-

Start Preamble

AGENCY:

Federal Deposit Insurance Corporation (FDIC).

ACTION:

Notice of proposed rulemaking.

SUMMARY:

The FDIC is seeking comment on proposed revisions to its regulations relating to interest rate restrictions that apply to less than well capitalized insured depository institutions. Under the proposed rule, the FDIC would amend the methodology for calculating the national rate and national rate cap for specific deposit products. The national rate would be the weighted average of rates paid by all insured depository institutions on a given deposit product, for which data are available, where the weights are each institution's market share of domestic deposits. The national rate cap for particular products would be set at the higher of the 95th percentile of rates paid by insured depository institutions weighted by each institution's share of total domestic deposits, or the proposed national rate plus 75 basis points. The proposed rule would also greatly simplify the current local rate cap calculation and process by allowing less than well capitalized institutions to offer up to 90 percent of the highest rate paid on a particular deposit product in the institution's local market area.

DATES:

Comments will be accepted until November 4, 2019.

ADDRESSES:

You may submit comments on the notice of proposed rulemaking using any of the following methods:

- Agency website: https://www.fdic.gov/regulations/laws/federal/. Follow the instructions for submitting comments on the agency website.

- Email: comments@fdic.gov. Include RIN 3064-AF02 on the subject line of the message.

- Mail: Robert E. Feldman, Executive Secretary, Attention: Comments, Federal Deposit Insurance Corporation, 550 17th Street NW, Washington, DC 20429.

- Hand Delivery: Comments may be hand delivered to the guard station at the rear of the 550 17th Street NW building (located on F Street) on business days between 7 a.m. and 5 p.m.

- Federal eRulemaking Portal: http://www.regulations.gov. Follow the instructions for submitting comments.

- Public Inspection: All comments received, including any personal information provided, will be posted generally without change to https://www.fdic.gov/regulations/laws/federal. Paper copies of public comments may be ordered from the FDIC Public Information Center, 3501 North Fairfax Drive, Room E-1002, Arlington, VA 22226, or by telephone at (877) 275-3342 or (703) 562-2200.

FOR FURTHER INFORMATION CONTACT:

Legal Division: Vivek V. Khare, Counsel, (202) 898-6847, vkhare@fdic.gov; Thomas Hearn, Counsel, (202) 898-6967, thohearn@fdic.gov; Division of Risk Management Supervision: Thomas F. Lyons, Chief, Policy and Program Development, (202) 898-6850, tlyons@fdic.gov; Judy Gross, Senior Policy Analyst, (202) 898-7047, jugross@fdic.gov.

End Further Info End Preamble Start Supplemental InformationSUPPLEMENTARY INFORMATION:

Policy Objectives

On December 18, 2018, the FDIC Board adopted an advance notice of proposed rulemaking (ANPR) to obtain input from the public on its brokered deposit and interest rate regulations in light of significant changes in technology, business models, the economic environment, and products Start Printed Page 46471since the regulations were adopted.[1] As described in the ANPR, interest rates have been rising, however the national rate that is used to calculate rate caps applicable to less than well capitalized banks has stayed low because of market dynamics, including the introduction of new deposit products and features. In an effort to ensure that the national rate cap is reflective of the prevailing rates offered by institutions, the FDIC sought comment on all aspects of its regulatory approach relating to the interest rate restrictions, and specifically asked for comment on potential changes to the methodology used to calculate the national rate. The policy objective of this NPR is to seek comment on a proposal that attempts to ensure that deposit interest rate caps appropriately reflect the prevailing deposit interest rate environment, while continuing to ensure that less than well capitalized institutions do not solicit deposits by offering interest rates that significantly exceed prevailing rates on comparable deposit products. The FDIC anticipates that another NPR that addresses policy issues related to brokered deposits more generally will be issued at a later date.

I. Background

Section 224 of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA) added section 29 to the Federal Deposit Insurance (FDI) Act titled “Brokered Deposits.” The law originally restricted “troubled” insured depository institutions without a waiver from (1) accepting deposits from a deposit broker and (2) soliciting deposits by offering rates of interest on deposits that are significantly higher than the prevailing rates of interest on deposits offered by other insured depository institutions (“institutions” or “banks”) having the same type of charter in such depository institution's normal market area.[2] Section 29 defined a “troubled institution” as an undercapitalized institution. Congress took further action two years later by enacting the Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA). As part of FDICIA, Congress made several amendments to align section 29 of the FDI Act with the prompt corrective action (PCA) framework.[3] One of these amendments broadened the applicability of section 29 from “troubled institutions” (i.e., undercapitalized banks) to any insured depository institution that is not well capitalized.

Statutory Provisions Related to the Interest Rate Restrictions

Under section 29, well capitalized institutions are not restricted in paying any rate of interest on any deposit. However, the statute imposes interest rate restrictions on categories of insured depository institutions that are less than well capitalized. These categories are (1) adequately capitalized institutions with waivers to accept brokered deposits (including reciprocal deposits excluded from being considered brokered deposits); [4] (2) adequately capitalized institutions without waivers to accept brokered deposits; [5] and (3) undercapitalized institutions.[6] The statutory restrictions for each category are described in detail below.

Adequately capitalized institutions with waivers to accept brokered deposits. Institutions in this category may not pay a rate of interest on deposits that “significantly exceeds” the following: “(1) The rate paid on deposits of similar maturity in such institution's normal market area for deposits accepted in the institution's normal market area; or (2) the national rate paid on deposits of comparable maturity, as established by the [FDIC], for deposits accepted outside the institution's normal market area.” [7]

Adequately capitalized institutions without waivers to accept brokered deposits. In this category, institutions may not offer rates that “are significantly higher than the prevailing rates of interest on deposits offered by other insured depository institutions in such depository institution's normal market area.” [8] For institutions in this category, the statute restricts interest rates in an indirect manner. Rather than simply setting forth an interest rate restriction for adequately capitalized institutions without a waiver to accept brokered deposits, the statute defines the term “deposit broker” to include “any insured depository institution that is not well capitalized . . . which engages, directly or indirectly, in the solicitation of deposits by offering rates of interest which are significantly higher than the prevailing rates of interest on deposits offered by other insured depository institutions in such depository institution's normal market area.” [9] In other words, the depository institution itself is a “deposit broker” if it offers rates significantly higher than the prevailing rates in its own “normal market area.” Without a waiver, the institution cannot accept deposits from a “deposit broker.” Thus, the institution cannot accept these deposits from itself. In this indirect manner, the statute prohibits institutions in this category from offering rates significantly higher than the prevailing rates in the institution's “normal market area.”

Undercapitalized institutions. In this category, institutions may not solicit deposits by offering rates “that are significantly higher than the prevailing rates of interest on insured deposits (1) in such institution's normal market area; or (2) in the market area in which such deposits would otherwise be accepted.” [10]

II. Regulatory Approach

The FDIC has implemented the statutory interest rate restrictions through two rulemakings.[11] While the statutory provisions noted above set forth a basic framework based upon capital categories, they do not provide certain key details, such as definitions of the terms “significantly exceeds,” “significantly higher,” “market,” and “national rate.” As a result, the FDIC defined these key terms via rulemaking in 1992. Both the “national rate” calculation and the application of the interest rate restrictions were updated in a 2009 rulemaking.

