-

Proclamation 9555 of December 15, 2016

To Implement the Nepal Preference Program and for Other Purposes

A Proclamation1. Section 915(b) of the Trade Facilitation and Trade Enforcement Act of 2015 (the “TFTEA”) (19 U.S.C. 4454) confers authority upon the President to provide preferential treatment for eligible articles imported directly from Nepal into the customs territory of the United States if the President determines that Nepal meets the eligibility requirements specified in section 915(b)(1)(A) of the TFTEA, taking into account the factors specified in section 915(b)(1)(B) of the TFTEA.

2. Pursuant to section 915(b) of the TFTEA, I have determined that Nepal meets the eligibility requirements of section 915(b)(1)(A), taking into account the factors specified in section 915(b)(1)(B).

3. Section 915(c) of the TFTEA describes the requirements for articles from Nepal to be considered eligible for duty-free treatment. Pursuant to section 915(c)(2)(A)(iv) of the TFTEA, the President may designate certain articles as eligible for duty-free treatment when imported from Nepal if, after receiving the advice of the United States International Trade Commission (Commission) in accordance with section 503(e) of the Trade Act of 1974 (the “Trade Act”) (19 U.S.C. 2463(e)), the President determines that such articles are not import-sensitive in the context of imports from Nepal.

4. Pursuant to sections 915(c)(2)(A)(iv) of the TFTEA, and after receiving advice from the Commission in accordance with section 503(e) of the Trade Act, I have determined to designate the articles included in Annex I of this proclamation as eligible for duty-free treatment when imported from Nepal.

5. Section 604 of the Trade Act (19 U.S.C. 2483), as amended, authorizes the President to embody in the Harmonized Tariff Schedules of the United States (the “HTS”) (19 U.S.C. 1202) the substance of the relevant provisions of the Trade Act and of other Acts affecting import treatment, and actions thereunder, including removal, modification, continuance, or imposition of any rate of duty or other import restriction.

6. In order to implement the duty-free treatment provided in accordance with the provisions of the TFTEA, it is necessary to modify the HTS, thus incorporating the substance of relevant provisions of the TFTEA, and of actions taken thereunder, into the HTS, pursuant to section 604 of the Trade Act.

7. In Proclamation 7748 of December 30, 2003, President Bush determined that the Central African Republic was not making continual progress in meeting the requirements described in section 506A(a)(1) of the Trade Act (19 U.S.C. 2466a(a)), as added by section 111(a) of the African Growth and Opportunity Act (the “AGOA”). Thus, pursuant to section 506A(a)(3) of the Trade Act (19 U.S.C. 2466a(a)(3)), President Bush terminated the designation of the Central African Republic as a beneficiary sub-Saharan African country for purposes of section 506A of the Trade Act.

8. Section 506A(a)(1) of the Trade Act authorizes the President to designate a country listed in section 107 of the AGOA (19 U.S.C. 3706) as a “beneficiary Start Printed Page 92500sub-Saharan African country” if the President determines that the country meets the eligibility requirements set forth in section 104 of the AGOA (19 U.S.C. 3703), as well as the eligibility criteria set forth in section 502 of the Trade Act (19 U.S.C. 2462).

9. Pursuant to section 506A(a)(1) of the Trade Act, based on actions that the Central African Republic has taken, I have determined that the Central African Republic meets the eligibility requirements set forth in section 104 of the AGOA and the eligibility criteria set forth in section 502 of the Trade Act, and I have decided to designate the Central African Republic as a beneficiary sub-Saharan African country.

10. On April 22, 1985, the United States and Israel entered into the Agreement on the Establishment of a Free Trade Area between the Government of the United States of America and the Government of Israel (the “USIFTA”), which the Congress approved in section 3 of the United States-Israel Free Trade Area Implementation Act of 1985 (the “USIFTA Act”) (19 U.S.C. 2112 note).

11. Section 4(b) of the USIFTA Act provides that, whenever the President determines that it is necessary to maintain the general level of reciprocal and mutually advantageous concessions with respect to Israel provided for by the USIFTA, the President may proclaim such withdrawal, suspension, modification, or continuance of any duty, or such continuance of existing duty-free or excise treatment, or such additional duties, as the President determines to be required or appropriate to carry out the USIFTA.

12. In order to maintain the general level of reciprocal and mutually advantageous concessions with respect to agricultural trade with Israel, on July 27, 2004, the United States entered into an agreement with Israel concerning certain aspects of trade in agricultural products during the period January 1, 2004, through December 31, 2008 (the “2004 US-Israel Agreement”).

13. In Proclamation 7826 of October 4, 2004, consistent with the 2004 US-Israel Agreement, President Bush determined, pursuant to section 4(b) of the USIFTA Act, that, in order to maintain the general level of reciprocal and mutually advantageous concessions with respect to Israel provided for by the USIFTA, it was necessary to provide duty-free access into the United States through December 31, 2008, for specified quantities of certain agricultural products of Israel.

14. Each year from 2008 through 2015, the United States and Israel entered into agreements to extend the period that the 2004 US-Israel Agreement was in force for 1-year periods to allow additional time for the two governments to conclude an agreement to replace the 2004 US-Israel Agreement.

15. To carry out the extension agreements, the President in Proclamation 8334 of December 31, 2008; Proclamation 8467 of December 23, 2009; Proclamation 8618 of December 21, 2010; Proclamation 8770 of December 29, 2011; Proclamation 8921 of December 20, 2012; Proclamation 9072 of December 23, 2013; Proclamation 9223 of December 23, 2014; and Proclamation 9383 of December 21, 2015, modified the HTS to provide duty-free access into the United States for specified quantities of certain agricultural products of Israel, each time for an additional 1-year period.

