the ACO to its assigned beneficiaries. An accurate understanding of the ACO providers/suppliers is also critical for ensuring compliance with program rules. We believe that this information is equally critical to the ACO for its own operational and compliance purposes. Thus, both CMS and the ACO need to have a common understanding of the individuals and entities that comprise the ACO participants and ACO providers/suppliers in the ACO. We obtain this common understanding by requiring the ACO to certify the accuracy of its ACO participant and ACO provider/supplier lists prior to the start of each performance year and to update the lists as changes occur during the performance year. Because we rely on these lists for both operational and program integrity purposes, we must have a transparent process that results in the accurate identification of all ACO participants and ACO providers/suppliers that compose each ACO in the Shared Savings Program.

We propose to add a new § 425.118 to reflect with more specificity the requirements for submitting ACO participant and ACO provider/supplier lists and the reporting of changes to those lists. In addition, we propose to revise § 425.204(c)(5) and to remove § 425.214(a) and § 425.304(d) because these provisions are addressed in new § 425.118.

(1) Certified Lists of ACO Participants and ACO Providers/Suppliers

We intend to continue to require ACOs to maintain, update and submit to CMS accurate and complete ACO participant and ACO provider/supplier lists, but are proposing to establish new § 425.118 to set forth the requirements and processes for maintaining, updating, and submitting the required ACO participant and ACO provider/supplier lists. New § 425.118 would consolidate and revise provisions at § 425.204(c)(5), § 425.214(a) and § 425.304(d) regarding the ACO participant and ACO provider/supplier lists. Specifically, we propose at § 425.118(a) that prior to the start of the agreement period and before each performance year thereafter, the ACO must provide CMS with a complete and certified list of its ACO participants and their Medicare-enrolled TINs. We would use this ACO participant list to identify the Medicare-enrolled individuals and entities that are affiliated with the ACO participant's TIN in PECOS, the CMS enrollment system. Because these individuals and entities are currently billing through the Medicare enrolled TIN identified by the ACO as an ACO participant, they must be included on the ACO provider/supplier list. We would provide the ACO with a list of all ACO providers/suppliers (NPIs) that we have identified as billing through each ACO participant's Medicare-enrolled TIN. In accordance with § 425.118(a), the ACO would be required to review the list, make any necessary corrections, and certify the lists of all of its ACO participants and ACO providers/suppliers (including their TINs and NPIs) as true, accurate, and complete. In addition, we propose that an ACO must submit certified ACO participant and ACO provider/supplier lists at any time upon CMS request. We note that all NPIs that reassign their right to receive Medicare payment to an ACO participant must be on the certified list of ACO providers/suppliers and must agree to be ACO providers/suppliers. We propose to clarify this point in regulations text at § 425.118(a)(4).

Finally, in accordance with developing and certifying the ACO participant and provider/supplier lists, we propose at § 425.118(d) to require the ACO to report changes in ACO participant and ACO provider/supplier enrollment status in PECOS within 30 days after such changes have occurred (for example, to report changes in an ACO provider's/supplier's reassignment of the right to receive Medicare payment or revocation of billing rights). This requirement corresponds with our longstanding policy that requires enrolled providers and suppliers to notify their Medicare contractors through PECOS within specified timeframes for certain reportable events. We recognize that PECOS is generally not accessible to ACOs to make these changes directly because most ACOs are not enrolled in Medicare. Therefore, an ACO may satisfy the requirement to update PECOS throughout the performance year by requiring its ACO participants to submit the required information directly in PECOS within 30 days after the change, provided that the ACO participant actually submits the required information within 30 days. We propose to require ACOs to include language in their ACO participant agreements (discussed in section II.B.1. of this proposed rule) to ensure compliance with this requirement. We are not proposing to change the current 30-day timeframe required for such reporting in PECOS. These changes are consistent with the current requirements regarding ACO participant and ACO provider/supplier list updates under § 425.304(d) and we believe that they would enhance transparency and accuracy within the Shared Savings Program. We further propose to remove § 425.304(d) because the requirements, although not modified, would be incorporated into new § 425.118(d).