“Significantly Exceeds” or “Significantly Higher.” [12] Through both the 1992 and the 2009 rulemakings, the FDIC has interpreted that a rate of interest “significantly exceeds” another rate, or is “significantly higher” than another rate, if the first rate exceeds the second rate by more than 75 basis points.[13] In adopting this standard in 1992, and subsequently retaining it in 2009, the FDIC offered the following explanation: “Based upon the FDIC's experience with the brokered deposit prohibitions to date, it is believed that this number will allow insured depository institutions subject to the Start Printed Page 46472interest rate ceilings . . . to compete for funds within markets, and yet constrain their ability to attract funds by paying rates significantly higher than prevailing rates.” [14]

“Market.” In the FDIC's regulations, as implemented through both the 1992 and 2009 rulemaking, the term “market” is “any readily defined geographical area in which the rates offered by any one insured depository institution soliciting deposits in that area may affect the rates offered by other insured depository institutions in the same area.” [15] The FDIC determines an institution's market area on a case-by-case basis.[16]

The “National Rate.” As part of the 1992 rulemaking, the “national rate” was defined as follows: “(1) 120 percent of the current yield on similar maturity U.S. Treasury obligations; or (2) In the case of any deposit at least half of which is uninsured, 130 percent of such applicable yield.” In defining the “national rate” in this manner, the FDIC understood that the spread between Treasury securities and depository institution deposits can fluctuate substantially over time but relied upon the fact that such a definition is “objective and simple to administer.” [17] By using percentages (120 percent, or 130 percent for wholesale deposits, of the yield on U.S. Treasury obligations) instead of a fixed number of basis points, the FDIC hoped to “allow for greater flexibility should the spread to Treasury securities widen in a rising interest rate environment.” Additionally, at the time of the 1992 rulemaking, the FDIC did not have readily available data on actual deposit rates paid and used Treasury rates as a proxy.

Prior to the 2009 rulemaking, yields on Treasury securities began to plummet, driven by global economic uncertainties, which resulted in a “national rate” that was lower than deposit rates offered by many institutions. As part of the 2009 rulemaking, with the benefit of having data on offered rates available on a substantially real-time basis, the FDIC redefined the “national rate” as “a simple average of rates paid by all insured depository institutions and branches for which data are available.” [18] At that time, the FDIC noted that the “national rate” methodology represents an objective average of rates paid by all reporting insured depository institutions for particular products.

The “Prevailing Rate”

The FDIC has recognized, as part of its regulation on interest rate restrictions, that competition for deposit pricing has become increasingly national in scope. Therefore, through the 2009 rulemaking, the FDIC presumes that the prevailing rate in an institution's market areas is the FDIC-defined national rate.[19]

Application of the Interest Rate Restrictions

A bank that is not well capitalized generally may not offer deposit rates more than 75 basis points above the national rate for deposits of similar size and maturity.[20]

As noted above, the national rate is defined as a simple average of rates paid by all insured depository institutions and branches that offer and publish rates for specific products. These products include non-jumbo and jumbo CDs of various maturities, as well as savings, checking and money market deposit accounts (MMDAs).[21] The FDIC receives interest rate data on various deposit products from a private data aggregator on a weekly basis. The data aggregator computes the simple averages for the various deposit products as well as the corresponding national rate cap by adding 75 basis points to each simple average. The FDIC then publishes on a weekly basis the national rate simple averages and corresponding national rate caps on its website.[22]

If the posted national rates differ from the actual rates in a bank's local market area, the bank may present evidence to the FDIC that the prevailing rate in a particular market is higher than the national rate.[23] If the FDIC agrees with this evidence,[24] the institution would be permitted to pay as much as 75 basis points above the local prevailing rate for deposits solicited in its local market areas. For deposits that are solicited on the internet or otherwise outside its local market, the institution would have to offer rates that do not exceed the national rate cap. In evaluating this evidence, the FDIC may use segmented market rate information (for example, evidence by State, county or metropolitan statistical area). Also, the FDIC may consider evidence as to the rates offered by credit unions but only if the insured depository institution competes directly with the credit unions in the particular market.

III. Need for Further Rulemaking

The current interest rate cap regulations became effective in 2010 and were adopted to modify the previous national rate cap (based on U.S. Treasury securities) that had become overly restrictive. Chart 1 below reflects the current national rate cap and the average of the top ten rates paid for a 12-month CD between 2010 and the present.[25] Chart 1 illustrates that between 2010 and approximately the second quarter of 2015, rates on deposits were quite low, even for the top rate payers. The current regulation's methodology for calculating the national rate, to which 75 basis points is added to arrive at the national rate cap, resulted in a national rate cap that allowed less than well capitalized institutions to easily compete with even the highest rates paid on the 12-month CD.

Start Printed Page 46473Since July 2015, however, market conditions have changed so the current national rate methodology results in a national rate for the 12-month CD that, when 75 basis points are added, produces a national rate cap that has remained relatively unchanged and could restrict less than well capitalized institutions from competing for market-rate funding. Market conditions have caused similar changes in the rates of other deposit products compared to the applicable rate cap, although the timing of when such changes occurred varied from product to product. Interest rates have been relatively low since the financial crisis that began in 2007. Towards the end of 2015, however, some banks began to increase rates paid on deposits as the Federal Reserve increased its federal funds rate targets. During this time, and up to the present day, the largest banks have been, on average, slower to raise interest rates on deposits (as published). This has held down the simple average of rates offered across all branches. Additionally, institutions, including the largest banks, have recently been offering more deposit products with special features, such as rewards checking, higher rates on odd-term maturities, negotiated rates, and cash bonuses, that are not included in the calculation of the posted national rate.

Because of these developments, the majority of the institutions subject to the interest rate caps have been granted approval to use the local rate cap for deposits obtained locally. The national rate cap, however, remains applicable to deposits that these institutions obtained from outside their respective normal market area, including through the internet.

Setting the national rate cap at a too low of a level could prohibit less than well capitalized banks from competing for deposits and create an unintentional liquidity strain on those banks competing in national markets. For example, a national rate cap that is too low could destabilize a less than well capitalized bank just as it is working on improving its financial condition. Preventing such institutions from being competitive for deposits, when they are most in need of predictable liquidity, can create severe funding problems. Additionally, a rate cap that is too low may be inconsistent with the statutory requirement that a firm is prohibited from offering a rate that “significantly exceeds” or is “significantly higher” than the prevailing rate. This could unnecessarily harm the institution and its customers, especially when liquidity planning is essential for safety and soundness. At the same time, however, the statute imposes interest rate restrictions on weak institutions. It has been the FDIC's experience that while some banks recover from problems, others use high-rate funding and other available funds, not to recover, but to delay insolvency—a strategy that could lead to increased losses for the deposit insurance fund.[26]

Consequently, the FDIC is proposing to modify its regulations to provide a more balanced, reflective, and dynamic national and local rate cap that will ensure that less than well capitalized institutions have the flexibility to access market-rate funding, yet prevent them Start Printed Page 46474from offering a rate that significantly exceeds the prevailing rate for a particular product, in accordance with Section 29.

Issues Raised by Commenters

In response to the ANPR on brokered deposits and interest rate restrictions, the FDIC received over 130 comments from individuals, banking organizations, non-profits, as well as industry and trade groups, representing banks, insurance companies, and the broader financial services industry. Of the total comments, 59 related to the FDIC's rules on the interest rate restrictions.

The majority of these commenters expressed concerns about the current national rate calculation and raised the same issues highlighted by the FDIC as part of the ANPR. Most commenters were of the view that the current national rate cap is too low. One reason cited by commenters was that the largest banks with the most branches have a disproportional effect on the national rate. These institutions have been slow to increase published rates even as interest rates offered by community banks and online-focused banks have begun to rise significantly in comparison. Many of these commenters suggested that this skewing effect is compounded by minimizing the significance of online-focused banks, which have few or no branches but tend to pay the highest rates. Commenters also noted that the national rate is low because published rates (1) tend to be lower than the actual interest paid on deposits after negotiation and (2) may not accurately reflect certain promotional or cash bonus products.

Some commenters stated that because of technological advances (e.g., internet and smartphones) any depositor can shop nationwide for the best yield, so all institutions compete in the national market. As a result of this new way to access deposits, along with the variety of available deposit products, commenters suggested that no single formula or set of formulas would be able to accurately define the prevailing rate in an institution's normal market area, although commenters expressed a desire for a more dynamic approach. One commenter stated that there will always be constant evolution in the types of interest paid to depositors, and new entrants will continue to develop different products.