16. On December 5, 2016, the United States entered into an agreement with Israel to extend the period that the 2004 US-Israel Agreement is in force through December 31, 2017, and to allow for further negotiations on an agreement to replace the 2004 US-Israel Agreement.

17. Pursuant to section 4(b) of the USIFTA Act, I have determined that it is necessary, in order to maintain the general level of reciprocal and mutually advantageous concessions with respect to Israel provided for by the USIFTA, to provide duty-free access into the United States through the close of December 31, 2017, for specified quantities of certain agricultural products of Israel.Start Printed Page 92501

18. Section 1206(a) of the Omnibus Trade and Competitiveness Act of 1988 (the “1988 Act”) (19 U.S.C. 3006(a)) authorizes the President to proclaim modifications to the HTS based on the recommendations of the Commission under section 1205 of the 1988 Act (19 U.S.C. 3005) if he determines that the modifications are in conformity with United States obligations under the International Convention on the Harmonized Commodity Description and Coding System (Convention) and do not run counter to the national economic interest of the United States. In 2006 and 2011, the Commission recommended modifications to the HTS pursuant to section 1205 of the 1988 Act to conform the HTS to amendments made to the Convention. In Proclamation 8097 of December 29, 2006, and Proclamation 8771 of December 29, 2011, President Bush and I, respectively, modified the HTS pursuant to section 1206 of the 1988 Act to conform the HTS to the amendments to the Convention.

19. Proclamation 8332 of December 29, 2008, implemented the United States-Oman Free Trade Agreement (the “USOFTA”) with respect to the United States and, pursuant to section 201 of the United States-Oman Free Trade Agreement Implementation Act (the “USOFTA Act”) (19 U.S.C. 3805 note), the staged reductions in rates of duty that President Bush determined to be necessary or appropriate to carry out or apply articles 2.3, 2.5, 2.6, 3.2.8, and 3.2.9, and the schedule of duty reductions with respect to Oman set forth in Annex 2-B of the USOFTA.

20. In order to ensure the continuation of the staged reductions in rates of duty for originating goods from Oman in categories that were modified to conform to the Convention, President Bush and I proclaimed in Proclamation 8097 and Proclamation 8771, respectively, modifications to the HTS that we determined were necessary or appropriate to carry out the duty reductions proclaimed in Proclamation 8332.

21. The United States and Oman are parties to the Convention. Because the substance of changes to the Convention are reflected in slightly differing form in the national tariff schedules of the United States and Oman, the rules of origin set out in Annex 3-A and Annex 4-A of the USOFTA must be changed to ensure that the tariff and certain other treatment accorded under the USOFTA to originating goods will continue to be provided under the tariff categories that were modified in Proclamation 8097 and Proclamation 8771. The United States and Oman have agreed to make these changes.

22. Section 202 of the USOFTA Act (19 U.S.C. 3805 note) provides certain rules for determining whether a good is an originating good for the purposes of implementing preferential tariff treatment under the USOFTA. Section 202(j) of the USOFTA Act authorizes the President to proclaim the rules of origin set out in the USOFTA and any subordinate tariff categories necessary to carry out the USOFTA, subject to the exceptions stated in section 202(j)(2)(A) of the USOFTA Act.

23. I have determined that the modifications to the HTS proclaimed pursuant to section 202 of the USOFTA Act and section 1206(a) of the 1988 Act are necessary or appropriate to ensure the continuation of tariff and certain other treatment accorded originating goods under tariff categories modified in Proclamation 8097 and Proclamation 8771 and to carry out the duty reductions proclaimed in Proclamation 8332.

24. Section 604 of the Trade Act authorizes the President to embody in the HTS the substance of the relevant provisions of that Act, and of other Acts affecting import treatment, and actions thereunder, including removal, modification, continuance, or imposition of any rate of duty or other import restriction. Section 1206(c) of the 1988 Act (19 U.S.C. 3006(c)), as amended, provides that modifications proclaimed by the President may not take effect before the thirtieth day after the date on which the text of the proclamation is published in the Federal Register.

25. Proclamation 8894 of October 29, 2012, implemented the United States-Panama Trade Promotion Agreement (the “USPTPA”) with respect to the Start Printed Page 92502United States and, pursuant to section 201 of the United States-Panama Trade Promotion Agreement Implementation Act (the “USPTPA Act”) (19 U.S.C. 3805 note), the staged reductions in duty that the President determined to be necessary or appropriate to carry out or apply articles 3.3, 3.5, 3.6, 3.26, 3.27, 3.28, and 3.29, and the schedule of duty reductions with respect to Panama set forth in Annex 3.3 of the USPTPA.

26. The United States and Panama are parties to the Convention. Because changes to the Convention are reflected in slight differences of form between the national tariff schedules of the United States and Panama, the rules of origin set out in Annex 4.1 of the USPTPA must be changed to ensure that the tariff and certain other treatment accorded under the USPTPA Act to originating goods will continue to be provided under the tariff categories that were proclaimed in Proclamation 8894. The United States and Panama have agreed to make these changes.