A number of commenters stated that the interest rate restrictions are penalizing less than well capitalized institutions and increase the likelihood of a liquidity failure because such institutions would be at a competitive disadvantage in raising deposit funding at the current rate caps.

Several commenters also raised concerns over examiners' use of the national rate cap as a proxy for “high risk” deposits for well capitalized banks. The FDIC has responded to these concerns by revising its Risk Management Supervision Manual of Examination Policies and clarifying to examiners that rate caps apply only to institutions that are less than well capitalized.[27]

One commenter believed that it would be inconsistent with Congressional intent for the FDIC to take action to modify interest rate restrictions in a manner that would allow less than well capitalized banks to accept high-rate deposits.

Recommendations Provided by Commenters

Many commenters provided recommendations for changing the national rate and national rate cap methodology. Commenters suggested the following changes:

- The national rate calculation should include all comparable deposit rates, including, for example, promotional CD products (e.g., “off-tenor” terms), specials offered (e.g., cash incentives), rewards checking products, and products that are available only in the online marketplace.

- The national rate calculation should include one entry per bank charter rather than the current approach that calculates the simple average of published rates by all branches.

- The national rate should be based on fixed income instruments such as U.S. Treasury yields or the Federal Home Loan Bank advance rate. Some of these commenters suggested that the current national rate cap should allow institutions to choose between the higher of the national rate cap set in the 1992 and the 2009 rulemaking. This would allow less than well capitalized institutions to offer rates at the higher of (1) 120, or 130 percent for wholesale deposits, of the U.S. Treasury yields plus 75 basis points and (2) the current national rate cap (simple average of all branches plus 75 basis points).

- The national rate calculation should be based on an average of the top listing service rates.

- Community banks should be able to use a more tailored local market rate that includes online rates, specials, and promotional rates.

Additionally, other commenters asserted that the interest rate restrictions should be eliminated and replaced with growth restrictions on banks that are undercapitalized or have serious asset quality issues.

In response to the issues raised by commenters, the FDIC seeks public comments on a proposal to amend the interest rate caps. The purpose of the proposed rule would be to ensure that the rate caps are more dynamic in that they remain reflective of the prevailing rates offered through all stages of the economic and interest rate cycles. Additionally, the proposed rule is intended to allow less than well capitalized insured depository institutions subject to the interest rate caps to reasonably compete for funds within markets, and yet, in accordance with Section 29, constrain them from offering a rate that significantly exceeds the prevailing rate for a particular product.

IV. Proposed Rule

The proposal would amend the national rate and both the national rate cap and the local rate cap. The proposal would also provide a new simplified process for institutions that seek to offer a local market rate that exceeds the national rate cap.

National Rate

The proposed national rate would be the weighted average of rates paid by all insured depository institutions on a given deposit product, for which data are available, where the weights are the institution's market share of domestic deposits. Through this proposal, the FDIC would continue to interpret the “prevailing rates of interest . . . in an institution's normal market area” to be the national rate, as defined by regulation. The key difference between the proposed national rate and the current national rate is that the calculation of the proposed national rate would be a weighted average based on an institution's share of total domestic deposits, while the current methodology is based on an institution's number of branches.

In determining the proposed national rate, the FDIC would calculate an average rate per institution for each specific deposit product that the institution offers, and for which data is available, including CDs of various tenors, as well as savings accounts, checking accounts and MMDAs. The national rate for a specific deposit Start Printed Page 46475product would then be calculated by multiplying each bank's rate by its amount of domestic deposits, summing these values, and dividing by the total amount of domestic deposits held by such institutions. Table 1 below presents data for a hypothetical deposit product. The national rate for this hypothetical deposit product would be 1.56 percent, the average of the rates offered by these banks, weighted by domestic deposits. Chart 2 compares the national rate under the current methodology weighted by branches to the proposed methodology weighted by deposits.

Calculation of the average using the weighted methodology:

Start Printed Page 46476Table 1

Bank Total deposits Share of industry deposits (%) Rate (%) Bank A 4,000 2.00 2.30 Bank B 3,000 1.50 2.25 Bank C 21,000 10.50 2.15 Bank D 4,000 2.00 2.05 Bank E 23,000 11.50 2.00 Bank F 12,000 6.00 1.99 Bank G 6,000 3.00 1.75 Bank H 76,000 38.00 1.45 Bank I 32,000 16.00 1.40 Bank J 3,000 1.50 1.00 Bank K 9,000 4.50 0.45 Bank L 2,000 1.00 0.25 Bank M 5,000 2.50 0.15 Total 200,000 100.00 N/A National Rate Cap

The proposal would interpret that a rate of interest “significantly exceeds” the prevailing rate, or is “significantly higher” than the prevailing rate, if the rate of interest exceeds the national rate cap. The national rate cap would be set to the higher of (1) the rate offered at the 95th percentile of rates weighted by domestic deposit share or (2) the proposed national rate plus 75 basis points. The FDIC would compute the permissible national rate cap applicable for different deposit products and maturities on a monthly basis, and would plan to publish such information on the FDIC's website on a monthly basis.[28]

Rates offered at the 95th Percentile. Through this proposal, one method for the national rate cap would be the rate offered at the 95th percentile of rates weighted by domestic deposit share. By definition, the rates that exceed this component of the national cap would be part of the top 5 percent of rates offered, weighted by domestic deposit share. In other words, setting the threshold at the 95th percentile would allow institutions subject to the interest rate restrictions to compete with all but the top five percent of offered rates, weighted by domestic deposit share. This standard is intended to set a reasonable proxy for rates that “significantly exceed” the prevailing rate in that the rate would allow less than well capitalized institutions to access market-rate funding. At the same time, it would constrain them from being at the very top of the market.

To determine the rate being offered at the 95th percentile, the FDIC would calculate an average rate per institution for each specific deposit product that the institution offers, and for which data is available, including CDs of various tenors, as well as savings, checking and MMDAs. These rates would be sorted by rate offered on the given deposit product from highest to lowest. An institution's percentile would be determined by taking the sums of the amounts of domestic deposits held by the institution and by all the institutions offering a lower rate, dividing that value by the total domestic deposits held by all institutions for which data is available. The rate offered by the bank whose percentile was the first at or above the 95th percentile would be the rate at the 95th percentile.

In Table 2 below, Bank C is the first institution offering a rate at or above the 95th percentile. Therefore, Bank C's rate of 2.15 percent would be the national rate cap for this hypothetical deposit product under the 95th percentile method.

Start Printed Page 46477Table 2

Bank Total deposits Share of industry deposits (%) Cummulative deposits Percentile (%) Rate (%) Bank A 4,000 2.00 200,000 100.0 2.30 Bank B 3,000 1.5 196,000 98.0 2.25 Bank C 21,000 10.5 193,000 96.5 2.15 Bank D 4,000 2.0 172,000 86.0 2.05 Bank E 23,000 11.5 168,000 84.0 2.00 Bank F 12,000 6.0 145,000 72.5 1.99 Bank G 6,000 3.0 133,000 66.5 1.75 Bank H 76,000 38.0 127,000 63.5 1.45 Bank I 32,000 16.0 51,000 25.5 1.40 Bank J 3,000 1.5 19,000 9.5 1.00 Bank K 9,000 4.5 16,000 8.0 0.45 Bank L 2,000 1.0 7,000 3.5 0.25 Bank M 5,000 2.5 5,000 2.5 0.15 National Rate Plus 75 Basis Points. Through this proposal, the second method for the national rate cap methodology would be the proposed national rate plus 75 basis points. This method for the national rate cap would build upon the long-standing application that an amount that is 75 basis points above the average rates offered on a particular product is an appropriate proxy for a rate that “significantly exceeds” or is “significantly higher” than the prevailing rate. The 75 basis point add-on to this national rate cap would also provide needed flexibility during low-rate environments, or when the rate paid at the 95th percentile is low due to a convergence of rates being offered by banks with relatively large deposit shares for particular products. In such cases, the 95th percentile may not represent a rate that “significantly exceeds” or is “significantly higher” than the prevailing rate for particular deposit products.

Proposed Methodology

Weighting the national rate and the national rate cap by domestic deposits is more representative of the amount of deposits placed at offered rates than weighting by branches (which is a feature of the current method), particularly for internet-only banks that have a large share of deposits but few branches and tend to pay higher rates. Moreover, the use of percentiles decreases the effects of institutions that may be viewed as pushing down the average by offering very low published rates, but at the same time may offer special features, such as cash bonuses or negotiated rates, that result in an effective higher interest expense paid to depositors than is reflected in the published rates.

Additionally, utilizing a percentile methodology would improve the current national rate cap by providing a more dynamic calculation. This is because the distribution of rates offered often reflects a large mass of rates at the low end of the market and fewer rates offered at the high end of the market. As many commenters noted, this distribution has caused the current national rate caps (calculated using a simple average) to remain low even as more institutions begin to pay higher rates. Because one component of the proposed national rate cap would be based on rates paid at the 95th percentile, the effect of having a large mass of rates at the low end of the market would not be as pronounced.

There are, however, potential data limitations with this proposed methodology. The data gathered from third party sources is based upon information provided directly by institutions or made available via public sources. As such, some rates being offered for certain products are left unreported or unpublished and therefore may not be captured as part of the data set used to determine the national rate caps. If a rate offered by an institution that has a sizeable market share of total domestic deposits is not included in the data sources, then the national rate cap may not be truly reflective of the market. In addition, if the data is not consistently reported or captured, the national rate cap could be subject to fluctuations from month to month due to the methodology's use of weighting. To ensure that all reported rates are incorporated in the national rate cap, the FDIC would review the data it receives to ensure that all rate information that has been provided is incorporated [29] before making the national rate cap available on the FDIC's website.

There may also be other factors (e.g., geopolitical changes, changes to the federal funds rate) that could have an impact on the rates being offered and may cause fluctuations in the national rate cap, given the proposed weighting by deposit share. Moreover, it is possible that one institution, or a few institutions, with a large deposit share could affect the national rate cap by withdrawing a product from the market or by introducing a product into the market. While such fluctuations, caused by factors other than data limitations, would be reflective of changes in the market, these changes could cause downward volatility in the national rate cap. In order to address the effect of this potential downward volatility, the FDIC proposes that, for institutions that are subject to the interest rate restrictions, any subsequent published national rate cap, that is lower than the previously published national rate cap, take effect 3 days after publication. The previously posted national rate cap would remain in effect during this 3-day period. Furthermore, in the event of a substantial unexpected decrease in the national rate cap, the FDIC would have the discretion to delay the date on which that national rate cap takes effect. Until the subsequent national rate cap takes effect, the previously published national rate cap would remain in effect.

Table 3 below compares the current and proposed national rate cap based upon the various deposit maturities using data from May 20, 2019,[30] and provides the applicable rate cap that is based upon the higher of the two proposed national rate caps.

Start Printed Page 46478Table 3—Comparison of the Current National Rate Cap and the Proposed National Rate Cap for Various Deposit Products (as of May 20, 2019)

Deposit products Current national rate cap Proposed national rate cap Interest Checking 0.81 0.80* Savings 0.84 1.05 MMDA 0.93 1.20 1 month CD 0.87 0.85* 3 month CD 0.97 0.94* 6 month CD 1.16 1.21 12 month CD 1.40 2.70 24 month CD 1.59 2.65 36 month CD 1.72 2.75 48 month CD 1.82 2.80 60 month CD 1.98 3.00 * For these products, the Proposed Rate Cap as of May 20, 2019, would be based on the weighted mean plus 75 basis points methodology as of March 2019. Source: FDIC and RateWatch. As part of this proposal, the FDIC would continue to publish the national rate cap for the on-tenor maturities noted above in Table 3.[31] If an institution seeks to offer a product with an off-tenor maturity for which a rate is not published by the FDIC, then the institution would be required to use the rate offered on the next lowest on-tenor maturity for that product as the applicable national rate cap. For example, an institution seeking to offer a 26-month CD product must use the rate offered for the 24-month CD product as the institution's national rate cap.

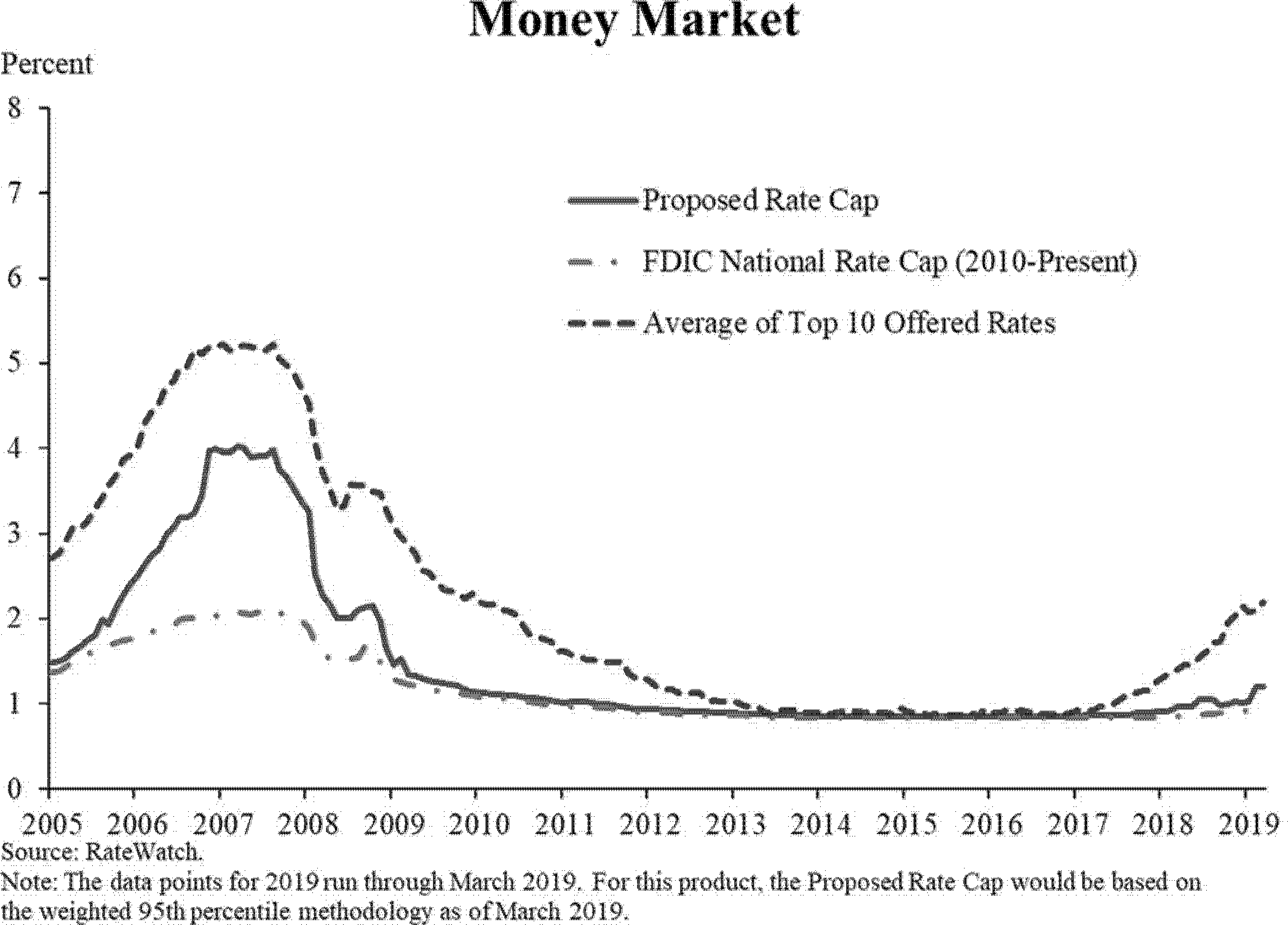

Historical Data. In determining the appropriateness of the proposed methodology for the national rate and national rate cap, the FDIC reviewed and considered the proposed national rate cap's progression over time relative to the current and previous rate caps and top rates from a listing service. Appendix 1 of this document provides charts with historical data for the various maturities. The charts illustrate that the proposed national rate cap set to the rate offered at the 95th percentile would be more reactive to and reflective of the fluctuations in the interest rate market than the current national rate cap for many of the maturities, particularly those with tenors of 6 months or more and MMDAs. To the extent that the rate offered at the 95th percentile is flat, and does not react to the top payers due to a convergence of rates among the banks with the largest deposit shares for particular deposit products (as currently seen with the interest checking product and the one and three month CDs), then the national rate plus 75 basis points would provide flexibility for institutions to remain competitive, while still satisfying the statutory interest rate restrictions applicable to less than well capitalized institutions.