27. Section 202 of the USPTPA Act (19 U.S.C. 3805 note) provides certain rules for determining whether a good is an originating good for the purposes of implementing tariff treatment under the USPTPA. Section 202(o) of the USPTPA Act authorizes the President to proclaim the rules of origin set out in the USPTPA and any subordinate tariff categories necessary to carry out the USPTPA, subject to the exceptions stated in section 202(o) of the USPTPA Act.

28. I have determined that the modifications to the HTS proclaimed pursuant to section 202 of the USPTPA Act and section 1206(a) of the 1988 Act are necessary or appropriate to ensure the continuation of tariff and certain other treatment accorded originating goods under tariff categories modified in Proclamation 8097 and Proclamation 8771 and to carry out the duty reductions proclaimed in Proclamation 8894.

29. Section 604 of the Trade Act authorizes the President to embody in the HTS the substance of relevant provisions of that Act, or other Acts affecting import treatment, and of actions taken thereunder, including removal, modification, continuance, or imposition of any rate of duty or other import restriction. Section 1206(c) of the 1988 Act provides that modifications proclaimed by the President may not take effect before the thirtieth day after the date on which the text of the proclamation is published in the Federal Register.

30. Proclamation 7987 of February 28, 2006, implemented the Dominican Republic-Central America-United States Free Trade Agreement (the “CAFTA-DR”) with respect to the United States and, pursuant to section 201 of the Dominican Republic-Central America-United States Free Trade Agreement Implementation Act (the “CAFTA-DR Act”) (19 U.S.C. 4031), the staged reductions in duty that the President determined to be necessary or appropriate to carry out or apply articles 3.3, 3.5, 3.6, 3.21, 3.26, 3.27, and 3.28, and Annexes 3.3 (including the schedule of United States duty reductions with respect to originating goods), 3.27, and 3.28 of the CAFTA-DR.

31. The United States, Costa Rica, the Dominican Republic, El Salvador, Guatemala, Honduras, and Nicaragua (the “CAFTA-DR countries”) are parties to the Convention. Because changes to the Convention are reflected in slight differences of form between the national tariff schedules of the United States and the other CAFTA-DR countries, Annexes 4.1, 3.25, and 3.29 of the CAFTA-DR must be changed to ensure that the tariff and certain other treatment accorded under the CAFTA-DR to originating goods will continue to be provided under the tariff categories that were proclaimed in Proclamation 7987. The United States and the other CAFTA-DR countries have agreed to make these changes.

32. Section 201 of the CAFTA-DR Act authorizes the President to proclaim such modifications or continuation of any duty, such continuation of duty-free or excise treatment, or such additional duties, as the President determines to be necessary or appropriate to carry out or apply articles 3.3, 3.5, 3.6, Start Printed Page 925033.21, 3.26, 3.27, and 3.28, and Annexes 3.3 (including the schedule of United States duty reductions with respect to originating goods), 3.27, and 3.28 of the CAFTA-DR.

33. I have determined that the modifications to the HTS proclaimed pursuant to section 201 of the CAFTA-DR Act and section 1206(a) of the 1988 Act are necessary or appropriate to ensure the continuation of tariff and certain other treatment accorded originating goods under tariff categories modified in Proclamation 8097 and Proclamation 8771 and to carry out the duty reductions proclaimed in Proclamation 7987.

34. Section 604 of the Trade Act authorizes the President to embody in the HTS the substance of relevant provisions of that Act, or other Acts affecting import treatment, and of actions taken thereunder, including removal, modification, continuance, or imposition of any rate of duty or other import restriction. Section 1206(c) of the 1988 Act provides that modifications proclaimed by the President may not take effect before the thirtieth day after the date on which the text of the proclamation is published in the Federal Register.

NOW, THEREFORE, I, BARACK OBAMA, President of the United States of America, by virtue of the authority vested in me by the Constitution and the laws of the United States of America, including but not limited to section 915 of the TFTEA (19 U.S.C. 4454), section 506A(a)(1) of the Trade Act (19 U.S.C. 2466a(a)); section 4(b) of the USIFTA Act (19 U.S.C. 2112 note); section 301 of title 3, United States Code; section 1206(a) of the 1988 Act (19 U.S.C. 3006(a)); section 202 of the USOFTA Act (19 U.S.C. 3805 note); section 202 of the USPTPA Act (19 U.S.C. 3805 note); section 201 of the CAFTA-DR Act (19 U.S.C. 4031); and section 604 of the Trade Act (19 U.S.C. 2483), do proclaim that:

(1) In order to provide for the preferential treatment provided for in section 915 of the TFTEA, the HTS is modified as provided in Annex I to this proclamation. The modifications to the HTS set forth in Annex I shall continue in effect through December 31, 2025.

(2) The Central African Republic is designated as a beneficiary sub-Saharan African country.

(3) In order to reflect this designation in the HTS, general note 16(a) and U.S. note 1 to subchapter XIX of chapter 98 to the HTS are each modified by inserting in alphabetical sequence in the list of beneficiary sub-Saharan African countries “Central African Republic.” Further, note 2(d) to subchapter XIX of chapter 98 is modified by inserting in alphabetical sequence in the list of lesser developed beneficiary sub-Saharan African countries “Central African Republic.”

(4) In order to implement U.S. tariff commitments under the 2004 US-Israel Agreement through December 31, 2017, the HTS is modified as provided in Annex II to this proclamation.

(5) The modifications to the HTS set forth in Annex II to this proclamation shall be effective with respect to eligible agricultural products of Israel that are entered, or withdrawn from warehouse for consumption, on or after January 1, 2017.