Local Rate Cap

Since the 2009 rulemaking, competition for deposits among insured depository institutions continues to grow increasingly digital and therefore national in scope. Today, a consumer in any market, including rural markets, can access rates and shop for deposit products by checking a variety of websites. In light of this evolution, the proposal would continue to presume that the national rate cap applies to rates offered on all deposits by less than well capitalized institutions. However, because the FDIC's experience suggests some institutions still do compete for particular products within their local market areas, the proposal would continue to provide a local rate cap process.

Specifically, the proposal would allow less than well capitalized institutions to provide evidence that any bank and credit union in its local market offers a rate on particular deposit product in excess of the national rate cap. If sufficient evidence is provided, then the less than well capitalized institution would be allowed to offer 90 percent of the competing institution's rate on the particular product. This would replace the current methodology that requires the local rate cap to be the average of the rates offered by all competing institutions, which can include credit unions, for a particular product plus 75 basis points.

As part of this proposal, the FDIC would define an institution's market area as any readily defined geographical area, which may include the State, county or metropolitan statistical area, in which the insured depository institution solicits depositors by offering rates on a particular deposit product. Less than well capitalized institutions that solicit deposit products outside of their local market area, such as online listing services, would not be allowed to offer rates on those nationally-sourced deposit products in excess of the national rate cap, and therefore would not be eligible for a local rate cap determination for those products.

An institution's local market rate cap would be based upon the rate offered on a particular deposit product type and maturity period by an insured depository institution or credit union that is accepting deposits at a physical location within the institution's local market area. If a less than well capitalized institution seeks to offer a product with an off-tenor maturity that is not offered by competing institutions within its local market area, then the institution would use the rate offered on the next lowest on-tenor maturity for that product when determining its local market rate cap. For example, a less than well capitalized institution seeking to offer a 26-month CD product would use the rate offered for a competitor's 26-month product. In this way, an institution would be able to take into consideration rates offered on off-tenor Start Printed Page 46479maturity products in calculating a local rate cap. If a 26-month product was not being offered by a competitor, then the institution would use the rate offered on a 24-month CD product to calculate the institution's local market rate cap.

A less than well capitalized institution would not be permitted to calculate its local rate cap based on rates that are tied to a deposit balance. For example, if a competing institution offers different interest rates for different deposit balances for the same deposit maturity, the institution may not pick the highest rate from the competing institution's rates. The less than well capitalized institution should average the competing institution's interest rates for each size deposit within each maturity period.[32] In addition, a less than well capitalized institution would be permitted to use published rates only, rather than adjusting a competing institution's rates to reflect special features, such as cash incentives being offered by that competing institution, when calculating its local market rate cap.

Similarly, for time deposits, the FDIC would view lack of limits on withdrawals as a special feature. For example, if an institution is reviewing a competitor's rates on a CD with a five year stated maturity but only a one-month limit on withdrawals (or considering offering such a product itself), the FDIC would look to the substance of the product, which is more akin to a one-month CD, when considering a less than well capitalized institution's request for a local rate determination.

The proposal would also eliminate the current two-step process where less than well capitalized institutions request a high rate determination from the FDIC and, if approved, calculate the prevailing rate within local markets. Instead, a less than well capitalized institution would need to notify its appropriate FDIC regional office that it intends to offer a rate that is above the national rate cap and provide evidence that it is competing against an institution or credit union that is offering a rate in its local market area in excess of the national rate cap. As described above, the institution would then be allowed to offer 90 percent of the rate offered by a competitor in the institution's local market area. The institution would be expected to calculate the local rate cap monthly, maintain records of the rate calculations for at least two examination cycles and, upon the FDIC's request, provide the documentation to the appropriate FDIC regional office and to examination staff during any subsequent examinations.

The proposal to amend the local rate cap is intended to streamline the current local rate cap process and provide additional flexibility for less than well capitalized institutions to compete with local competition offering rates in excess of the national rate cap. This proposal would also address a popular promotional method of attracting new maturity deposits by offering higher rates on off-tenor products.

Treatment of Non-Maturity Deposits for Purposes of the Interest Rate Restrictions

For purposes of the interest rate restrictions, the FDIC has from time to time looked at the question of when non-maturity deposits in an existing account are considered “accepted” or “solicited.” The FDIC, through this proposal, is considering an interpretation under which non-maturity deposits are viewed as “accepted” and “solicited” for purposes of the interest rate restrictions at the time any new non-maturity deposits are placed at an institution.

Under this proposed interpretation, balances in a money market demand account or other savings account, as well as transaction accounts, at the time an institution falls below well capitalized would not be subject to the interest rate restrictions. However, if funds were deposited to such an account after the institution became less than well capitalized, the entire balance of the account would be subject to the interest rate restrictions. If, however, the same customer deposited funds into a new account and the balance in that account was subject to the interest rate restrictions, the balance in the initial account would continue to not be subject to the interest rate restrictions so long as no additional funds were accepted. Interest rate restrictions also generally apply to any new non-maturity deposit accounts opened after the institution falls to below well capitalized.

The term “accept” is also used in PCA-triggered restrictions related to brokered deposits and employee benefit plan deposits.[33] The FDIC plans to address in a future rulemaking when deposits are “accepted” for purposes of these PCA-related restrictions, both for non-maturity deposits, such as transaction accounts and MMDAs, as well as for certificates of deposits and other time deposits.

V. Alternatives

Below are alternatives that were considered, and on which the FDIC is seeking comment, as part of this proposed rulemaking.

Higher of Two Previous Rate Caps

As an alternative to replacing the 75 basis points as the threshold for “significantly exceeds” and the current simple average methodology for the national rate, the FDIC considered retaining the current threshold but modifying it so that, for a particular deposit product, the national rate cap would be 75 basis points added to the higher of: (1) The current simple average calculation; or (2) the methodology used by the FDIC between 1992 and 2009, i.e., 120 percent or, 130 percent for wholesale deposits, of the applicable Treasury security rate, plus 75 basis points.

Several commenters suggested that the FDIC allow institutions to pay the higher of the previous national rate cap, which tracks the yields on comparable Treasury securities plus 75 basis points, or the current national rate cap. Chart 3 below shows the national rate cap based on Treasury securities from 1996 through the present. The chart also shows the current rate cap from 2009 forward, as well as the average of top rates from a listing service from 1996 to the present.

Start Printed Page 46480Chart 3 illustrates the difficulties in determining a prevailing market rate that accurately reflects the true market value of different deposit products in changing economic environments. The method used to calculate the previous national rate cap (using U.S. Treasury securities) worked well for many years because rates on Treasury obligations tracked closely the rates on deposits. In 2008, however, the rates on Treasury obligations dropped dramatically because of a flight to quality during the financial crisis. Consequently, the yields on U.S. Treasuries fell faster than deposit rates and no longer tracked the rates available on deposits, thereby prompting the FDIC to change the national rate to the current simple average approach. The current approach provided institutions much needed relief during the post-crisis years up until 2015 when, as described above, rates started increasing and the national rate cap lagged behind. At the same time, however, because the current methodology was so permissive, it effectively made the interest rate restrictions non-constraining for less than well capitalized institutions for several years.