(6) The provisions of subchapter VII of chapter 99 of the HTS, as modified by Annex II to this proclamation, shall continue in effect through December 31, 2017.

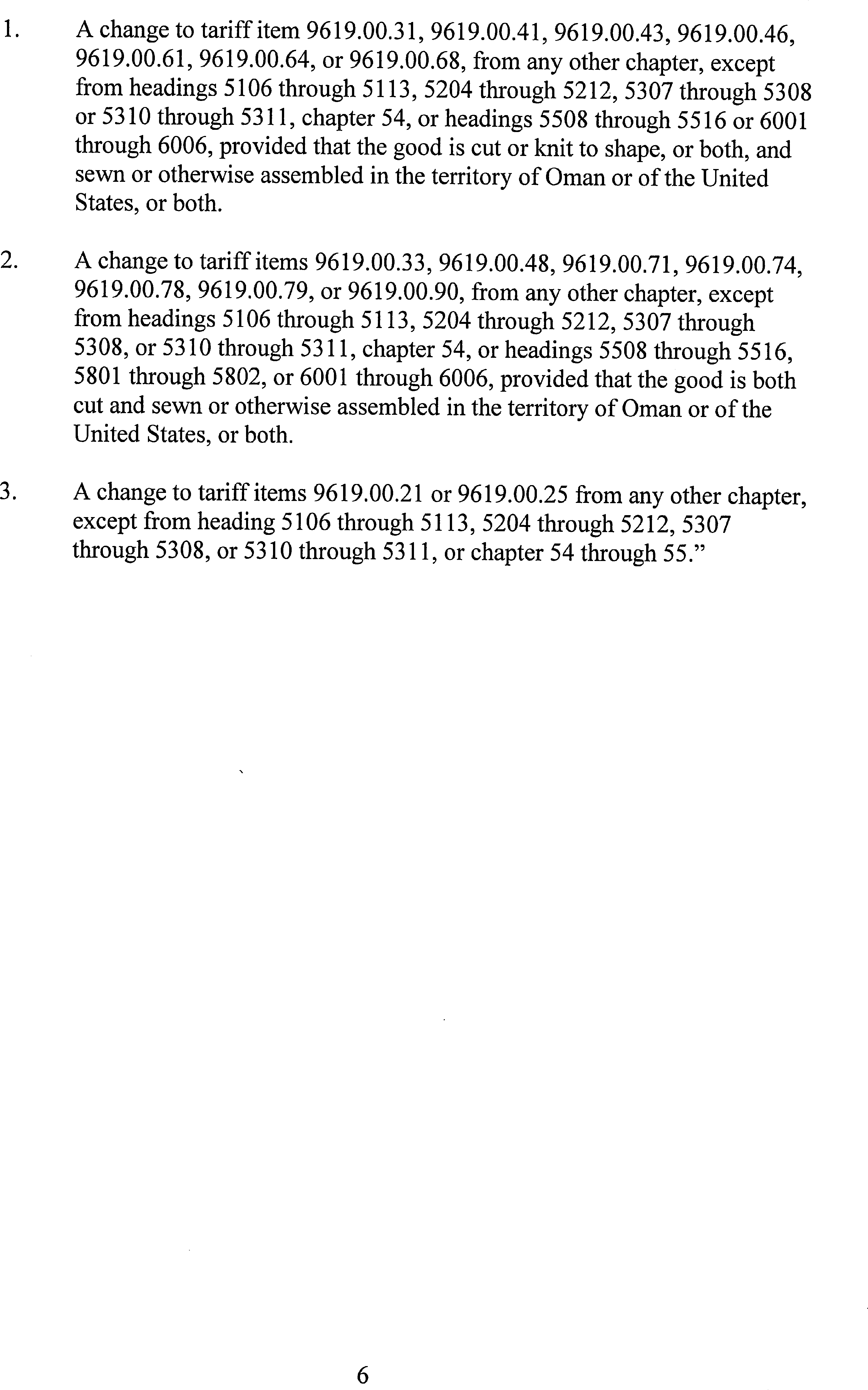

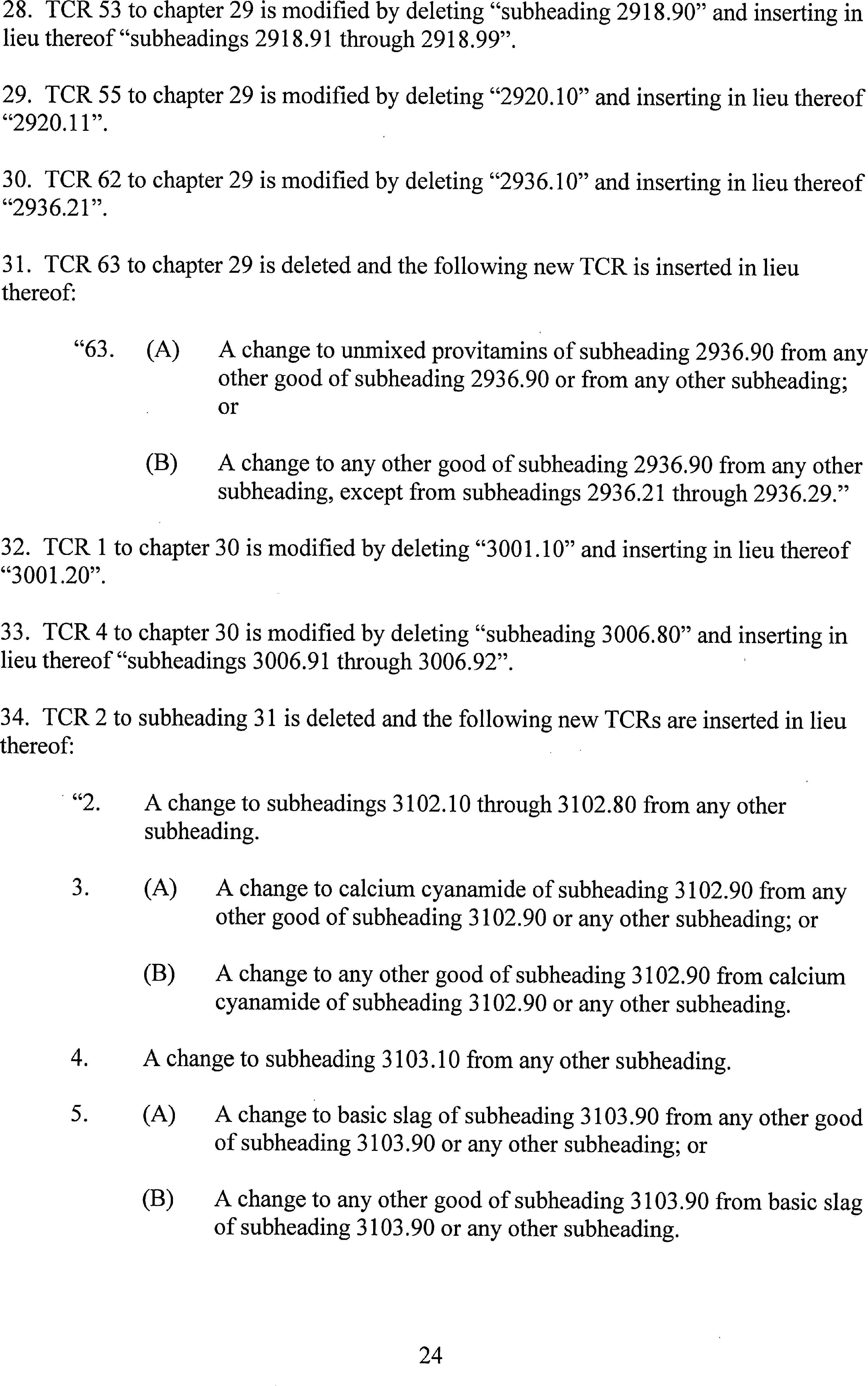

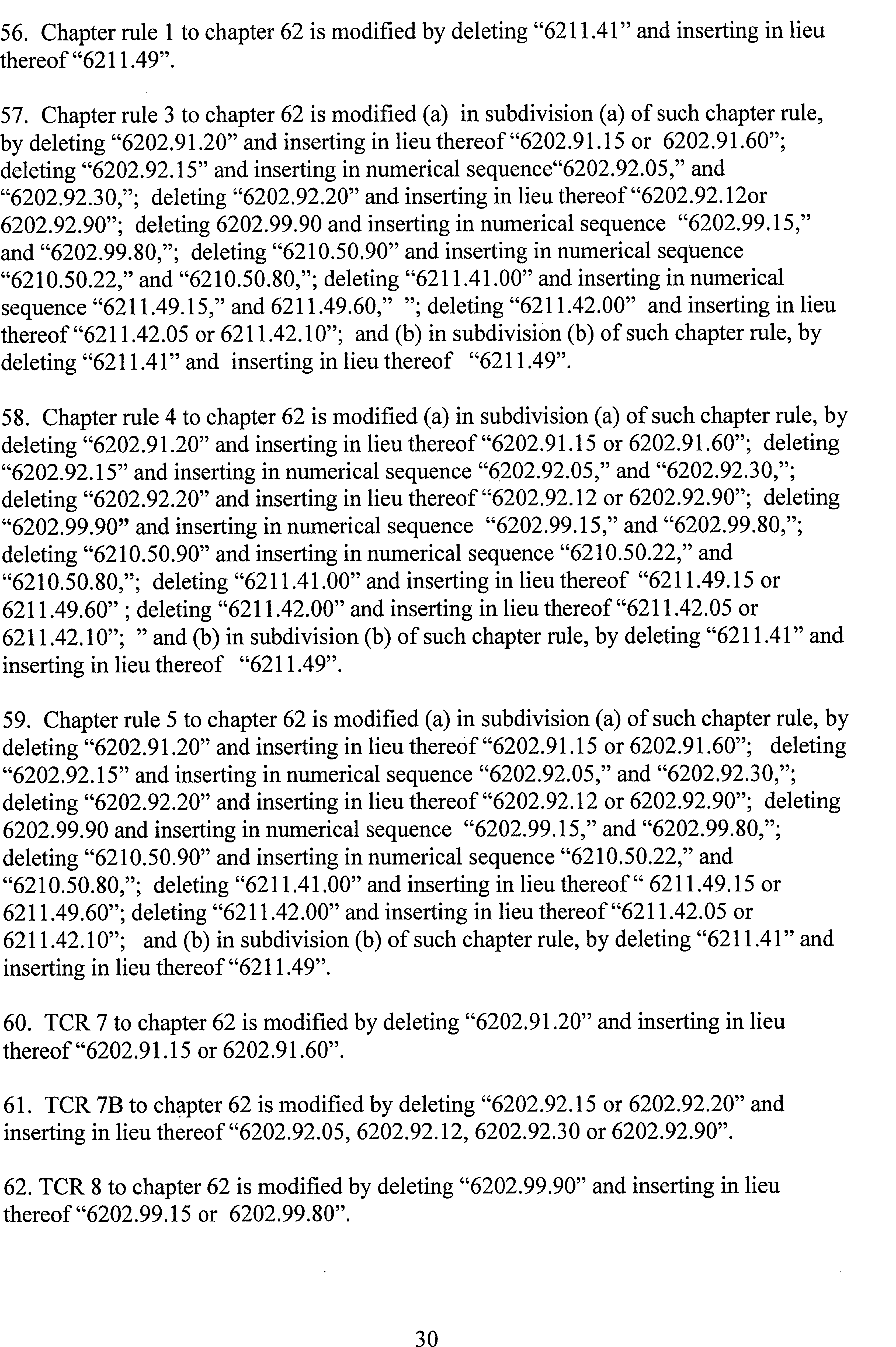

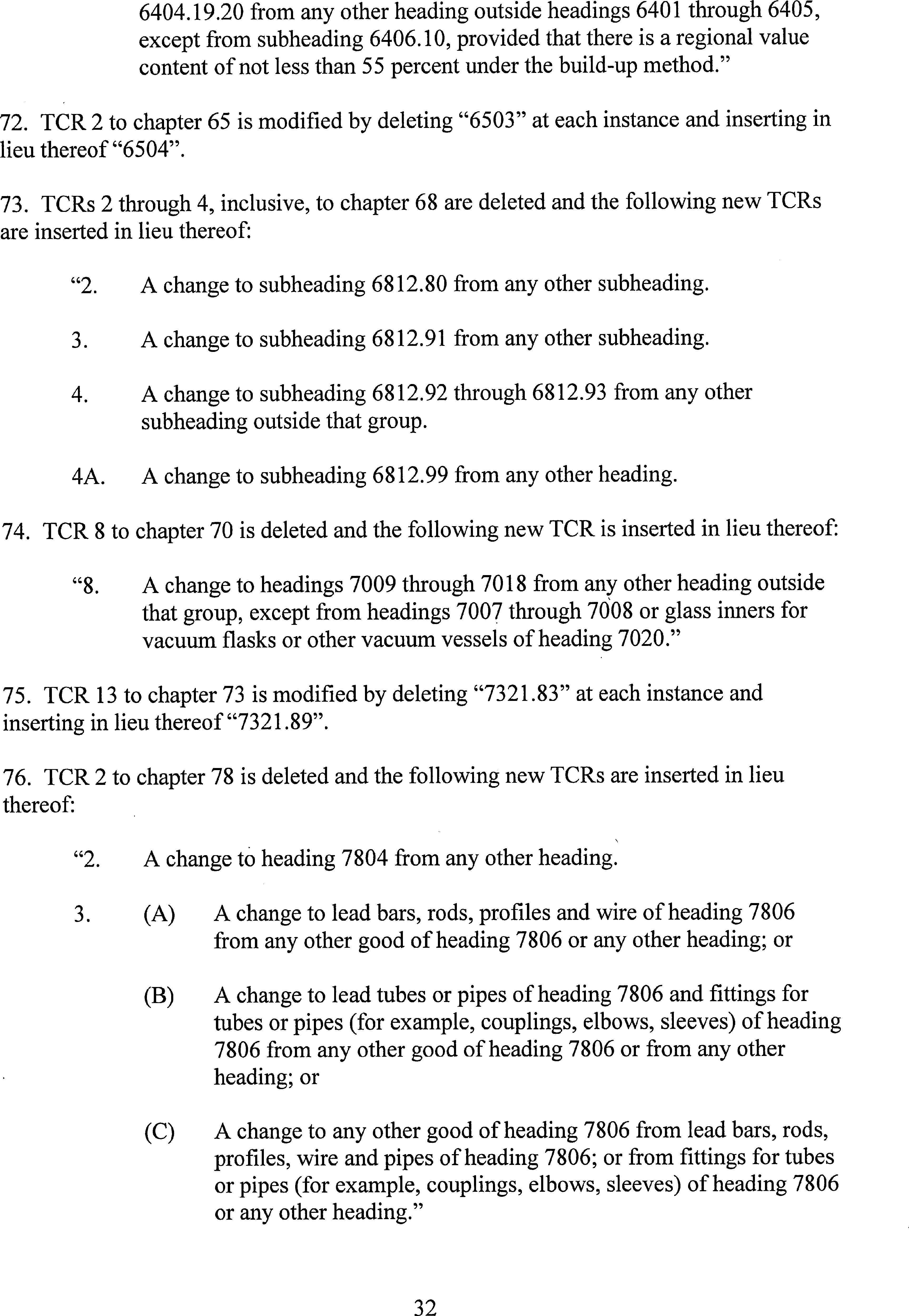

(7) In order to reflect in the HTS the modifications to the rules of origin under the USOFTA, general note 31 to the HTS is modified as provided in Annex III to this proclamation.

(8) The modifications and technical rectifications to the HTS set forth in Annex III to this proclamation shall be effective with respect to goods entered, or withdrawn from warehouse for consumption, on or after the later of (i) February 1, 2017, or (ii) the thirtieth day after the date of publication of this proclamation in the Federal Register. Start Printed Page 92504

(9) In order to provide generally for the modifications in the rules for determining whether goods imported into the customs territory of the United States are eligible for preferential tariff treatment under Annex 4.1 of the USPTPA, to provide preferential tariff treatment for certain other goods under the USPTPA, and to make technical and conforming changes in the general notes to the HTS, the HTS is modified as set forth in Annex IV to this proclamation.