Today, with the benefit of having data to review the ability of previous and current national rate calculations to capture deposit market conditions, it is apparent that neither measure works in all interest rate environments. Given that the method used to calculate the national rate cap tied to U.S. Treasury securities works well under certain economic conditions (high-rate or rising-rate environments), and the current method of calculating the national rate cap works well under other economic conditions (falling-rate environment), the FDIC considered setting the national rate cap applicable to less than well capitalized institutions at the higher of the previous and current rate caps. The FDIC also considered whether the U.S. Treasury securities index would warrant a multiplier plus 75 basis points, as previously provided.

The FDIC believes that this alternative would be simple to administer and provide immediate and continuous relief to institutions subject to the interest rate restrictions. Using a fixed income product such as U.S. Treasury securities would also mitigate potential data limitations in determining a national rate based solely upon rates reported to third-party sources. However, U.S. Treasury securities are not deposit rates and, as indicated by the chart above, do not always track deposit rates. Also, U.S. Treasury securities do not have the necessary range of maturities that are prevalent with deposit products, particularly with the recent popularity of non-maturity deposits.[34] Moreover, there are certain rate environments in which neither alternative might be expected to yield a rate that “significantly exceeds” or is “significantly higher” than the prevailing rate, such as a high rate environment in which Treasury yields dropped precipitously while deposit rates remained constant.

Average of the Top-Payers

Some commenters suggested that the FDIC use an average of the top rates paid as the national rate cap. As an example, the FDIC could set the national rate cap based upon the average of the top-25 rates offered (by product type). Under this approach, the FDIC would interpret that a less than well capitalized institution “significantly exceeds the prevailing rate in its normal market area” if it offers a rate that is above the average of the top rates offered in the country. This approach would be simple to administer and the Start Printed Page 46481FDIC would be able to provide real-time rate caps because it would no longer need to maintain and review the extensive data it receives from third party data providers to calculate averages.

At the same time, setting the “prevailing rate” based upon rates offered at the top of the market might be viewed as inconsistent with the FDIC's historical interpretation that the “prevailing rates” offered should include rates offered by all participants in the market. The subset of banks paying the highest rate may have a small market share and have little to no influence over competitive rates paid in the market. Further, this same small subset of banks could be significant outliers from the rates offered by the market.

Incorporate Specials and Promotions Into the Current National Rate Calculation

Several commenters suggested that the FDIC change its methodology in calculating the current national rate and include additional inputs for the published rates, such as special negotiated rates or other monetary bonus offers. Calculating the national rate with these special features is problematic. Foremost, information regarding special features is not consistently provided by institutions to private publications. Additionally, the data provided by institutions on Call Reports is limited to a very broad category of interest expense on non-maturity deposits and maturity deposits on only a quarterly basis. Institutions do not provide details on the interest expense related to the variety of deposit products, particularly for maturity deposits.

One Vote per Institution

Commenters also recommended that published rates be limited to the highest rate offered by each depository institution. According to commenters, this would prevent a skewing effect on the national rate by the largest institutions with the most branches. In considering this alternative, the FDIC analyzed the impact of this change. The chart below compares, for the 12-month CD, the current national rate cap (using all branches) and the national rate rap using the highest rate offered by each IDI (in other words, each institution gets “one vote”). The differences in rates range from 15 to 52 basis points, with a range of 25 basis points between 2012 through 2017, as illustrated in Chart 4 below.

In the FDIC's view, the one-bank, one-vote approach, almost by definition would result in a national rate that may not be reflective of market rates currently being offered. Moreover, the FDIC believes that institutions with multiple branches and more deposits have a greater impact on competition and the market rates. Therefore, including branches or weighting by market share is a more reflective way to calculate the national rate.Start Printed Page 46482

Federal Home Loan Bank Borrowing Rate

Many commenters suggested that the FDIC amend the current national rate calculation and use the Federal Home Loan Bank (FLHB) borrowing rate for each maturity. The FDIC chose not to propose the FHLB borrowing rate for several reasons. The FHLB borrowing rate is not based upon rates offered by institutions,[35] but is instead based upon the cost of funds for FHLB member institutions and requires that FHLBs obtain and maintain collateral from their members to secure the advance. Collateral requirements and borrowing interest rates may also vary based on an insured depository institution's financial condition. Moreover, FHLB advances, unlike deposit products, are not insured and not guaranteed by the U.S. government. In addition, there are 11 different FHLB districts, all that establish their own rates that may vary between districts. As such, the FHLB borrowing rate would be an imprecise indicator of rates offered on deposits by insured depository institutions.

VI. Expected Effects

The interest rate restrictions apply to an insured depository institution that is less than well capitalized under the Prompt Corrective Action (PCA) capital regime. An institution may be less than well capitalized either because: (1) Its capital ratios fall below those set by the federal banking agencies for an institution to be deemed well capitalized; or (2) it otherwise meets the capital requirements for the well capitalized category, but is subject to a written agreement, order, capital directive, or prompt corrective action directive issued by its primary regulator that requires the institution to meet and maintain a specific capital level for any capital measure.36

Currently, very few insured depository institutions are less than well capitalized. As of March 30, 2019, there were 5,362 FDIC-insured institutions. Of these, 22 had capital ratios that put them in a PCA category lower than well capitalized and hence, potentially, affected by the proposed rule.37 The FDIC reviewed deposit interest rate information for a sample of 17 of these institutions for which data were available. Twelve of the 17 paid deposit interest rates that were less than both the current and the proposed national rate caps. Five of these 17 institutions paid interest rates on a number of deposit products that exceeded the current national rate cap but were less than the proposed national rate cap. A few deposit products at three of the banks paid rates exceeding both the current and proposed national rate caps.

Deposit interest rates paid by less than well capitalized banks that exceed the current national rate cap reflect situations where banks avail themselves of the local rate cap process. By generally increasing the level of the national interest rate caps in the current interest rate environment, the proposal can be expected to reduce the need for less than well capitalized banks to avail themselves of the local rate cap process. This is expected to simplify liquidity planning for these institutions.

In some future less favorable economic and banking environment, where the number of less than well capitalized banks increases substantially, the effects of the rule would become more meaningful.

Conceptually, under the proposed rule, the national rate cap would appear more responsive to, and reflective of, changes in the interest rate environment than is the current national rate cap. This would likely reduce the potential for severe liquidity problems or liquidity failures at viable banks to arise solely as a result of the operation of the cap. The FDIC believes this aspect of the rule is important, although difficult to quantify given uncertainties about both the future interest rate environment and the future condition of banks.

Having a national interest rate cap that is more reflective of the interest rate environment may also result in lower losses to the DIF. In the last financial crisis, the FDIC encouraged mergers and problem asset reduction for problems banks while they were opened as well as innovations in franchise marketing for failed bank assets.[38] Inappropriately restricting banks from competing for deposits could result in expedited failures and less time for less than well capitalized institutions to solve their problems either through asset sales or mergers.

On the other hand, by generally increasing the rate caps, the proposed rule may increase the possibility, as compared to the current national rate cap, that a less than well capitalized institution could continue to fund imprudent operations by soliciting insured deposits at high interest rates. Since the proposal sets the national rate cap at the greater of the deposit weighted average rate plus 75 basis points, or the 95th percentile of deposit weighted interest rates, two types of interest rate environments should be distinguished.

When interest rates are low and the rates paid by institutions are distributed over a relatively narrow band, the “average plus 75 basis points” prong of the rule would likely determine the cap. The operation of the cap in these low interest rate environments would be similar to the current cap, which defines “significantly exceeds” by reference to a 75 basis point difference. In higher or rising interest rate environments, in which the deposit interest rates paid by institutions are widely dispersed, the “95th percentile” prong of the rule would be more likely to determine the cap. In these environments, the proposal would in effect limit the interest rate paid by a less than well capitalized institution to less than the top five percent of deposit weighted rates on comparable deposit products. This ensures that the national rate cap will remain within a defined percentile band of the distribution of prevailing interest rates.