(10) The modifications to the HTS made by paragraph (9) of this proclamation shall enter into effect on the date, as announced by the United States Trade Representative in the Federal Register, that the conditions set forth in the Agreement have been fulfilled, and shall be effective with respect to goods entered, or withdrawn from warehouse for consumption, on or after that date.

(11) In order to provide generally for the modifications in the rules for determining whether goods imported into the customs territory of the United States are eligible for preferential tariff treatment under the CAFTA-DR, to provide preferential tariff treatment for certain other goods under the CAFTA-DR, and to make technical and conforming changes in the general notes to the HTS, the HTS is modified as set forth in Annex V to this proclamation.

(12) The modifications to the HTS made by paragraph (11) of this proclamation shall enter into effect on the date, as announced by the United States Trade Representative in the Federal Register, that the applicable conditions set forth in the CAFTA-DR have been fulfilled, and shall be effective with respect to goods entered, or withdrawn from warehouse for consumption, on or after that date.

(13) Any provisions of previous proclamations and Executive Orders that are inconsistent with the actions taken in this proclamation are superseded to the extent of such inconsistency.

IN WITNESS WHEREOF, I have hereunto set my hand this fifteenth day of December, in the year of our Lord two thousand sixteen, and of the Independence of the United States of America the two hundred and forty-first.