The FDIC is interested in commenters views on the impact of the proposed rule in less favorable economic environments, as regard to the objective of avoiding liquidity problems and liquidity failures of viable institutions, and the objective of ensuring that less than well capitalized institutions do not solicit deposits at interest rates significantly exceeding prevailing interest rates on comparable deposit products.

Appendix 1

Historical charts illustrating the proposed national rate cap, the top rates offered, and the previous and current national rate caps, where applicable, since 2005.

Start Printed Page 46483 Start Printed Page 46484 Start Printed Page 46485 Start Printed Page 46486 Start Printed Page 46487 Start Printed Page 46488 Start Printed Page 46489 Start Printed Page 46490 Start Printed Page 46491 Start Printed Page 46492I. Request for Comment

The FDIC invites comment from all members of the public regarding all aspects of the proposal, including the alternatives considered. This request for comment is limited to this proposal. The FDIC will carefully consider all comments that relate to the proposal. In particular, the FDIC invite comment on the following questions:

Question 1. Does the proposed calculation of the rate caps enable less than well capitalized institutions to compete for deposits while satisfying section 29? If not, please explain why.

Question 2. The FDIC proposes to update the national rate cap information every month, with discretion to update the rate cap more or less frequently. Currently, the FDIC updates this information on a weekly basis. Should national rate calculations be provided more or less frequently than every month, as proposed?

Question 3. U.S. Treasury securities do not have maturities that are comparable to non-maturity deposit products (e.g., money market or interest checking). If the FDIC were to use U.S. Treasury securities in its calculation for the national rate cap, is there a fixed income product that could be used in place of U.S. Treasury securities as a proxy for the national rate cap for non-maturity deposit products?

Question 4. The proposed national rate and rate cap are weighted by deposit share, which gives relatively more influence to internet-only institutions that have large deposit shares than the current all-branch approach. Is this weighting system appropriate?

Question 5. To address potential downward volatility in the national rate cap, the FDIC is proposing that, for institutions that are subject to the interest rate restrictions, any subsequent published national rate cap, that is lower than the previously published national rate cap, take effect 3 days after publication. In certain circumstances, the FDIC would also have discretion to delay the date on which a national rate cap takes effect. Is this a reasonable approach to address the effects of potential downward volatility in the national rate cap? Are there other ways to address or reduce the effect of potential volatility on less than well capitalized institutions that are subject to the interest rate restrictions?

Question 6. Data limitations do not allow consistent means to include certain special promotions, like cash bonuses, to be included in the proposed national rate calculations. Is it appropriate to incorporate specials and promotions? Is there another way to capture these promotions or deposit products that pay interest based upon an index or are triggered at some future date (e.g., step-up rates)?

Question 7. The proposed national rate plus 75 basis points is being proposed as an option for products whose rates converge, as seen with a few deposit products. While this appears to be a useful alternative for a few products in the current rate environment, it might be less appropriate in other rate environments. For example, this alternative could yield a rate cap that does not “significantly exceed” the prevailing rate in a high rate environment. Are there better options for setting a proxy to determine what it means to “significantly exceed” Start Printed Page 46493a prevailing market rate when rates converge?

Question 8. Should the local rate be exclusively limited to institutions with a smaller geographical footprint? If so, how should eligibility be determined?

Question 9. If there is significant movement downwards in the national rate cap from one publication period to the next, do institutions need additional time to lower interest rates on particular products in an effort to be in compliance with the rate caps? If so, what is an appropriate amount of time?

Question 10. internet institutions are not included in the local deposit rate calculation. Is this a reasonable approach? If the FDIC allowed institutions to use internet competitors in their local rate calculations, how would they choose such competitors and which ones should be chosen?

Question 11. For purposes of the rate restrictions, the FDIC is considering an interpretation under which balances in non-maturity deposit accounts at the time the institution becomes less than well capitalized are not subject to the interest rate restrictions, but the balance would be if new funds were deposited into such accounts. Is this interpretation appropriate? Would there be substantial operational difficulties for institutions to monitor additions to these existing accounts in order to determine when they would be subject to the interest rate restrictions?

VI. Administrative Law Matters

A. Paperwork Reduction Act

In accordance with the requirements of the Paperwork Reduction Act (PRA) of 1995, 44 U.S.C. 3501-3521, the FDIC may not conduct or sponsor, and the respondent is not required to respond to, an information collection unless it displays a currently valid Office of Management and Budget (OMB) control number. This proposed rule does not create a new or revise an existing information collection. Therefore, no Paperwork Reduction Act clearance submission to OMB will be made.

B. Solicitation of Comments on Use of Plain Language

Section 722 of the Gramm-Leach Bliley Act,[39] requires the Federal banking agencies to use plain language in all proposed and final rules published after January 1, 2000. The FDIC invites your comments on how to make this revised proposal easier to understand. For example:

- Has the FDIC organized the material to suit your needs? If not, how could the material be better organized?

- Are the requirements in the proposed regulation clearly stated? If not, how could the regulation be stated more clearly?

- Does the proposed regulation contain language or jargon that is unclear? If so, which language requires clarification?

- Would a different format (grouping and order of sections, use of headings, paragraphing) make the regulation easier to understand?

C. Regulatory Flexibility Act

The Regulatory Flexibility Act (RFA) requires that, in connection with a proposed rule, an agency prepare and make available for public comment an initial regulatory flexibility analysis that describes the impact of the proposed rule on small entities.[40] However, a regulatory flexibility analysis is not required if the agency certifies that the proposed rule will not have a significant economic impact on a substantial number of small entities, and publishes its certification and a short explanatory statement in the Federal Register together with the proposed rule. The Small Business Administration (SBA) has defined “small entities” to include banking organizations with total assets of less than or equal to $550 million that are independently owned and operated or owned by a holding company with less than or equal to $550 million in total assets.[41]

Generally, the FDIC considers a significant effect to be a quantified effect in excess of 5 percent of total annual salaries and benefits per institution, or 2.5 percent of total noninterest expenses. The FDIC believes that effects in excess of these thresholds typically represent significant effects for FDIC-insured institutions.

The FDIC is proposing revisions to its regulations relating to interest rate restrictions that apply to less than well capitalized insured depository institutions, by amending the methodology for calculating the national rate and national rate cap. The proposal would also modify the current local rate cap calculation and process.

Specifically, the proposal defines the national rate for a deposit product as the average rate for that product, where the average is weighted by domestic deposit share. The proposed national rate cap is the higher of (1) the rate offered at the 95th percentile of rates weighted by domestic deposit share or (2) the proposed national rate plus 75 basis points.

Because the FDIC's experience suggests some institutions compete for particular products within their local market area, the proposal would continue to provide a local rate cap process.

Specifically, the proposal would allow less than well capitalized institutions to provide evidence that any bank or credit union in its local market offers a rate on particular deposit product in excess of the national rate cap. If sufficient evidence is provided, then the less than well capitalized institution would be allowed to offer 90 percent of the competing institution's rate on the particular product. For the reasons discussed below, the FDIC certifies that the proposed rule will not have a significant economic effect on a substantial number of small entities.

Based on March 31, 2019, Call Report data, the FDIC insures 5,362 depository institutions, of which 3,920 are considered small entities for the purposes of RFA.[42] As of March 31, 2019, 20 small, FDIC-insured depository institutions were less than well capitalized.[43] This represents less than two-fifths of one percent of all FDIC-insured institutions as of March 31, 2019, and approximately one-half of one percent of small, FDIC-insured institutions. For 17 small institutions that were less than well capitalized as of March 31, 2019, and that reported rates to a private data aggregator, FDIC analysts compared the national rate caps calculated under the current methodology with the national rate caps which would have been in effect under the proposal during the month of March across 11 deposit products.[44] As Start Printed Page 46494described in more detail below, the analysis shows that the proposed national rate caps are less restrictive than the current national rate caps, and would reduce the likelihood that less than well capitalized institutions would need to avail themselves of the local rate cap determination process.