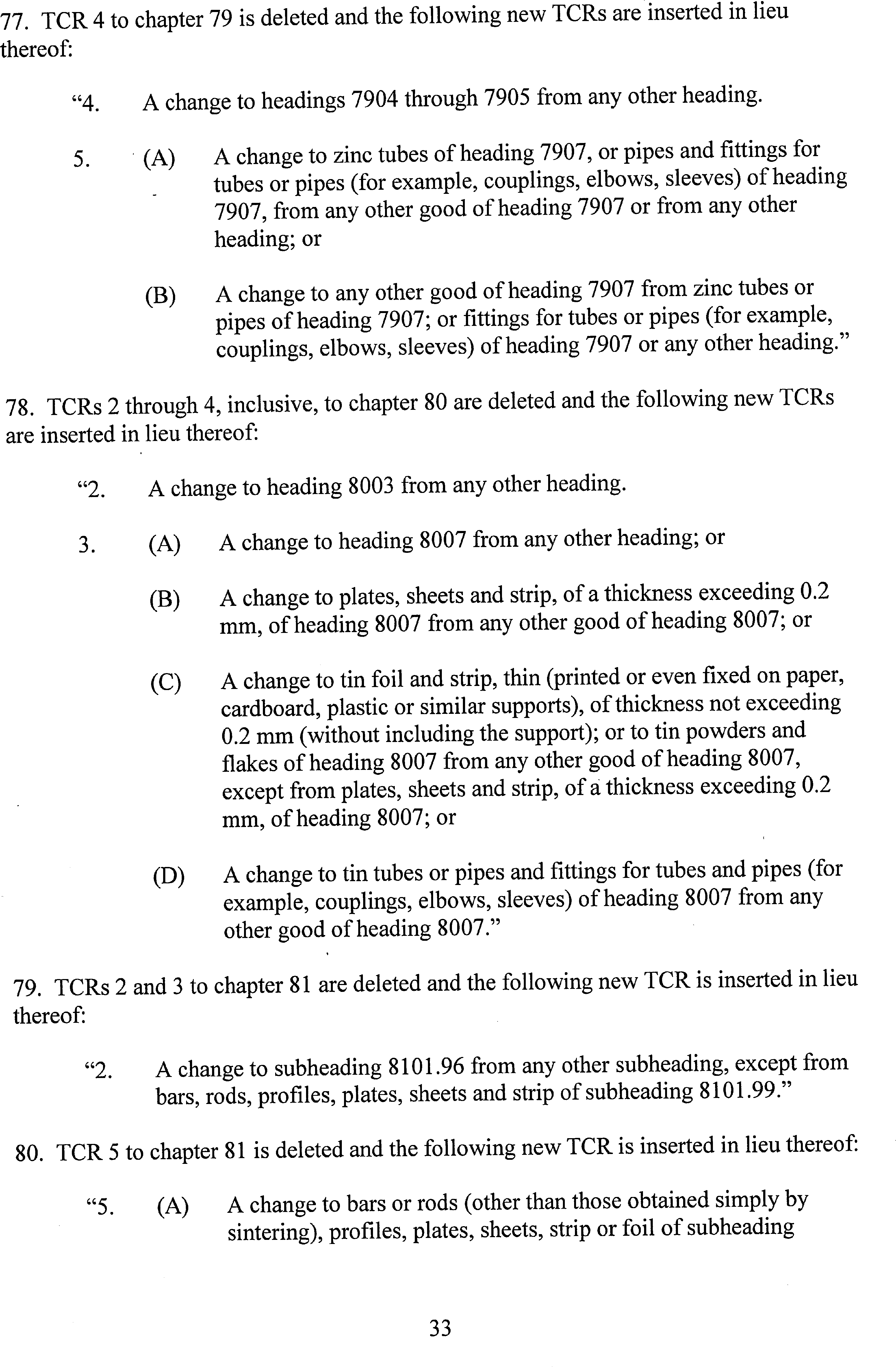

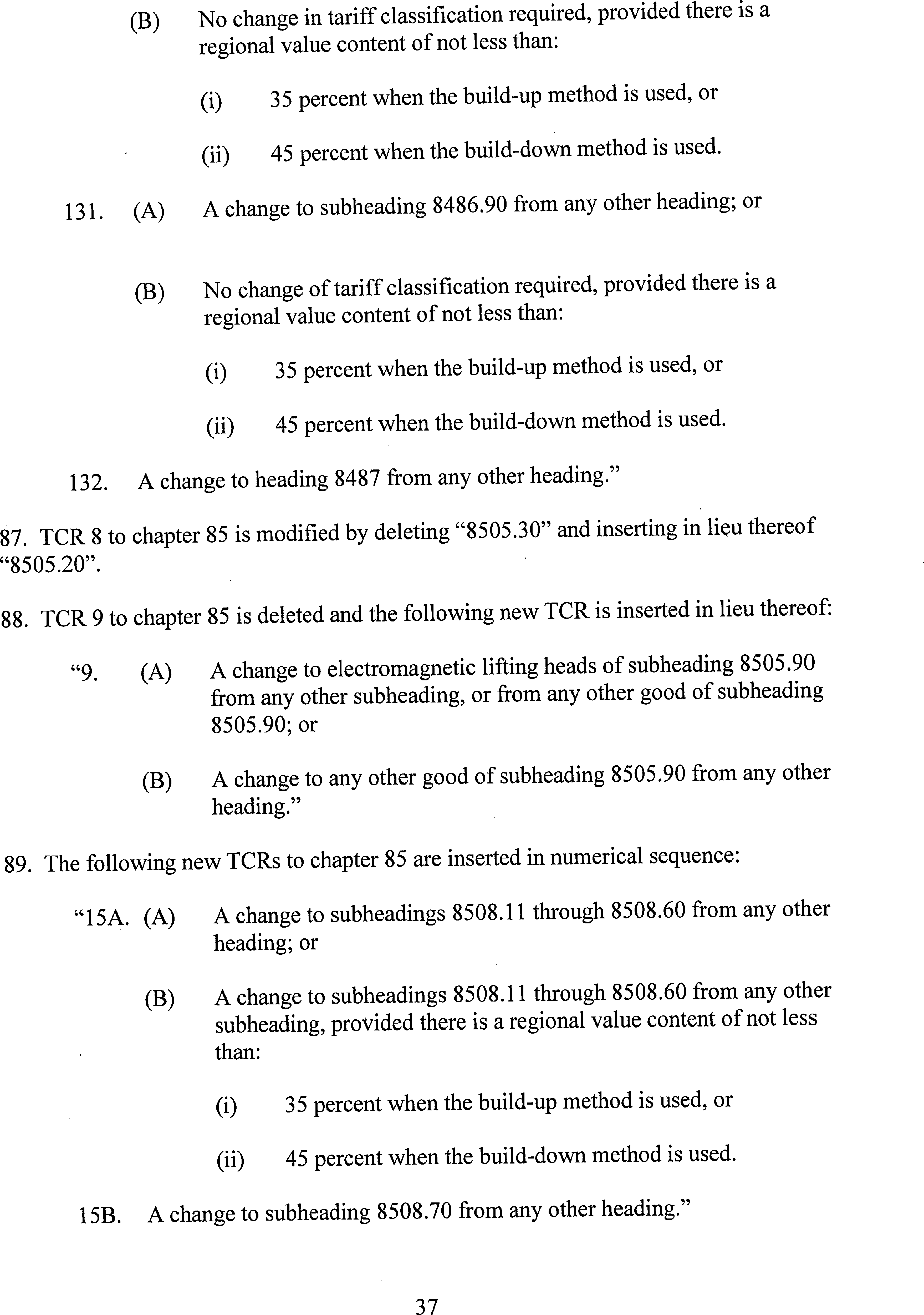

Start Printed Page 92505 Start Printed Page 92506 Start Printed Page 92507 Start Printed Page 92508 Start Printed Page 92509 Start Printed Page 92510 Start Printed Page 92511 Start Printed Page 92512 Start Printed Page 92513 Start Printed Page 92514 Start Printed Page 92515 Start Printed Page 92516 Start Printed Page 92517 Start Printed Page 92518 Start Printed Page 92519 Start Printed Page 92520 Start Printed Page 92521 Start Printed Page 92522 Start Printed Page 92523 Start Printed Page 92524 Start Printed Page 92525 Start Printed Page 92526 Start Printed Page 92527 Start Printed Page 92528 Start Printed Page 92529 Start Printed Page 92530 Start Printed Page 92531 Start Printed Page 92532 Start Printed Page 92533 Start Printed Page 92534 Start Printed Page 92535 Start Printed Page 92536 Start Printed Page 92537 Start Printed Page 92538 Start Printed Page 92539 Start Printed Page 92540 Start Printed Page 92541 Start Printed Page 92542 Start Printed Page 92543 Start Printed Page 92544 Start Printed Page 92545 Start Printed Page 92546 Start Printed Page 92547 Filed 12-19-16; 8:45 a.m.]

Document Information

- Published:

- 12/20/2016

- Department:

- Executive Office of the President

- Entry Type:

- Presidential Document

- Document Type:

- Proclamation

- Document Number:

- 2016-30738

- Pages:

- 92499-92547 (49 pages)

- EOCitation:

- of 2016-12-15

- PDF File:

- 2016-30738.pdf