Five of the 17 (just under 30 percent) less than well capitalized institutions for which data were available reported offering rates above the national rate caps calculated under the current methodology for seven out of the 11 products considered.[45] Under the proposed methodology, three institutions reported rates above the national rate caps on two products. Thus, the number of deposit products with rates constrained by the national rate cap is reduced for all five institutions, and two of those institutions would be relieved of the need to avail themselves of the local rate cap determination process.

For the 3-month, 6-month, 36-month, and 48-month CD products, two less than well capitalized small institutions reported offering rates above the national rate caps calculated under the current methodology. On average, the reported offering rates were 6, 13, 29, and 58 basis points above the national rate caps, respectively.

Three institutions reported offering rates above the national rate caps calculated under the current methodology for the 12-month and 24-month CD products, and four reported offering rates above the national rate caps as currently calculated for the 60-month CD product. Rates offered on the 12-month and 24-month CD products were 37 and 45 basis points above the national rate caps, on average. Rates offered on the 60-month CD product averaged 26 basis points above the national rate cap for that product.

Across all deposit products offered at rates above the national rate caps calculated under the current methodology, the rates offered were 30 basis points above the national rate caps on average.

Had the national rate caps in effect at the time been calculated under the proposed methodology, then two less than well capitalized small institutions would have reported offering rates that averaged 11 basis points above the national rate cap for the 3-month CD product, and one institution would have reported offering a rate three basis points above the national rate cap for the 48-month CD product.

Across all deposit products offered at rates above the national rate caps calculated under the proposed methodology, the rates offered were 7 basis points above the national rate caps on average.

No less than well capitalized small institution reported offering a rate above the national rate caps calculated under the current or proposed methodology for savings, interest checking, MMDA, or 1-month CD products during the timeframe considered.

The number of small, less than well capitalized institutions with offered rates above the national rate caps falls from five under the current methodology to three under the proposed methodology. Thus, the number of small less than well capitalized institutions that need to rely on a local rate cap is expected to fall.

The FDIC cannot more precisely quantify the effects of the proposed rule relative to the current methodology because it lacks data on the dollar amounts placed in deposit products broken down by the rates offered. However, few small institutions are less than well capitalized, and most of those small, less than well capitalized institutions for which data were available reported rates across the 11 deposit products considered that were below the national rate caps as calculated under both the current and proposed methodologies. For the few less than well capitalized institutions as of March 31, 2019 whose deposit interest rates are constrained by the current national rate cap but not the proposed rate cap, the effect of the rule would be burden reducing in the sense of reducing the need for local rate cap determinations.

Based on the foregoing information, the FDIC certifies that the proposed rule will not significantly affect a substantial number of small entities. The FDIC welcomes comments on its analysis. Specifically, what data would help the FDIC better quantify the effects of the proposal compared with the current methodology?

D. Riegle Community Development and Regulatory Improvement Act

Section 302 of the Riegle Community Development and Regulatory Improvement Act of 1994 (RCDRIA), 12 U.S.C. 4701, requires that each Federal banking agency, in determining the effective date and administrative compliance requirements for new regulations that impose additional reporting, disclosure, or other requirements on insured depository institutions, consider, consistent with principles of safety and soundness and the public interest, any administrative burdens that such regulations would place on depository institutions, including small depository institutions, and customers of depository institutions, as well as the benefits of such regulations.[46] In addition, new regulations that impose additional reporting, disclosures, or other new requirements on insured depository institutions generally must take effect on the first day of a calendar quarter that begins on or after the date on which the regulations are published in final form.

Because the proposal would not impose additional reporting, disclosure, or other requirements on IDIs, section 302 of the RCDRIA therefore does not apply. Nevertheless, the requirements of RCDRIA will be considered as part of the overall rulemaking process. In addition, the FDIC also invites any other comments that further will inform the FDIC's consideration of RCDRIA.

Start List of SubjectsList of Subjects in 12 CFR Part 337

- Banks

- Banking

- Reporting and recordkeeping requirements

- Savings associations

- Securities

Authority and Issuance

For the reasons stated in the preamble, the FDIC proposes to amend 12 CFR part 337 as follows:

Start PartPART 337—UNSAFE AND UNSOUND BANKING PRACTICES

End Part Start Amendment Part1. The authority for 12 CFR part 337 continues to read:

End Amendment Part Start Amendment Part2. Amend § 337.6 as follows:

End Amendment Part Start Amendment Parta. Revise paragraphs (a) introductory text and (a)(3)(i) through (iii);

End Amendment Part Start Amendment Partb. Remove paragraph (a)(5)(iii);

End Amendment Part Start Amendment Partc. Remove paragraphs (b)(2)(ii) and (b)(3)(ii) and redesignate paragraphs (b)(2)(i) and (b)(3)(i) as paragraphs (b)(2) and (3); and

End Amendment Part Start Amendment Partd. Remove paragraph (f).

End Amendment PartThe revisions read as follows:

Start Amendment PartBrokered deposits.(a) Definitions. For the purposes of this section and § 337.7, the following definitions apply:

* * * * *(3) * * *

(i) For purposes of section 29 of the Federal Deposit Insurance Act, this section, and § 337.7, the terms well capitalized, adequately capitalized, and Start Printed Page 46495 undercapitalized,[11] shall have the same meaning for each insured depository institution as provided under regulations implementing section 38 of the Federal Deposit Insurance Act issued by the appropriate federal banking agency for that institution.[12]

(ii) If the appropriate federal banking agency reclassifies a well capitalized insured depository institution as adequately capitalized pursuant to section 38 of the Federal Deposit Insurance Act, the institution so reclassified shall be subject to the provisions applicable to such lower capital category under this section and § 337.7.

(iii) An insured depository institution shall be deemed to be within a given capital category for purposes of this section and § 337.7 as of the date the institution is notified of, or is deemed to have notice of, its capital category, under regulations implementing section 38 of the Federal Deposit Insurance Act issued by the appropriate federal banking agency for that institution.[13]

* * * * *3. Add § 337.7 to read as follows:

End Amendment PartStart SignatureInterest rate restrictions.(a) Definitions—(1) National rate. The weighted average of rates paid by all insured depository institutions on a given deposit product, for which data are available, where the weights are each institution's market share of domestic deposits.

(2) National rate cap. The higher of:

(i) The interest rate offered on a particular deposit product at the 95th percentile by insured depository institutions, for which data is available, weighted by each institution's share of total domestic deposits; or

(ii) The national rate plus 75 basis points.

(3) Local market rate cap. 90 percent of the highest interest rate paid on a particular deposit product in the institution's local market area. An institution's local market rate cap shall be based upon the rate offered on a particular product type and maturity period by an insured depository institution or credit union that is accepting deposits at a physical location within the institution's local market area.

(4) Local market area. An institution's local market area is any readily defined geographical area, which may include the State, county or metropolitan statistical area, in which the insured depository institution solicits depositors by offering rates on a particular deposit product.

(5) On-tenor and off-tenor maturities. On-tenor maturities include the following term periods: 1-month, 3-month, 6-month, 12-month, 24-month, 36-month, 48-month, and 60-month. All other term periods are considered off-tenor maturities for purposes of this section.

(b) Computation and publication of national rate cap—(1) Computation. The Corporation will compute the national rate cap for different deposit products and maturities, as determined by the Corporation based on available and reported data.

(2) Publication. The Corporation will publish the national rate cap monthly, but reserves the discretion to publish more or less frequently, if needed, on the Corporation's website. Except as provided in paragraph (e) of this section, for institutions that are less than well capitalized at the time of publication, a national rate cap that is lower than the previously published national rate cap will take effect 3 days after publication. The previously published national rate cap will remain in effect during this 3-day period.

(c) Application—(1) Well capitalized institutions. A well capitalized institution may pay interest without restriction under this section.